Bitcoin skew turns positive for the first time since 2019

Bitcoin has managed to surpass its strong resistance at $7k and has been reflecting buying momentum. Unlike multiple pumps and dumps noticed in the BTC market, the current price action appeared to be organically driven with enough volume to support the price of the digital asset. With an evolving price, the BTC Options market highlighted an important metric that had been laying in the negative zone and has turned positive.

According to the data provider Skew, the cryptocurrency has been less volatile in the past few days. This reduced volatility gave rise to a positive volatility skew. The metric indicated the options contracts for the same underlying asset, Bitcoin, in this case, with different strike prices, but which had the same expiration, will have different implied volatility.

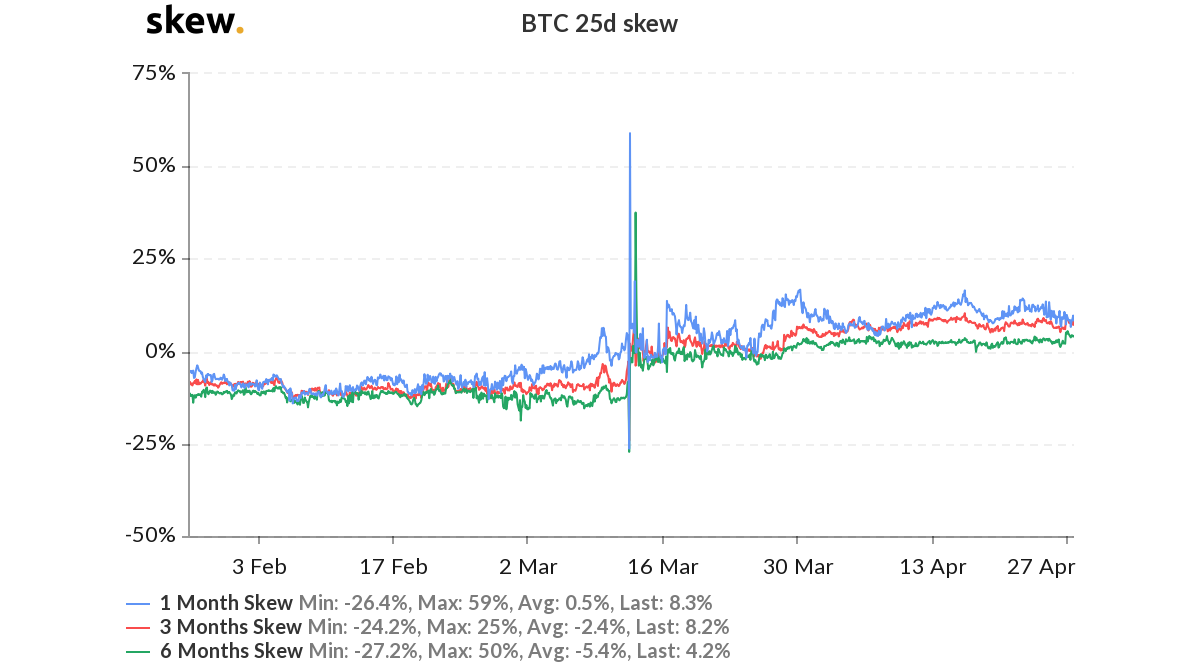

For the first time since 2019, BTC options market skew remained positive across different time frames.

Source: Skew

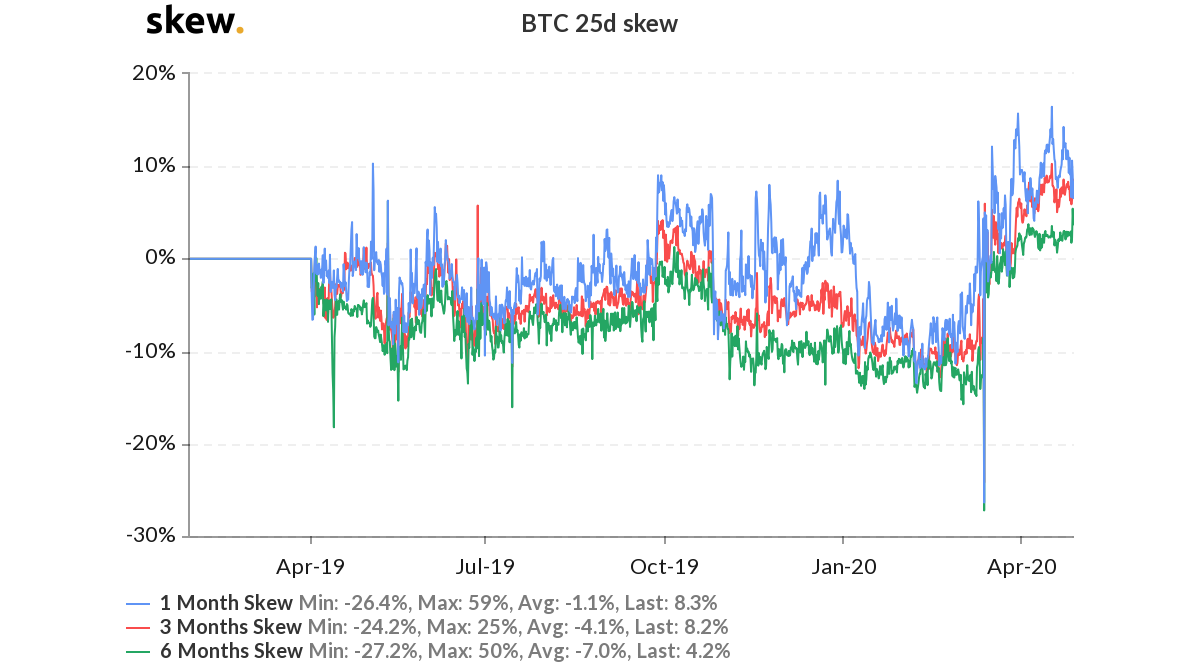

The above chart highlighted the immense volatility in the market on 12 March. The metric had remained in negative and had seen a brief positive level in 2019.

Source: Skew

Bitcoin halving is just a few days away, and traders will most likely long on bitcoin, which would further fuel this metric and keep it positive. The reduced implied volatility across BTC charts may result in a positive spin for the BTC price too around halving, as BTC was already valued at $7.675.10, at press time.