‘Bitcoin era ‘pump and dump schemes might be most common on Binance

The integrity of the cryptocurrency ecosystem has improved over the years, but the bad rapport that comes with cases of alleged pump and dump schemes continues to shade the industry.

Market manipulation has been a major issue for the crypto-markets over the past few years. Although illicit activities stretch from wash trading to whale trades, pump and dump schemes carried out by self-organized groups over the Internet ranks as the most common form of manipulation.

A recent study conducted by the Department of Computer Science, Sapienza University of Rome, claimed that the biggest Pump Signal group was identified to be on one of the largest exchanges in the world – Binance. The study suggested that the organized actions of the group were able to generate a volume of transactions worth 5176 BTC in a single operation.

After undertaking two major case studies, the report suggested a way to better understand and detect the pump and dump scheme in an active market. The detection was carried out only on Binance because the exchange exposes APIs that allow the retracement of every single transaction in the history of a trading pair. However, the report said,

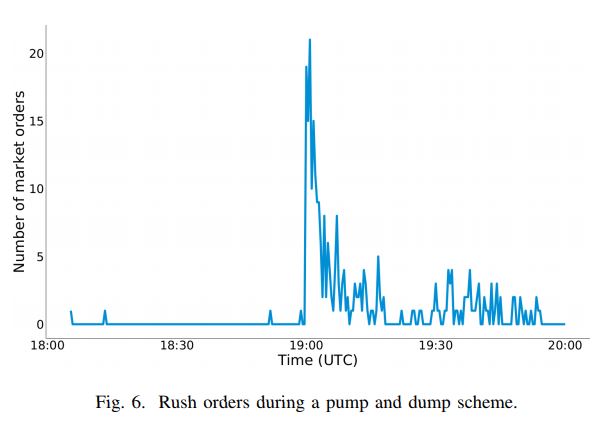

“The Binance APIs do not tell the kind of order (e.g.: Market, Limit, Stop Loss) placed by the buyer, so we need to infer this information. Since we do not know the original nature of these orders we define them as rush orders. We believe that we have a good witness on the abrupt rise of market orders even with this approximation.”

Source: Pump and Dumps in the Bitcoin Era: Real-Time Detection of Cryptocurrency Market Manipulations

The study identified that rush orders were rare during the hours before the pump and suddenly, grow just towards the start of the scheme. However, with the help of rush order analysis, among the major manipulations, different groups arrange schemes on the same altcoin over time periods that are always a few days apart.

Additionally, the report also suggested that if exchanges keep a sharp eye on the buy and sell orders, a pump and dump scheme can be detected as soon it starts taking shape.

Self-regulation could possibly help exchanges avoid manipulation

One of the ways suggested back in 2018 by the Department of Justice (DoJ) and the Commodities Futures Trading Commission (CFTC) is the method of self-regulation of crypto-assets.

Unregulated markets have a larger tendency to attract illegal practices; hence, such a policy enforced by exchanges and detailed market monitoring can avoid such trades.

Such a step was taken forwards by Bittrex exchange in 2019 after it announced that market participants involved in manipulation will be held accountable. Since then, market manipulation has drastically dropped on the exchange, the study claimed.