Bitcoin Options trades high post halving: less optimistic, more realistic?

The direction of the wind changes as fast as trends change in the cryptocurrency space.

After months of anticipation and wait, Bitcoin finally underwent its 3rd halving, and the asset’s valuation remained under $9000. With many expecting BTC to consolidate somewhere near $10,000 before the halving, the 15 percent dip on 9th-10th May, dented their hopes.

Now, less than 24-hours into the halving, the sentiment is beginning to change.

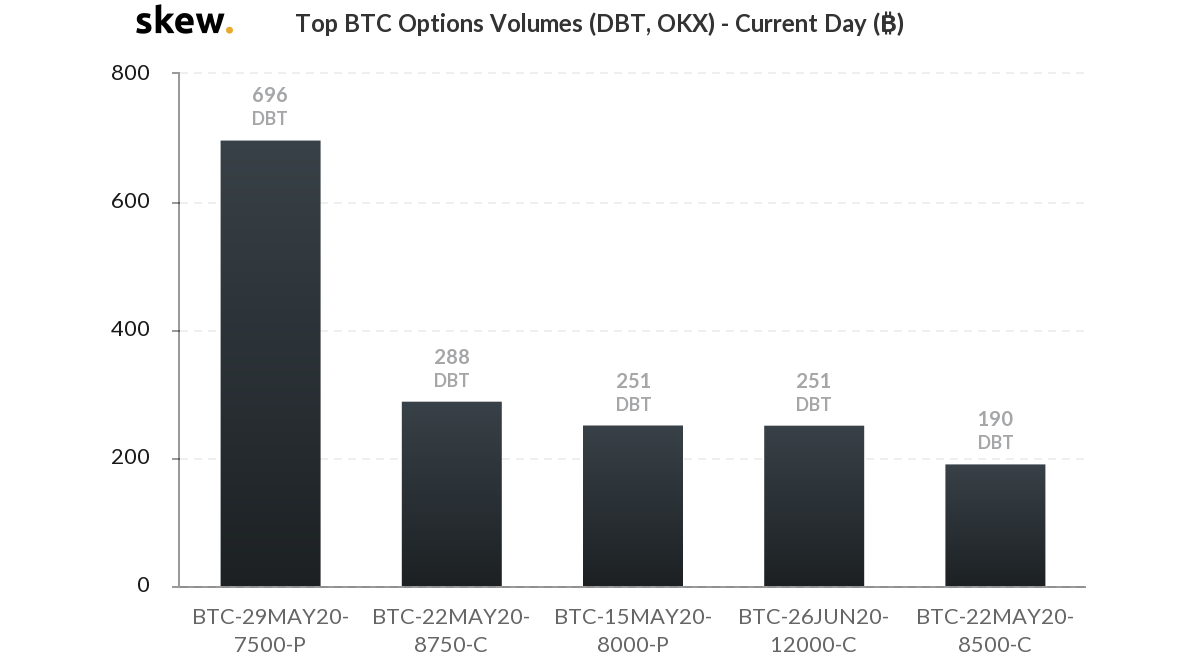

Source: Skew

According to data from Skew analytics, the most traded contract on Bitcoin Options depicted a bearish trend, at the time of writing. The contract with a 696 BTC in volume, was trading with a strike price of $7500 put, with expiry date 29th May 2020. The third most traded contract was also $8000 put, but the expiry date was 15th May, with a strike price of $8000. A total of 947 BTC in options contracts were currently marked along with the expectation of a price crash.

