Bitcoin v. Ethereum v. XRP: A comparative analysis of their distribution

There has been a recurring argument about the distribution of tokens and pre-mining of coins, especially for Bitcoin, Ethereum, and XRP. Some argue that the pre-mining and allocation of funds to founders/company has to be done to stay afloat. However, others disagree. This a touchy topic that dips its toes into ethics and morality.

Bitcoin has danced this dance quite a few times. People have questioned Satoshi’s motives on being the only miner and the wealth he has accumulated as a result. Dan Hedl addressed each of these concerns, factually and logically, in his tweet thread.

No Pre-mining: Satoshi gave a two-month heads up before mining the genesis block.

Genesis Block: Satoshi Nakamoto included a message of no pre-mine. Dan Hedl tweeted,

“Before Satoshi’s invention, the concept of pre-mining didn’t exist. To be this prescient demonstrated incredible maturity.”

Satoshi wasn’t alone: Hal Finney mined Bitcoin a day after it was launched.

Declining Hash: Satoshi Nakamoto steadily reduced his mining footprint after sufficient hashrate had accumulated on the network.

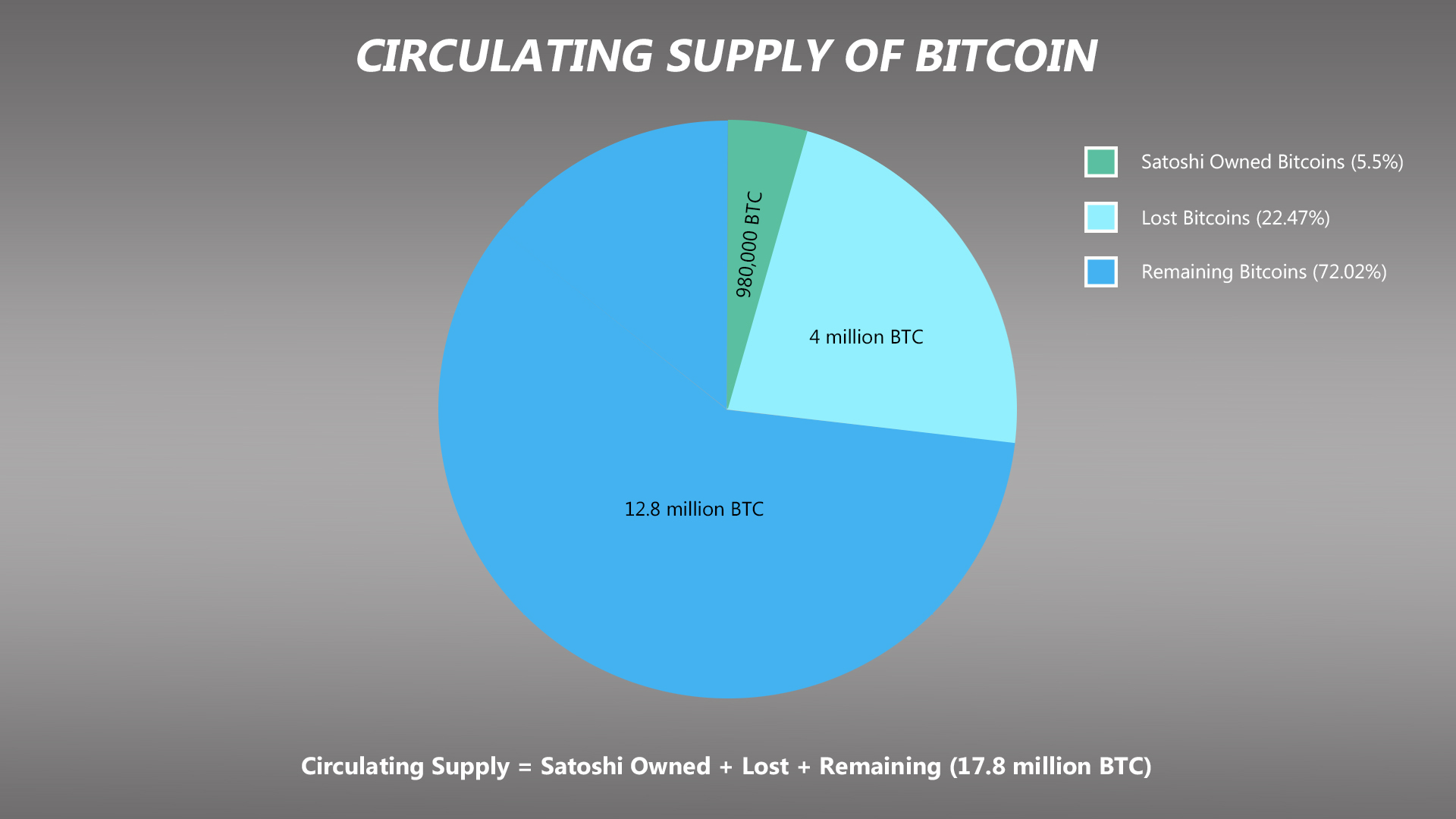

Satoshi’s Balance: Although it is said that Satoshi accumulated approximately 700,000 BTCs, he only spent a couple of coins in test transactions. He never really cashed out.

