Bitcoin’s ‘Death Cross’: Here’s what you need to know about Bitcoin’s pump

Bitcoin’s slump after the Bakkt announcement and another slump almost a month later was a dream come true for the shorts, but little did they know that their happy dream would turn into a nightmare soon. Yes, Bitcoin pumped a whopping 29.85% in less than 48 hours, a pump which led to the liquidation of over $220 million in shorts.

Flabbergasted and perhaps, flummoxed? Here’s what you need to know about the dumps and the pumps.

Shorts’ Nostalgia of the Death Cross that never really happened

Source: TradingView

Before the pump actually began, Bitcoin was on its way towards an uber-bearish territory, the Death Cross. The Death Cross is typically a bearish signal and occurs when the 50-day simple moving average drowns below the 200-day simple moving average. It looked like a perfect setup for a Death Cross. However, there were different things at play which prevented it from manifesting.

The Not-So Mysterious Pump

Bitcoin’s price has reduced its correlation due to developments in the ecosystem, unless it’s a hack. However, crypto-Twitter seems to believe that yesterday’s pump was due to the announcement of China’s stance on blockchain technology. The most important thing at play is the money coming into the Bitcoin ecosystem via stablecoins.

Tether printed a total of $170 million USDT in the last 24 hours and approximately $100 million was printed before the pump began on October 25 at 15:00 UTC. $5 million USDC were printed halfway through the pump. This is perhaps the crucial reason why Bitcoin pumped.

Moreover, the RSI had hit an oversold zone on 23 October and was meandering in that zone, something which also indicated the incoming pump. What’s interesting is the extent of the pump.

Bitcoin’s price went from $7,393 to $8,784 in a single candle, which is ~19% rise from wick-to-wick or 16% actual rise. Following this candle was another candle which pumped from $8,642 to $10,350, another ~19% wick-to-wick surge. The second candle is yet to close, depending on where the candles close, this could be a historic moment for Bitcoin’s daily candles.

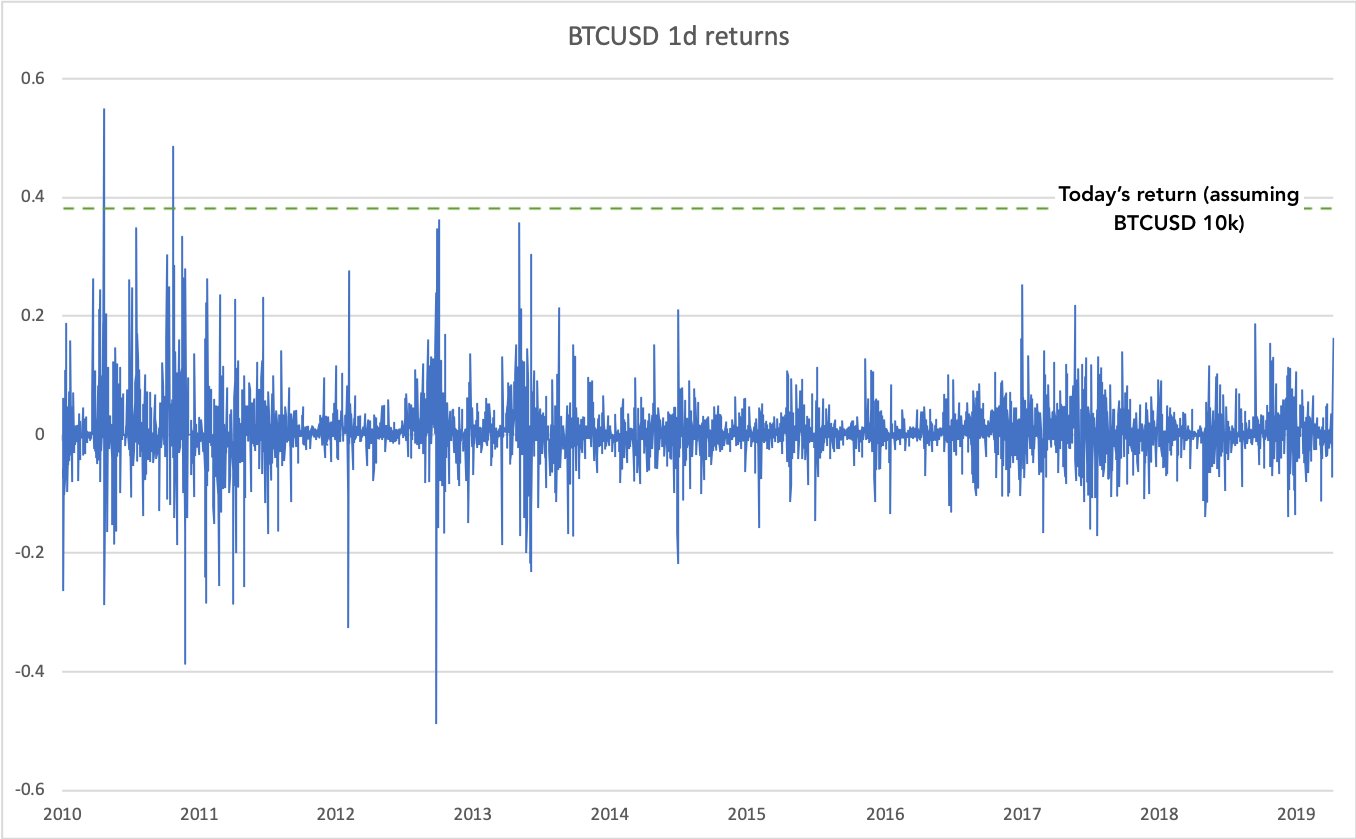

As pointed out by Nic Carter, a daily close of such a huge margin has only been seen twice in Bitcoin’s entire lifetime.. The first one was 54% on 11/6/10, followed by a 48% on 5/10/11. If the price closes above $10,000, the return would be the third-highest 1D return.

Source: Twitter

Bitcoin Pumped; What Next?

Source: TradingView

April’s pump in Bitcoin’s price from ~$4,000 to ~$14,000 was unnatural, which is why the price is undergoing an organic price discovery which is in the form of consolidation. At the time of writing, Bitcoin’s pump has put it well above the 200-Day moving average, which puts Bitcoin back in the bull territory. However, the price has not yet closed above $9,736, which is the 0.618 or 61.8% Fibonacci level. Unless the price closes above this level, Bitcoin would undergo more consolidation and sideways movements in the next few months. This also means that we could see $8,000 levels again.