Bitcoin’s correlation to gold continues to rise as market cap holds steady

Even with the ongoing fluctuation in the price of Bitcoin [BTC], a lot of investors are looking forward to investing in the king coin due to the growth in its market cap over the past few months. With coin movements growing more significant by the day, more and more traders are now getting into the cryptoverse.

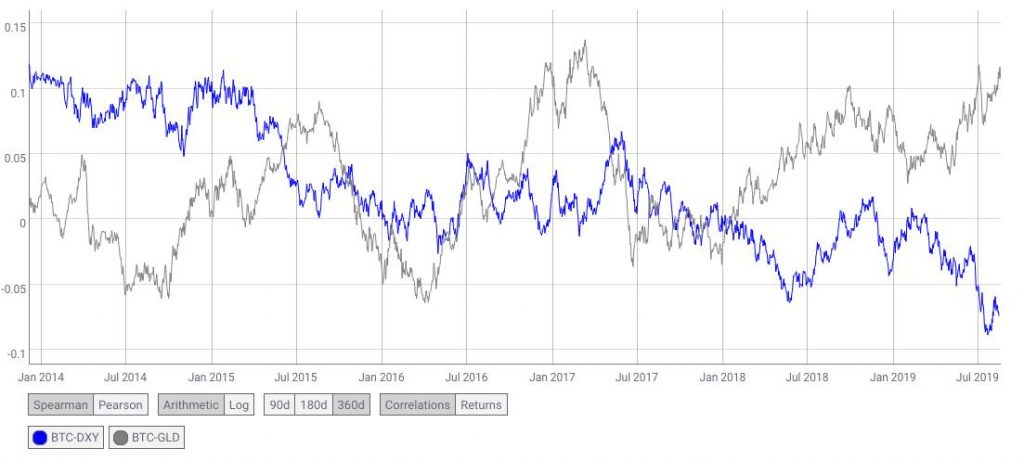

Gold has been the go-to, safe asset for traders over the years. However, with an increasing crypto-adoption rate, BTC has started growing in a correlated manner with gold, while its correlation to the USD is falling.

Gold and BTC are moving ahead in the same direction at the same rate, making the correlations highly suitable. The growth in market cap of BTC can be termed to be the main reason behind the correlated growth of gold and digital gold.

Source: TradingView

It is evident from the graph above that Bitcoin has been on a roller coaster ride lately. BTC recorded a 24-hour dip of 5.11% and was priced at $10,178.31, at press time, with a market cap of $182.07 billion.

The global adoption of digital assets has pushed the interest of investors towards the king coin. Even with the volatile nature of the digital gold, heavy returns are attracting more investors. Also, this heavy inflow of capital into the market has raised the market cap too, as investors have started to understand the monetary value of Bitcoin. One crypto enthusiast, @Woonomic, commented on Twitter,

“As BTC grows in market cap [attracting more mainstream or macro investors looking for exposure, instead of early adopters], we can see its correlation with GLD is increasing [grey] and its correlation to USD strength is decreasing [blue].”