Bitcoin runs into a bearish bastion at $37.5K – What now?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- If BTC can traverse the $38k mark, traders can maintain their bullish expectations.

- The liquidity charts suggested that a reversal could take BTC to $35k or lower.

Bitcoin [BTC] maintained its bullish market structure on the price chart. The $37.5k resistance was unbeaten yet but BTC’s uptrend was still in play. In other news, the BTC hash rate reached its highest point in seven days.

AMBCrypto noted that miners were selling and that the miner balance had fallen dramatically in recent weeks. Could this selling pressure tip the scales and force a reversal?

The trendline support has strong defenders

In the past three weeks, BTC formed a trendline support (green) and has tagged it multiple times. On each occasion, the bulls have managed to buy the dip and force prices higher once more.

Besides, the structure remained bullish, although a move below $34.8k would change it.

The RSI was at 57 and has dropped over the past ten days. While momentum slowed down, the bears didn’t yet have the advantage.

The On-Balance Volume also slowed down but hasn’t broken its uptrend.

The local highs near $38k could be taken out before a move downward. The expectations of a drop in prices would solidify upon a price move beneath the trendline support.

To the north, $41k-$43k would be a target if BTC climbs above $38.5-$38.7k.

Price is attracted to liquidity and could see a range formation

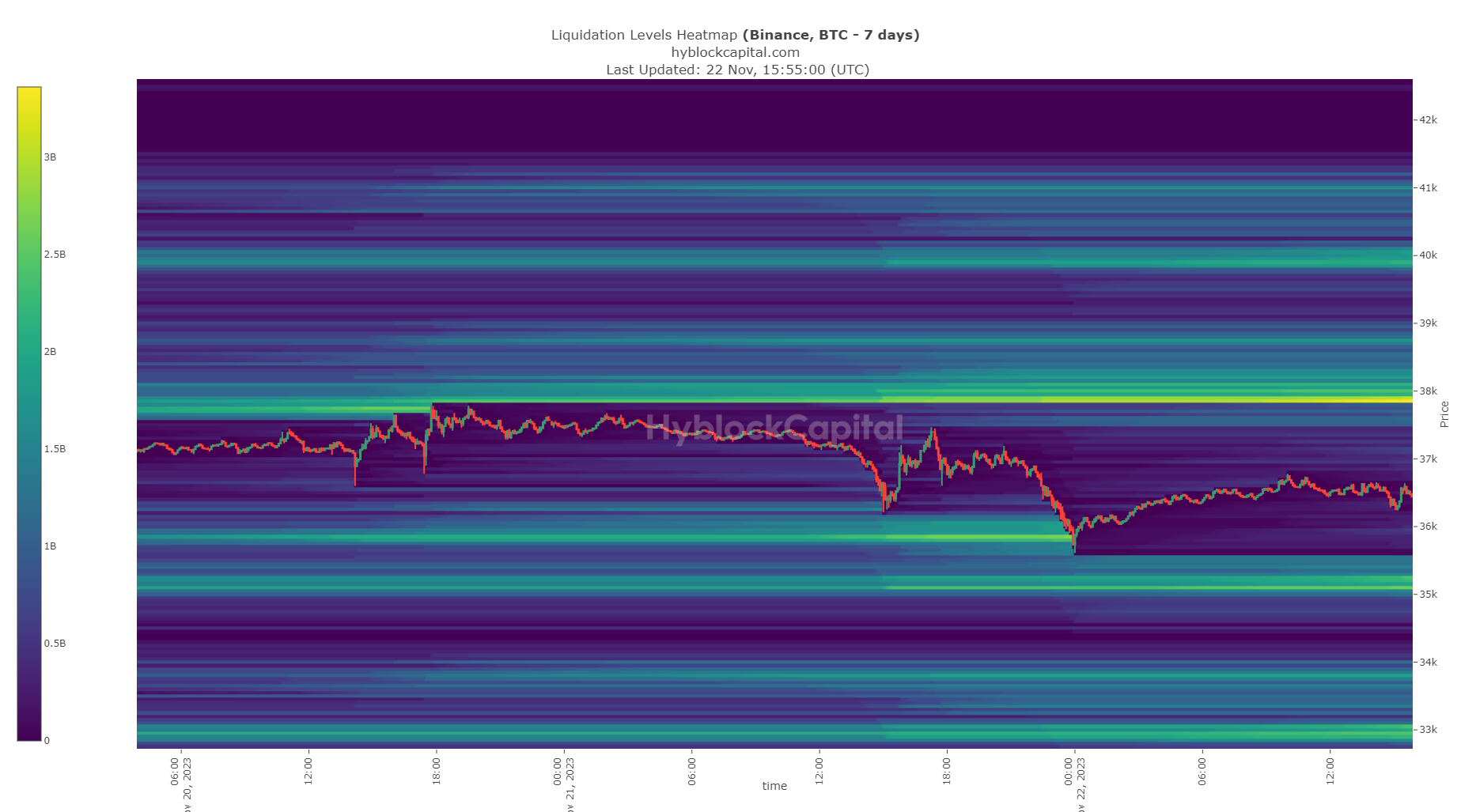

Source: Hyblock

With the past seven days as the look-back period, the liquidation levels heatmap was plotted. AMBCrypto’s analysis of this data alongside the technical perspective showed that a move to $38k was a strong likelihood.

This was because of the current bullish bias on the charts, the trendline support holding strong, and the huge pool of liquidity at $37.9k-$38.2k.

Read Bitcoin’s [BTC] Price Prediction 2023-24

If BTC moved to this zone but was unable to close a 4-hour trading session above $38k, a reversal would become more likely.

In that case, a move south to $35k in search of the next pool of liquidity could commence. The formation of a range would be made clear if BTC falls to $33.8k and bounces thereafter.