Bitcoin, other cryptos’ herding behavior may have reversed after COVID-19

Financial education has led investors and most traders into diversifying their portfolios to mitigate risks. Apart from bonds, stocks, and gold, cryptocurrencies have evolved into another asset class that people want to invest in due to the notion of its lack of correlation to global economic events. This notion precipitates a herding behavior in crypto-markets, like in the traditional market. However, as markets everywhere collapsed due to the unforeseen COVID-19 pandemic, this notion had to face some serious questions.

Crypto-markets have largely been looked upon from a profit-making perspective and there is data available on how even small allocations to Bitcoin could substantially improve portfolio returns. Abiding by this logic, many traders around the world have started to herd top cryptos like Bitcoin, Ethereum, Litecoin, etc.

In fact, according to a paper that researched and understood the effects of a ‘Black Swan’ Event [COVID-19] on Herding behavior in the crypto-market, unconditional herding is an evolving pattern in the most prominent international market.

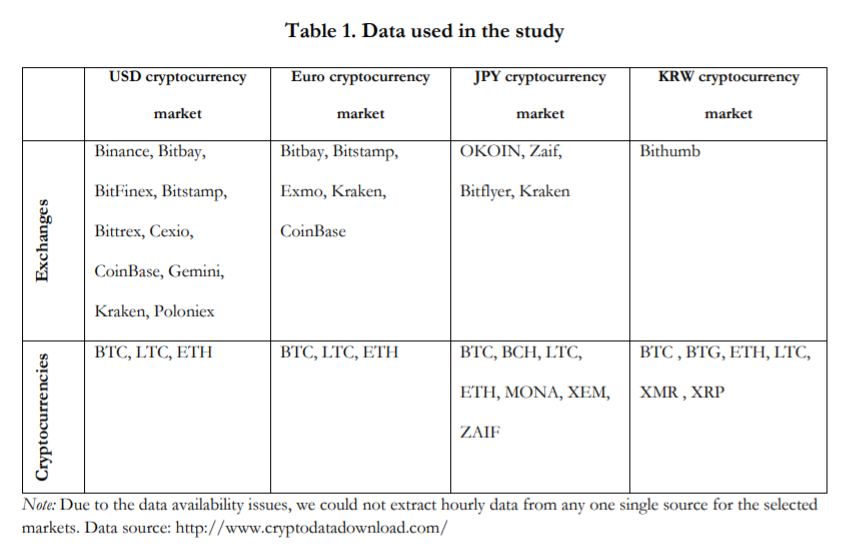

The researchers focused on crypto-markets in the US dollar, Japanese Yen, Euro, and South Korean Won and noted that unconditional herding is common across all markets, except for KRW.

Source: The Effects of a ‘Black Swan’ Event (COVID-19) on Herding Behavior in Cryptocurrency Markets: Evidence from Cryptocurrency USD, EUR, JPY, and KRW Markets

Traders in USD markets were herding crypto during the rising and falling trend, while JPY and KRW cryptocurrency markets noted interest in collecting crypto just during the falling market. KRW market was the highest herder of crypto during its downtime. The research also highlighted that “herding increases with the level of uncertainty,” according to the observations made before COVID-19 and how it impacted the markets.

After the market crash, it was noted that increased volatility decreased herding behavior.

This was especially visible in the USD and Euro crypto-markets. Thus, contradicting the maxim which says “herding is stronger during times of heightened uncertainty.” Despite the change in herding behavior of crypto, Bitcoin’s inclusion in Chinese Yuan and Japanese Yen indices incurred gains in terms of risk-adjusted returns. However, there has been no mathematical formula to assure positive yields in terms of herding or inclusion of BTC in the portfolios.