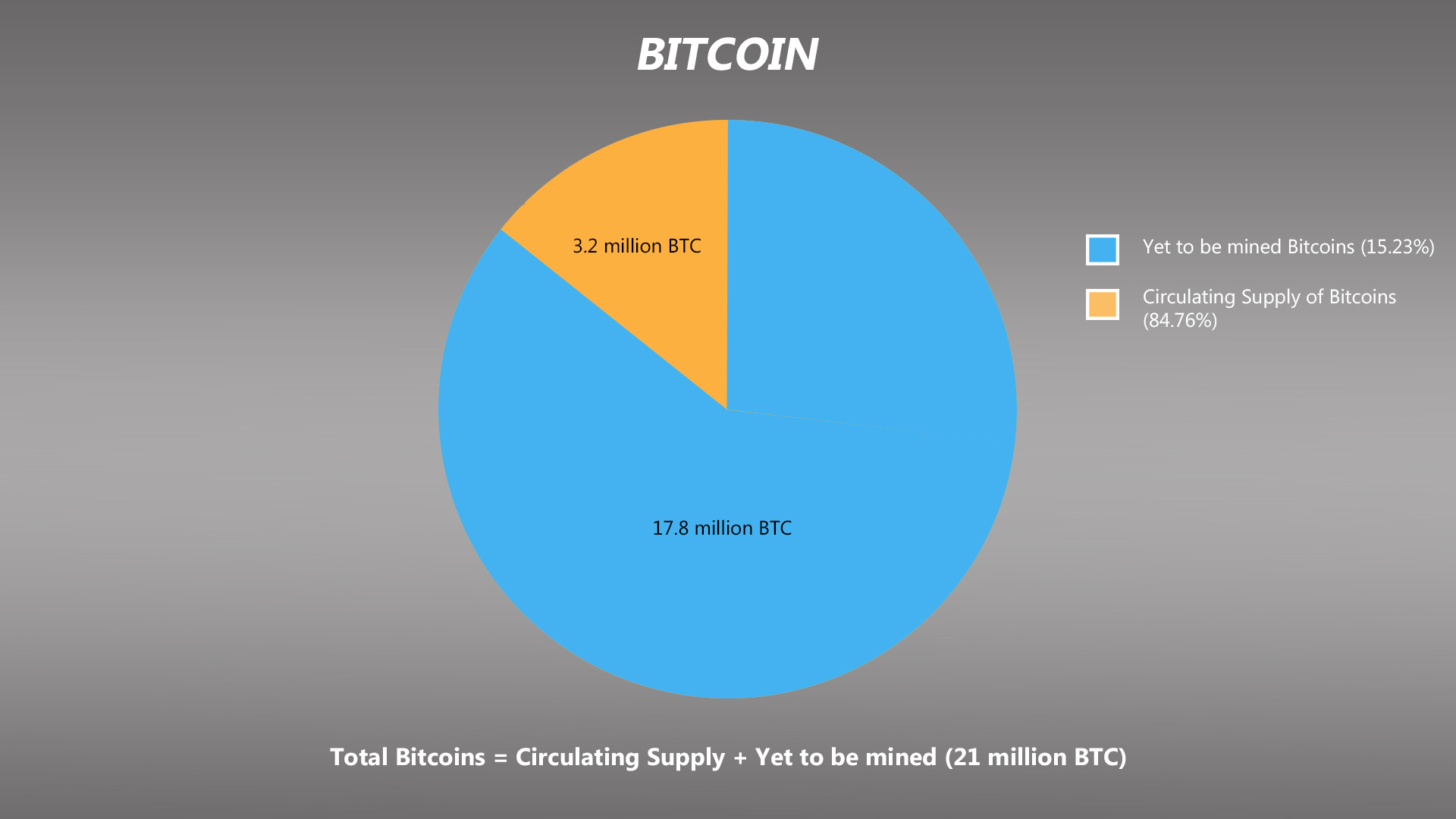

Here is an approximate Bitcoin distribution, as of 2019.

