Bitcoin price does not conform to interest, so what’s fuelling the rise?

Where is the source of the Bitcoin-bull run?

That was the question raised when the tide turned in the favour of the top cryptocurrency back in April, 2018 as Bitcoin saw a massive daily gain initiating the current bull-run, and that is still the question reverberating now.

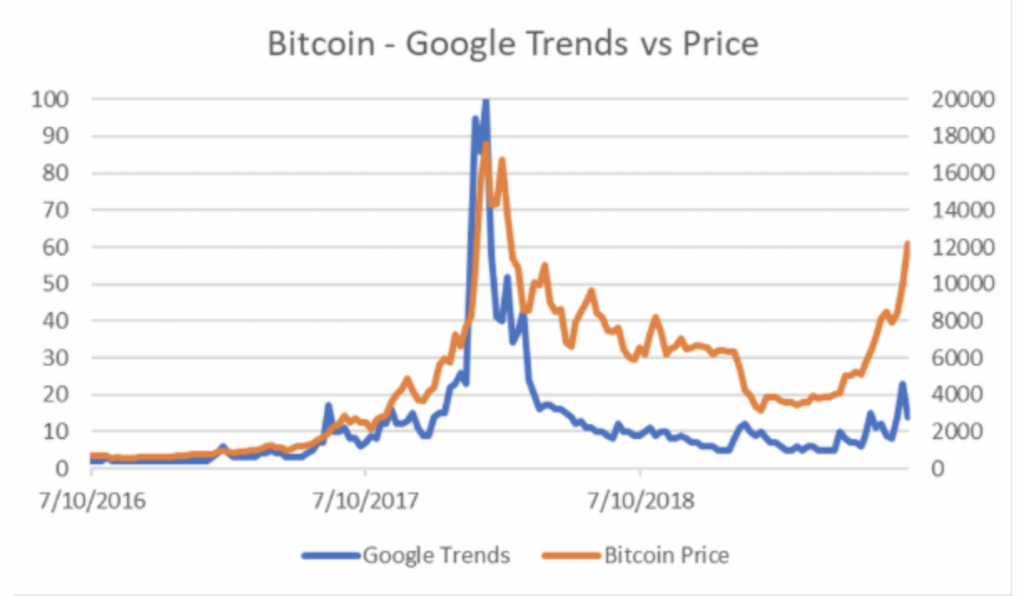

According to Forbes, the crypto-community, for the most part, does not care about the Bitcoin price rise. Charing the sentiment of the larger public, as measured by Google trends, against the price of the top cryptocurrency, there is an obvious divergence.

The report added that this divergence has only manifested off-late, and hence,

“There was a reasonably high degree of correlation between Bitcoin prices and interest in bitcoin.”

Citing three possible reasons for this trend to price difference, the report questioned volatility, adoption, and institutional breakouts. Firstly, the prospects of the outpouring of crypto-knowledge has already reached the larger public and hence the search results have died down. This knowledge boom could certainly be pointed to for the increase in price, as new nascent investors come into the crypto-fold.

Secondly, volatility is so much so that daily investors don’t seem to care enough to enquire on the search engine. To be fair, four months ago, Bitcoin was less than $5,000, last week it was $9,500, yesterday it was $13,000 and now its trading at $11,500, so volatility is a fair argument.

Thirdly, the US may have been ousted as the centre of the cryptocurrency world, leading to Asian players to step in. A noticeable trend was seen during the April 2 rise, where Bitcoin rose by over 17 percent in a 24-hour window, with the crux of that rise occurring during Asian trading hours.

Lastly, no surprises in guessing who the latest heavy-weight addition is in the cryptocurrency space. Institutional investors have buoyed the market with several price blessings in 2019, most notably, JP Morgan, Fidelity and even Facebook with Libra. Hence, an institutional whale could be moving the price, leading to quiet trend results.

Calling this an “inflection point,” the report stated that if the highs are lost, the skeptics will once again point to volatility and short-term price changes. However, most analysts suggest that the price will continue to find upward momentum until the May 2020 halving.

The report concluded,

“If we stay at these levels, or get further increases, it seems difficult to believe that more investors won’t start dabbling.”