Bitcoin’s credentials as a medium of exchange may be far from dead

Over the last few years, Bitcoin has undergone several shifts in terms of its utility.

Initially, it was introduced as a form of decentralized currency. Over time however, the sentiment changed. With the emergence of other virtual assets or altcoins, the community was exposed to better alternatives that were faster and cheaper in terms of transactions. Bitcoin’s credentials as a medium of exchange [MoE] weakened with time, but it slowly gave rise to the perception that BTC is a better form of Store-of-Value [SoV].

At press time, a part of the community believed that Bitcoin’s position in the market as a form of currency still had a substantial case.

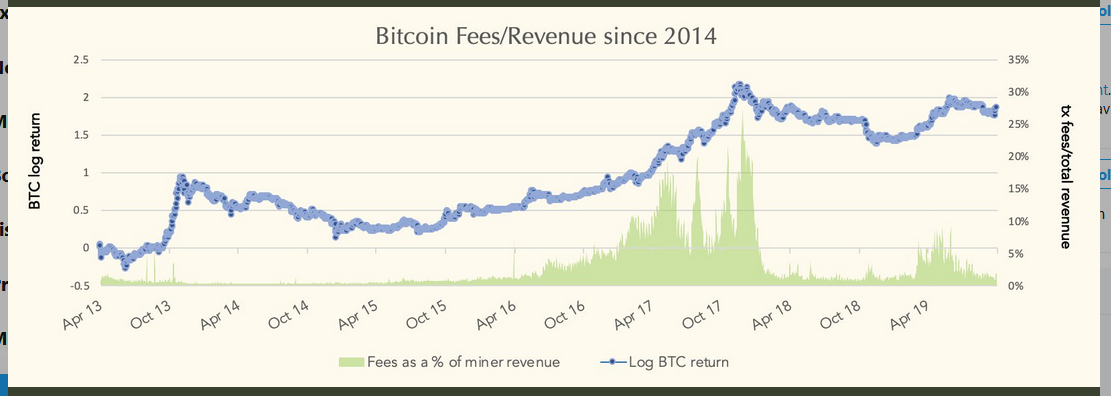

Elias Simos, Senior Research Analyst at decentralpark.io, recently put forward an argument that drew correlations between Bitcoin fees and miners’ revenue.

Source: Twitter

Simos suggested that over the years, Bitcoin fees have gradually increased, especially after April 2016. He pointed out that the consistent increment of BTC fees as a percentage of miners’ revenue suggested that Bitcoin’s utility as MoE remained valid for the long-term. However, Simos clarified that the chart appeared ‘distorted’ in order to correctly explain BTC’s utility value due to the inclusion of bull markets.

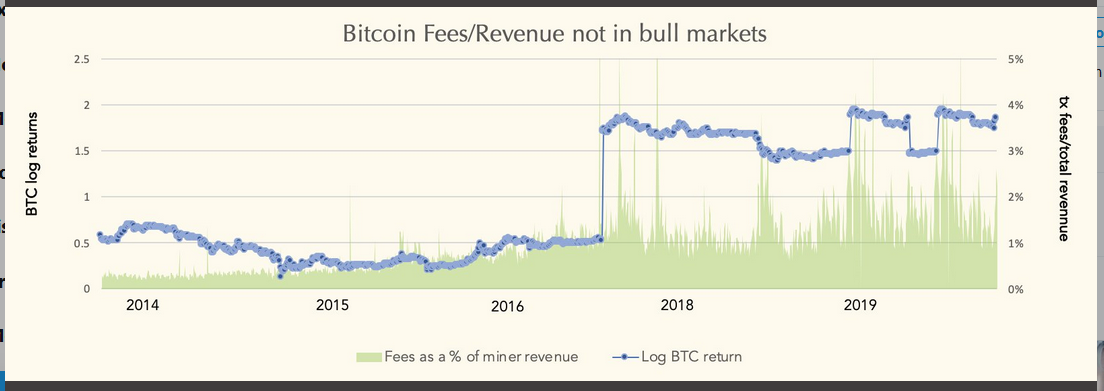

Source: Twitter

Simos presented another chart that excluded bull runs and demonstrated a clearer picture. When the bullish phase was removed from the equation, the graph indicated that the BTC fees as a percentage of miners’ revenue continued to grow at a steady pace. Further, the trend did not suffer any anomaly, even when the block reward halving was adjusted. Therefore, a clear utility of BTC as an MoE could be derived from the charts.

Bitcoin’s current image as a ‘Store-of-Value’ is significant in the community, but the aforementioned data suggest that its utility as a currency may still surface in the near future.