The circulating supply of Bitcoin can be broken further into,

Comparing the conditions that Bitcoin or Satoshi faced during the launch to Ethereum or XRP would, in a way, put these arguments/debates to rest.

Ethereum v. Bitcoin

Vitalik Buterin, the brainchild behind Ethereum, the second-largest cryptocurrency, had a total of 500,000 ETH in one of his wallets, which were worth approximately $450,000 initially. These coins reduced in number, but the value reached as high as $500 million or $0.5 billion during the peak price of Ethereum. Unlike Satoshi, Vitalik Buterin was now in possession of ETH which could be used to his liking.

Moreover, a large portion of Ethereum’s pre-mined coins was allocated to the foundation and the token sale, which is why the argument about Etheruem’s distribution as wealth arises. Further, the price of the token during a token sale is said to generally increase, which would put the founders at an advantage. Genesis, pre-mine and token sale tokens contribute to a whopping 67% of the total circulating supply of Ethereum.

Unlike Bitcoin, Ethereum’s maximum supply is not capped; it increases by approximately 10% every year. In 2018, ETH’s total supply increased to 100 million, something which was a new milestone for the community while also raising concerns of inflation among the community.

The argument about Etheruem’s pre-mine erupted back in 2018 when there was a question of pumping the price of coins by well-known community members. Buterin stepped in to alleviate the problem as he tweeted,

I personally am really proud to have helped set the precedent of small premines being legitimate. It’s an appalling idea that people operating boxes burning huge piles of electricity are somehow the only ones who should be allowed to gain from crypto seignorage revenue.

— Vitalik Non-giver of Ether (@VitalikButerin) October 5, 2018

In this tweet, Buterin said that he was “proud” of popularizing the pre-mine model of fundraising, which added more fuel to the fire. In recent times, the same debate caught on after a user argued how pre-mining in Ethereum was “worse than worst” and it had an “atrocious wealth distribution,” which would prevent it from scaling socially.

The pie chart below depicts the Ethereum distribution, as of 13 August, 2019.

Gini Co-efficient

Gini Co-efficient is a statistical measure of distribution. Higher the Gini Co-efficient, more the inequality in distribution. Balaji Srinivasan, ex-CTO of Coinbase, explained how each cryptocurrency has six subsystems namely, mining, client, developer, exchange, node, and owner. Gini co-efficient for these was further derived from the Lorenz curve. For now, the Gini Co-efficient in the distribution of ETH/BTC can be used to determine how Ethereum’s distribution is slightly skewed, when compared to Bitcoin.

