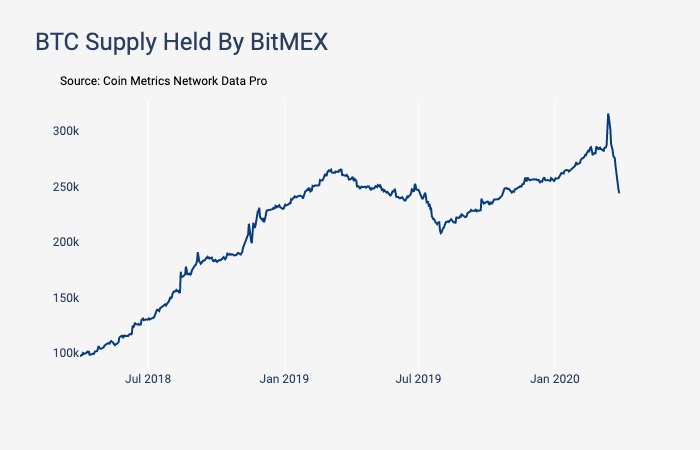

Bitcoin supply on BitMEX drops while Bitfinex, Kraken report rise

At the time of writing, Bitcoin’s price had attained some form of stability after the king coin pumped from $6200 to $6700 within a matter of 4 hours. However, such pumps have been the exception, rather than the norm over the past few weeks, with almost $2.7 million Futures contracts being set-off on BitMEX when Bitcoin was between $6200-$6300. Contributing to the negative sentiment was Bitcoin’s supply held on BitMEX, a figure that has been noting a freefall over the past two weeks, according to Coin Metrics’ recent report.

Source: Coin Metrics

The fall began with the massive liquidations that took place on 13 March. On the given date, the BitMEX exchange held a total of 315k BTC, but on 29 March, this value had fallen to 244k BTC.

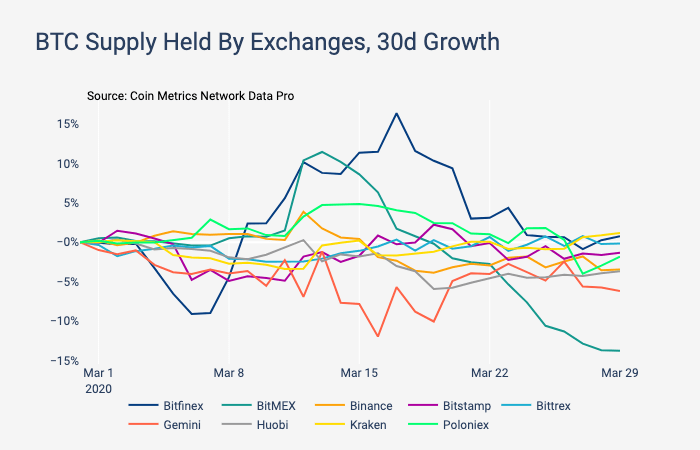

BitMEX was not the only exchange to report a reduced volume of BTC held on the exchange. Other prominent exchanges like Binance, Gemini, Bitstamp, Poloniex, and Huobi, also reported a fall in their Bitcoin balance. In fact, Kraken and Bitfinex remained the only two exchanges to note an increase in their BTC supply. The growth recorded by both was 1% each.

Source: Coin Metrics

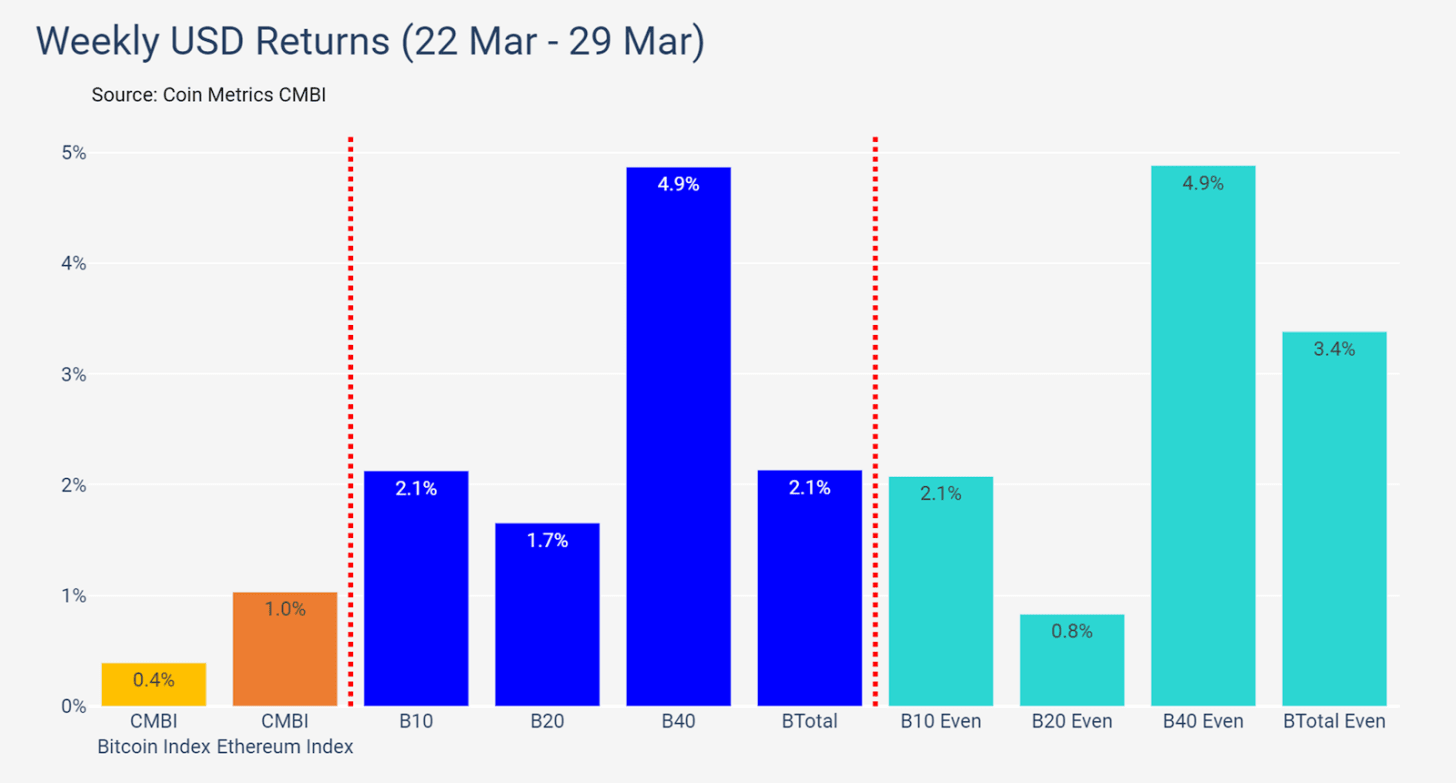

Apart from the reduced supply, the Coin Metrics Bletchley Index for Bitcoin was among the worst performers over the past week, recording only 0.4% growth. CMBI Bitcoin, along with CMBI Ethereum, were outperformed by Bletchley multi-asset indexes.

Source: Coin Metrics

Most other Bletchley indexes experienced intra-week highs of over 10% above last week’s close. However, as the week progressed, all indexes collapsed significantly through the weekend and finished up between 0 and 5%. Bletchley 40 or the small-cap assets finished strongest over the past week, recording 5% against the U.S. dollar and 3.5% against Bitcoin.