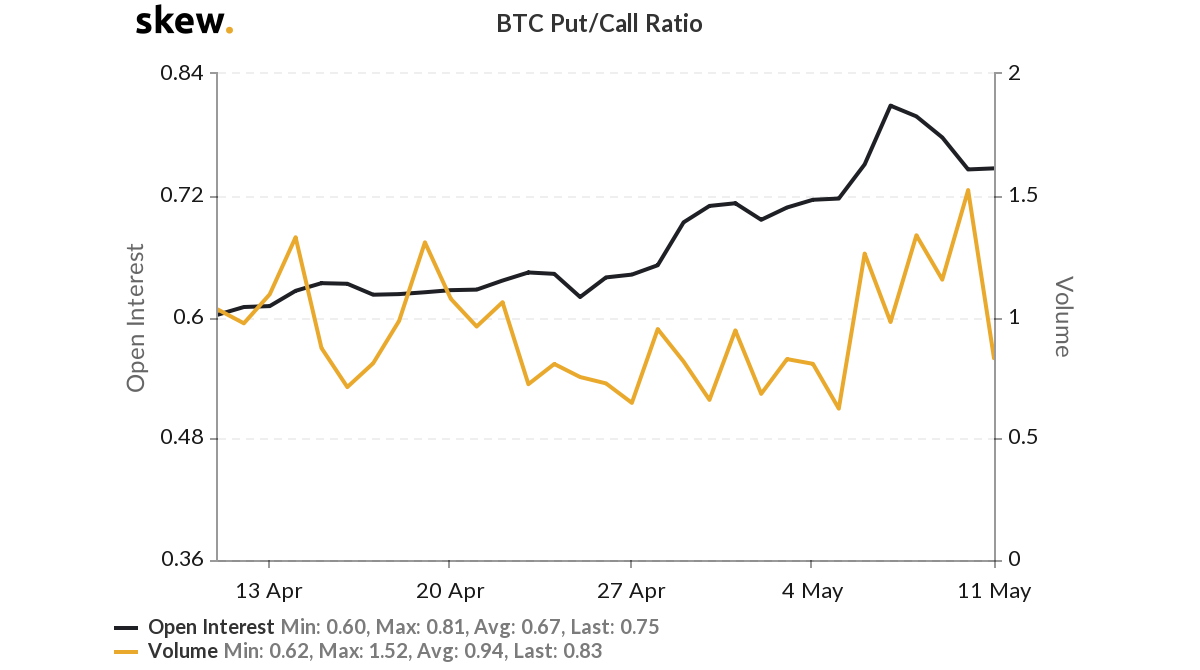

Source: Skew

However, a certain anomaly was observed, as the Put/Call ratio indicated a drop instead of a rise in the charts. The ratio dropped from 1.58 to 0.83 which suggested that a surge in either closing put positions or opening call positions, relative to the rising price.

Neither was the case at press time. Bitcoin registered a minor 0.34% percent dip since the halving, whereas the above data exhibited that put contracts held the upper hand in terms of the higher trading volume. Hence, the only explanation could be that the recent data was yet to be incorporated in the Put/Call ratio calculations.

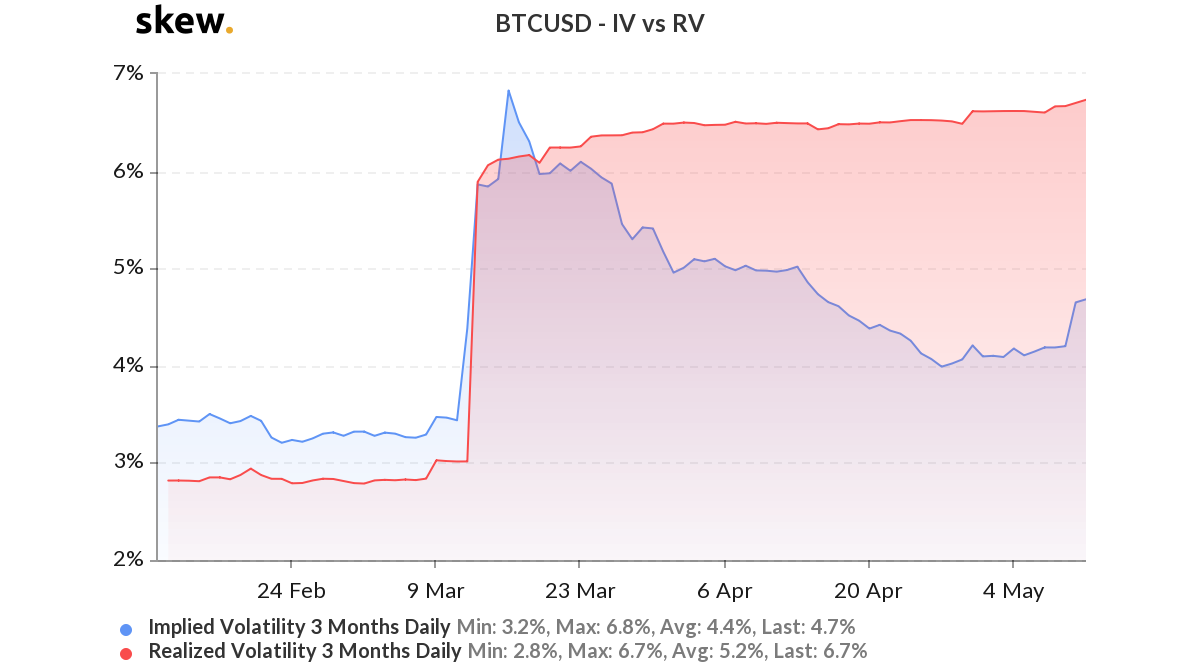

Source: Skew

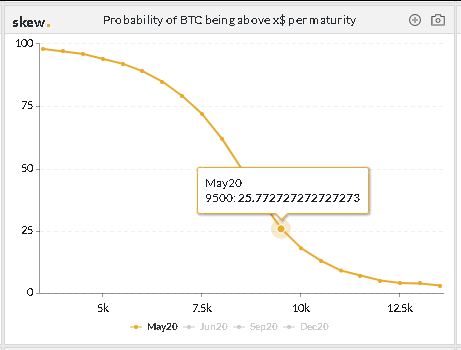

With such market dynamics coming into play, BTC/USD 3-month daily Implied Volatility also underwent a spike after nearly 3 weeks of stability. The spike in implied volatility is a clear indication that BTC prices are expected to undergo price swings in the near future. However, the probability index of Bitcoin crossing $9500 was relatively low at 25 percent, as optimism had faded away.

Source: Skew