Bitcoin: 0.65; Ethereum: 0.76

XRP v. Bitcoin

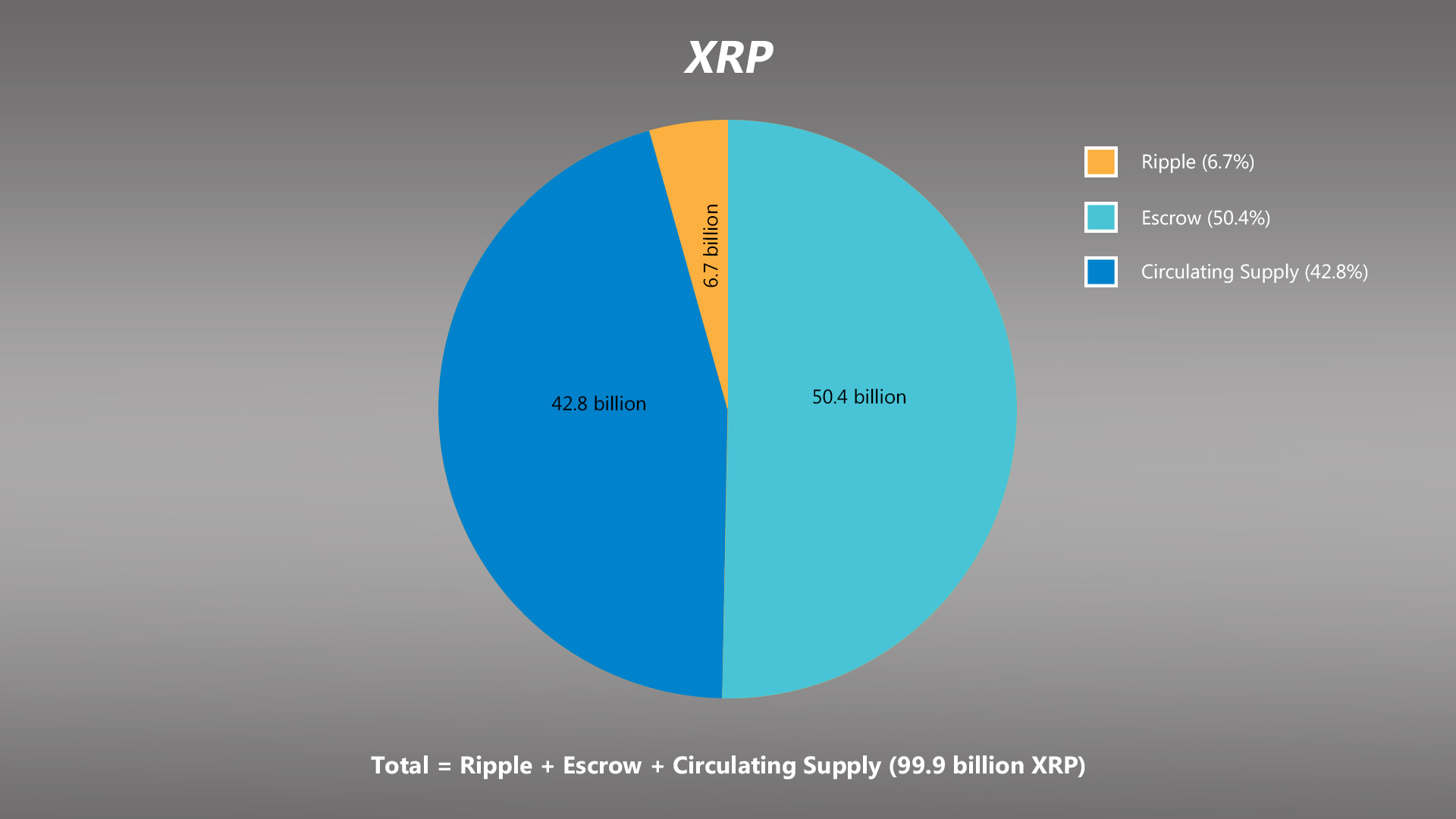

The story of XRP distribution is in stark contrast to that of Ethereum. Yet, issues similar to that of Ethereum have been raised for XRP as well. There is a lot of mystery with regards to Ripple and XRP. Adding more mystery to the fact is the escrowed XRP and those given to the founders.

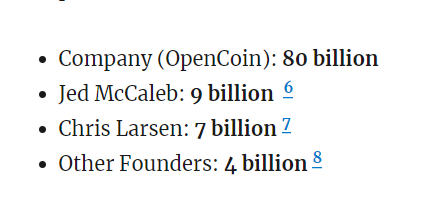

XRP developers took a different approach to cryptocurrencies at that time; all of the 100 billion XRP was pre-mined and distributed. A major chunk of the XRP went into escrow, another portion went to the founders, while the rest was for the general public.

As per Hodor’s blogs, this was how 100 billion XRP [Total Supply] was distributed.

Source: Hodor

Below is the actual distribution of XRP, as seen on the official website.

This distribution has led many to question if XRP is indeed decentralized, since approximately 60% of the total supply was held, either in escrow or by the founding members. Further, BitMEX research’s blog sheds light on some of the popular criticism that is faced by XRP. As mentioned above, the distribution of wealth is one of the important aspects that helps in deciding if a cryptocurrency ecosystem is decentralized.

Where does this leave us now?

Vitalik Buterin and Brad Garlinghouse have individually tried their best to ward off such arguments by logically approaching them. However, it has not subsided yet. Founders do play an important role however, the community argues that they should not wield huge denominations of their own inventions by pre-mining without competition.

Although Bitcoin did face similar questions in the early days, the same seems to be dead. Some argue that Satoshi Nakamoto’s distribution was probably the best anyone could have done, considering it was the birth of cryptocurrencies and there wasn’t any history as a reference. Dan Hedl put it best,

“Satoshi was a person like any other, not some infallible being. This was the fairest distribution he could have come up with. It’s intellectually dishonest to compare Satoshi’s early mining of Bitcoin at a loss, with premining of an ICO with a positive market value.”

Perhaps, these issues will not be solved completely, as there are always people addressing the same issue from a logical standpoint, while some from a community perspective. Perhaps, the answer can be found by taking a multidirectional approach, considering, Ethos, Pathos, Logos, and even Kairos.

Speaking about wealth distribution, Adam Back told AMBcrypto that sound money was very important “for functioning global economy and that wealth would eventually get redistributed.”

“I think Bitcoin in terms of distribution is pretty reasonable – certainly an attempt to replicate it with a claim to improve fairness would definitionally be less fair – as well as facing near impossible network effect, and credibility of scarcity and store of value given the adverse precedent of a political reset. That would be something akin to the abandonment of the gold standard for politically distributed fiat money.”