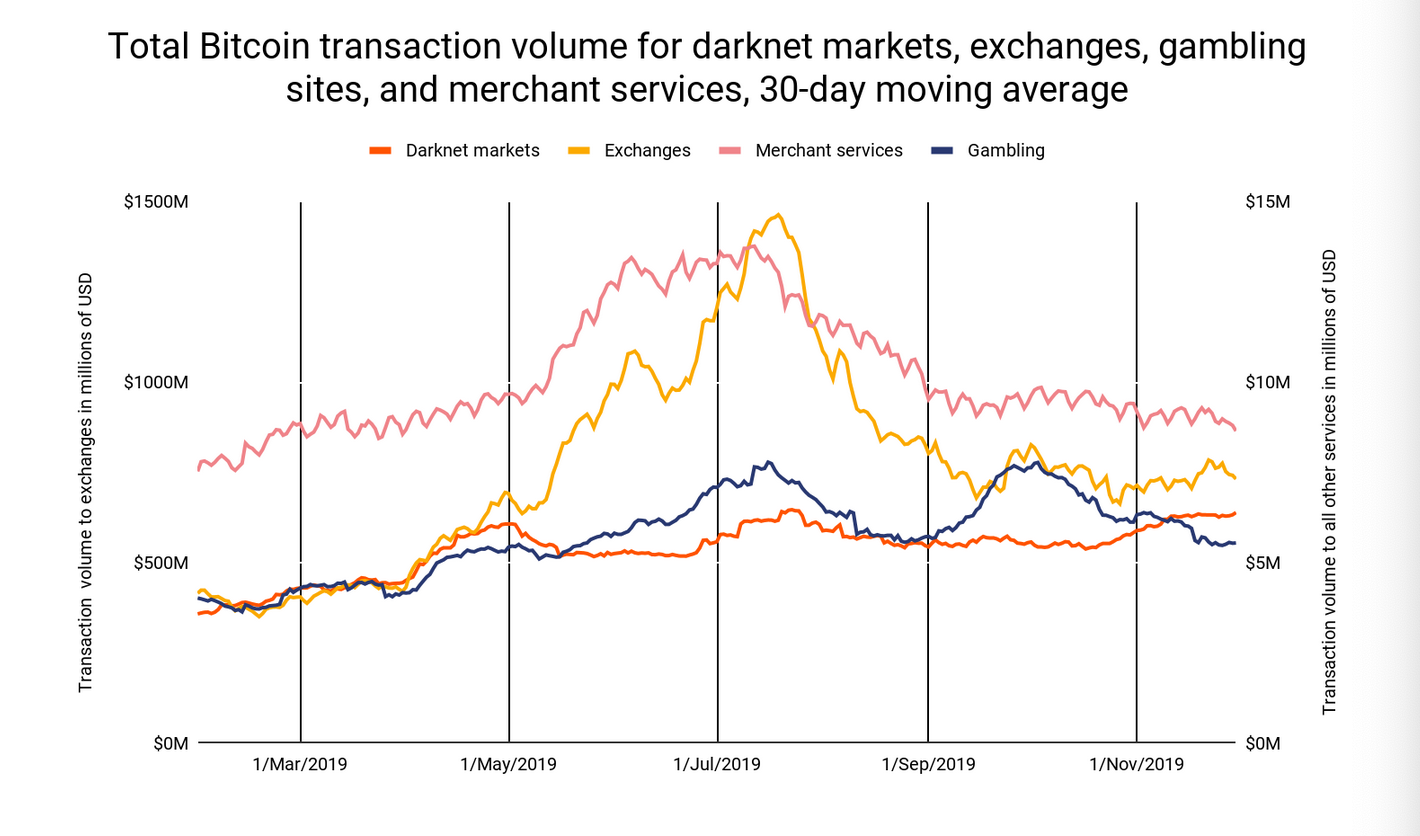

Bitcoin worth $600 million was spent on the darknet in 2019 Q4

The year 2019 saw 11 exchanges being hacked, resulting in the theft of almost $2.8 billion in bitcoin. According to an earlier report, the stolen bitcoins were moved into several exchanges with bulk movements to Binance and Huobi. However, new research from Chainalysis stated that over $600 million worth of bitcoin was spent on the darknet markets during the last quarter of 2019 alone.

Source: Chainalysis

It further noted that Bitcoin‘s price had a lesser impact on consumer behavior and continued at a much narrower volume range throughout the year. It noted:

“Perhaps our most interesting finding is that darknet markets’ transaction activity appears to be less influenced by the ebbs and flows of the cryptocurrency markets and other forms of seasonality compared to other services.”

Bitcoin has been the go-to currency on the darknet where users could buy stolen credit card information and an array of illegal drugs. However, these illicit transactions account for just 1 percent of all BTC transactions.

