Bitcoin’s $1T market cap is 1% aggregated institutional investment away

Initially envisioned as a P2P electronic cash system, Bitcoin’s narrative has changed over time, and now, the asset is primarily viewed as an inflationary hedge against various fiat currencies. Over the past few years, its store-of-value characteristics have taken flight, with many suggesting that incoming institutional investors can help solidify this position.

Ryan Watkins, Research Analyst at Messari, opined on this matter recently and highlighted the changes that may manifest once these types of investors show up in the space.

After Bitcoin’s latest display of survival amidst economical turbulence, prominent hedge fund manager Paul Tudor Jones had stated,

“Every day that goes by that bitcoin survives, the trust in it will go up.”

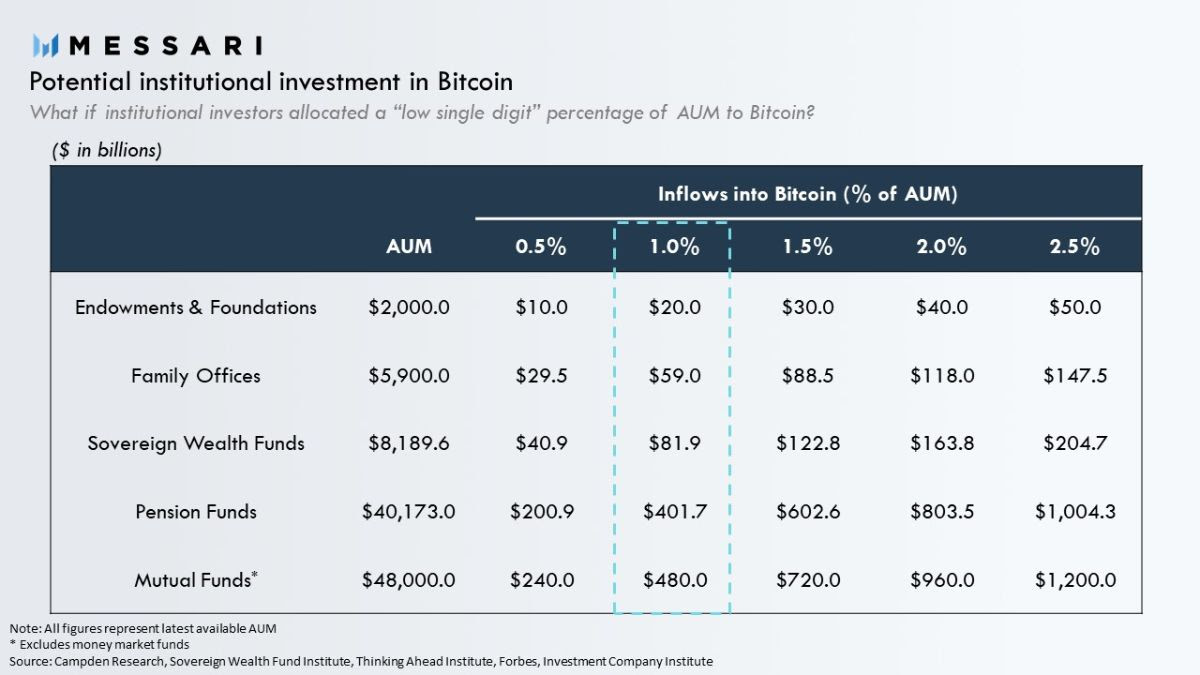

Tudor Jones also revealed that he had 1% of his wealth in Bitcoin at the moment. Keeping that as the standard allocation, Watkins estimated the capital flow in Bitcoin from different institutional investors with their respective Assets Under Management (AUM).

Analyzing the capital allocation from investors such as pension funds, mutual funds, endowments, foundations, family offices, sovereign wealth funds, and hedge funds, the following table was formulated.

Source: Messari

From the chart, it can be observed that even if 1% of the total AUM from pension funds flows into Bitcoin, the capital inflows noted by the asset would be a whopping $400 billion.

For comparison, Bitcoin’s present market cap is $178 billion. A 1% allocation from mutual funds would inflate the market cap by $480 billion. Hence, an aggregated allocation of 1% across all institutional investors would easily increase Bitcoin’s market cap by $1 trillion or in simple terms, $50,000 per BTC.

Importance of Hedge Funds; Possible First Mover?

Although Watkins did not mention any allocation from hedge funds, he believes that hedge funds are likely going to be the first institutional movers in the space.

Now, a 1% allocation from hedge funds could be extremely lucrative for Bitcoin as well.

According to PWC Crypto’s Hedge Fund Report, medium hedge funds’ returns on investment were +30 percent in 2019, while a vast majority were either family offices or high-net individuals. The most common crypto-hedge fund strategy was also quantitative (48%), which meant that liquidity was essential for trading in these assets, making Bitcoin the perfect fit among other digital assets.

The success rate for crypto-hedge funds seems enticing enough for institutional investors to dip their toes into Bitcoin, a development that can open the floodgates in terms of capital affluence for the world’s largest virtual currency.