Bitcoin slumps under $7k for the fifth time as its price falls by over 5%

The Bitcoin price has been having a tough time to recover from the major fall on 12 March. Until a couple of days ago, BTC was well above $7k, but in this battle between the buyers and sellers, the sellers have taken the lead at press time, as BTC once again dipped below $7k.

Source: BTC/USD on Trading View

Since 12 March, this was BTC’s fifth attempt to stay above $7k. This suggests a presence of strong resistance at $7k, which would require more momentum from the buyers to short the coin and keep it above the immediate resistance.

On 10 April, as BTC fell by 5.35% within 4 hours, two more candles had taken shape. One was a green candle, indicating buying pressure, however, this was overtaken by the sellers once against as the next hour produced a long red candle and its wick went as low as $6,867.63, at press time. The fall that took place at 0500 UTC triggered liquidations worth $16 million in a single hour. However, BTC has been witnessing spurts of buy and sell liquidation in the market over 24-hours.

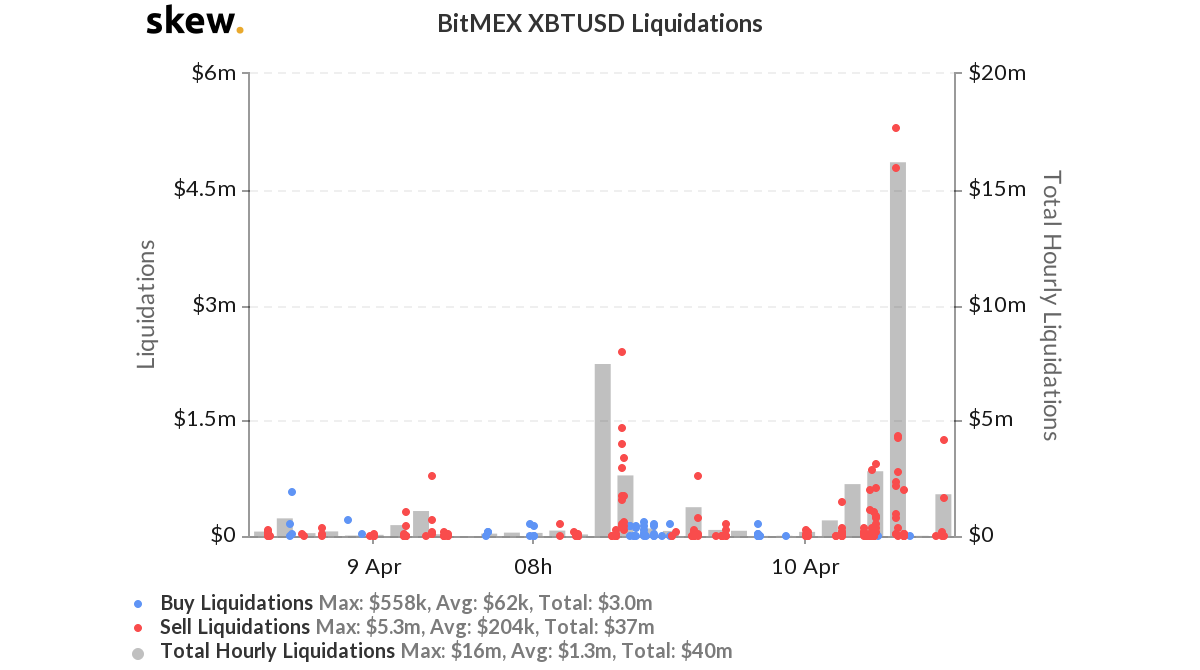

Source: Skew

According to data provider, Skew, a total of $40 million in liquidation took place on the BitMEX exchange. After several weeks, the Sellers were in full swing as they amounted for $37 million worth in long liquidations, compared to just $3 million short liquidations. This indicated that the sellers in the market have an upper hand and were pushing the price of BTC down.

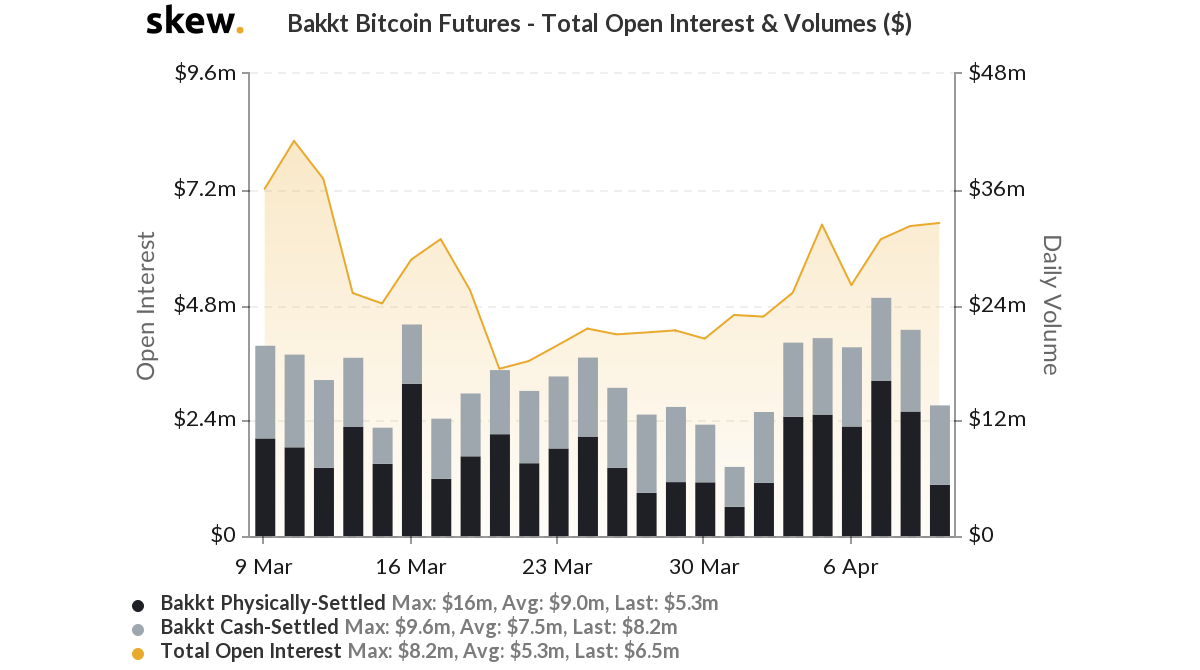

Despite a rocky market, BTC futures have been seen a spike in Open Interest [OI] in the market. Apart from the overall market, the CME BTC futures and Bakkt BTC futures noted a rising OI and volume after the slump.

Source: Skew

On 10 April, Bakkt OI was reported to be at $6.5 million, whereas the volume was close to $13 million. On the other hand, the CME BTC futures were way ahead with $179 million in OI and a daily volume of $110 million.