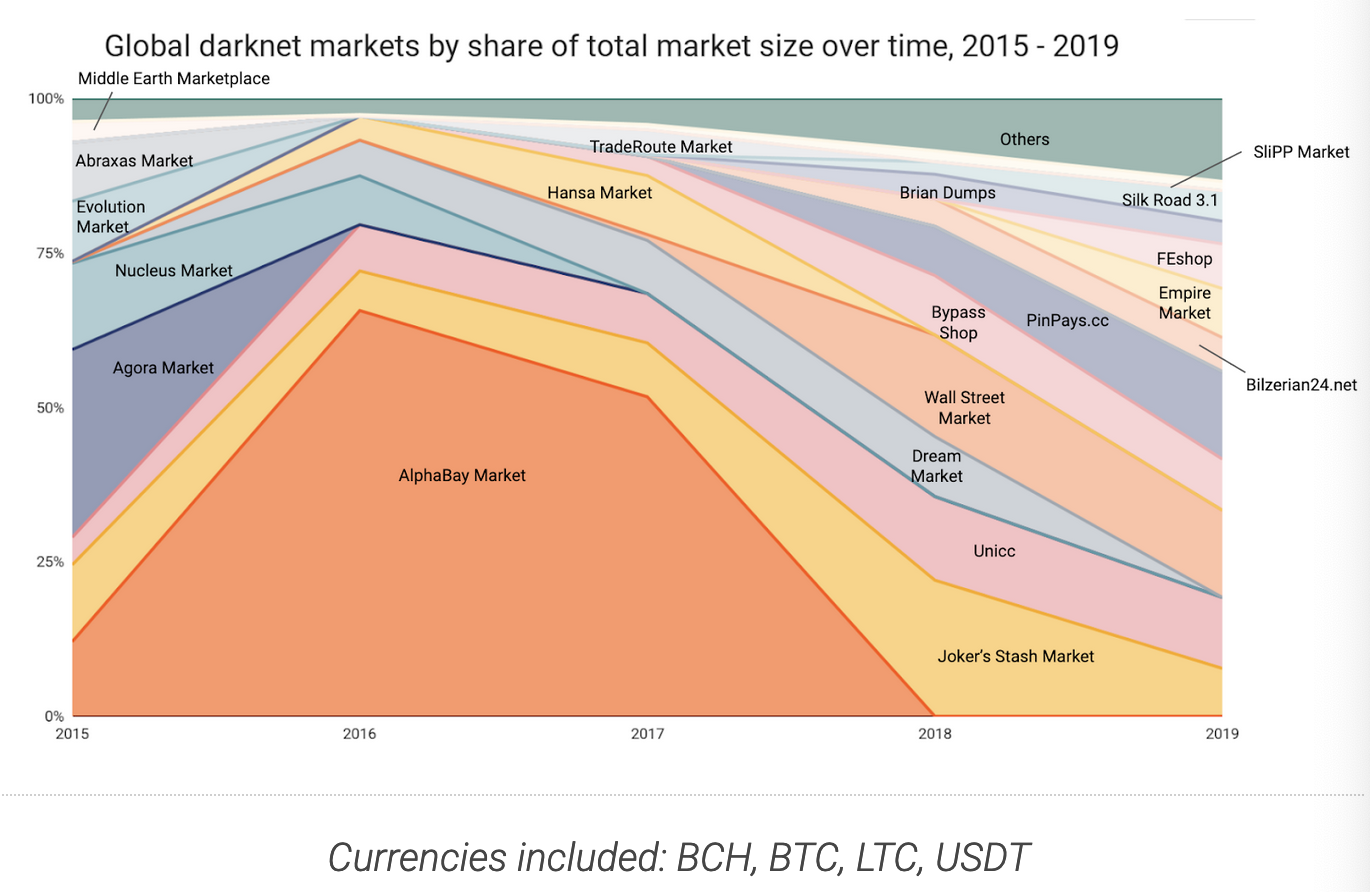

Source: Chainalysis

Despite being targeted by the authorities, the amount of bitcoin involved in fraudulent activities hit a new high, with scammers tripling in number and stealing $3.5 billion from victims in 2019.

Recently, researchers from the International Institue for Counter-Terrorism [ICT] issued a report titled ‘Identifying Money Transfers and Terror Finance Infrastructure’. The report linked a “bitcoin address with high transaction volume, a website that includes a webmaster with ties to Hamas, and social media pages that all but point to Hamas as having used Bitcoin as one of its sources of funding terrorism in the West Bank.”

However, such uses of the largest digital asset have kept many investors, large-scale adoption, and regulators at bay. Many countries have put forth Anti-money laundering and counter-terrorism financial rules for virtual currencies. The European Union in its 5th Anti-Money Laundering [AMLD5] extended its policies to the VCs.