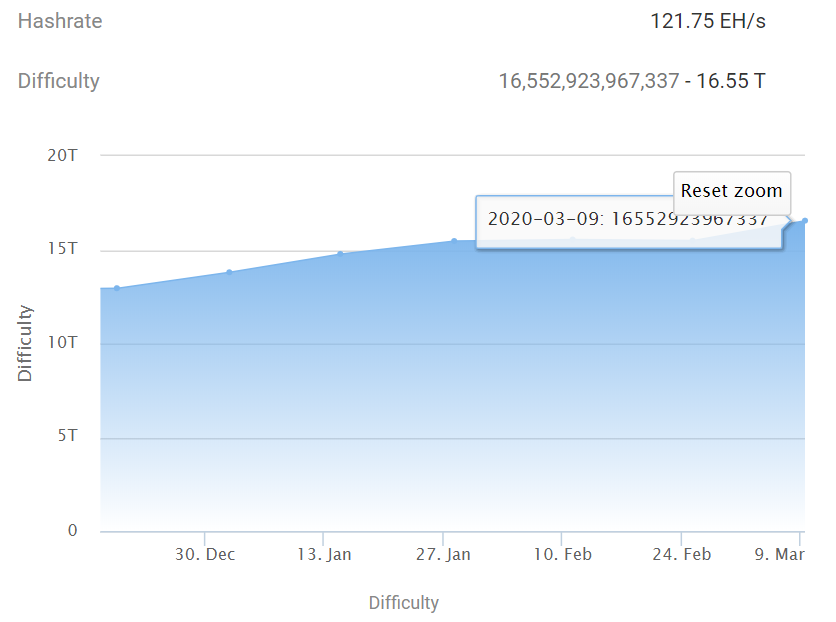

Bitcoin mining difficulty hits a new high at 16.55 TH/s

Digital Gold, Bitcoin’s value has been getting slashed since 8 March, at press time, BTC price fell by 15.75% and was at $7,835.68. The bear attack has many analysts and traders alike thinking that it’s the right time to buy the dip.

Source: BTC/USD on Trading View

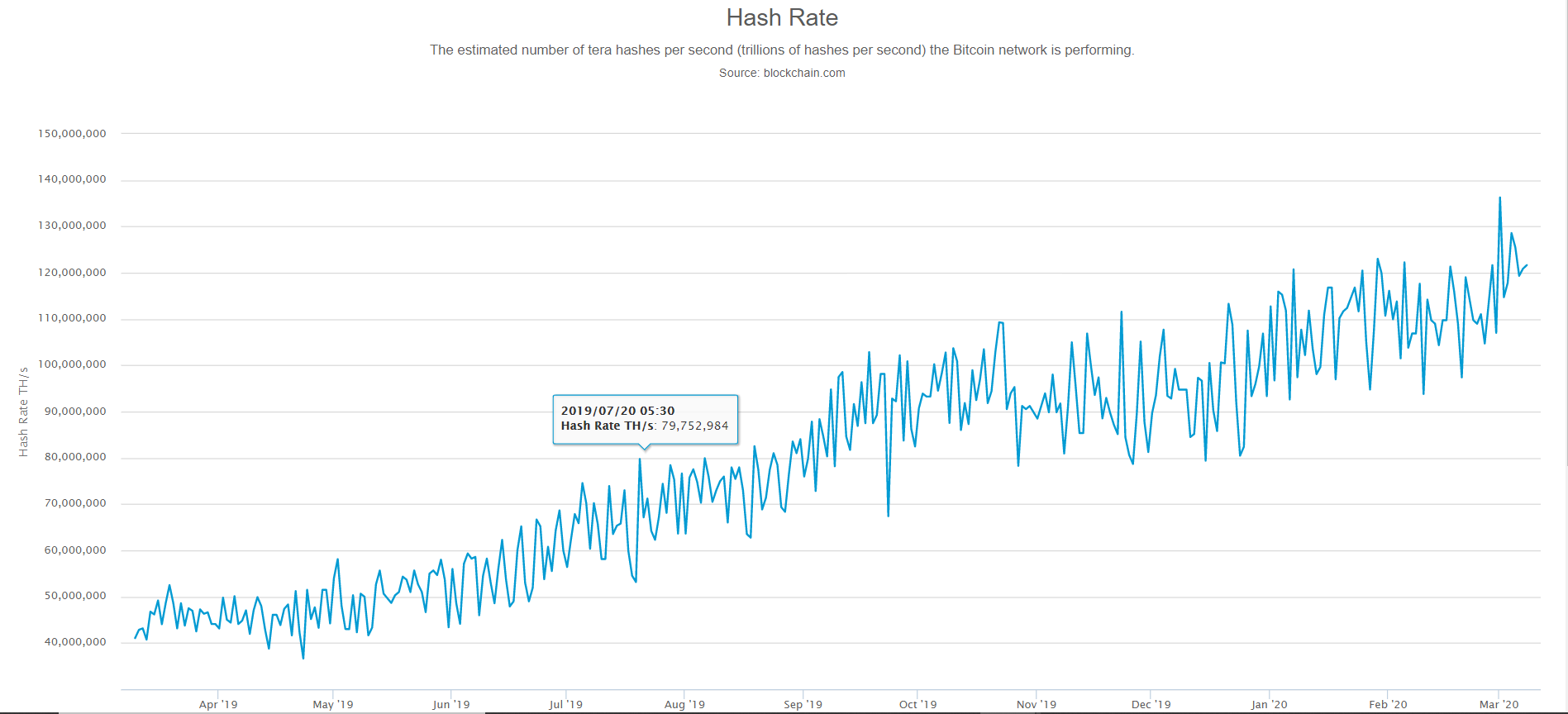

The price of BTC has been very volatile since entering 2020. The coin managed to rise, fall and correct itself all in a matter of three months, and was once again re-visiting its depths. However, Bitcoin’s difficulty and hash rate have continued to stride up over the past three months.

Mining difficulty stagnated during the end of December 2019, but an increase in the hash rate triggered the difficulty to rise. Mining difficulty stood at an all-time high of 16.55 TH/s, according to data provided by BTC.com, a major bitcoin mining pool.

Source: BTC.com

With the current ATH, the difficulty increased by 6.88%; estimates suggest that this might push the difficulty to 17.71 TH/s, making it more difficult for the miners to validate new blocks.

The state of the network and miners were reflected by hash rate and mining difficulty. As mining difficulty increased, the hash rate had recently marked an ATH at 136.36 TH/s.

Source: Blockchain.com

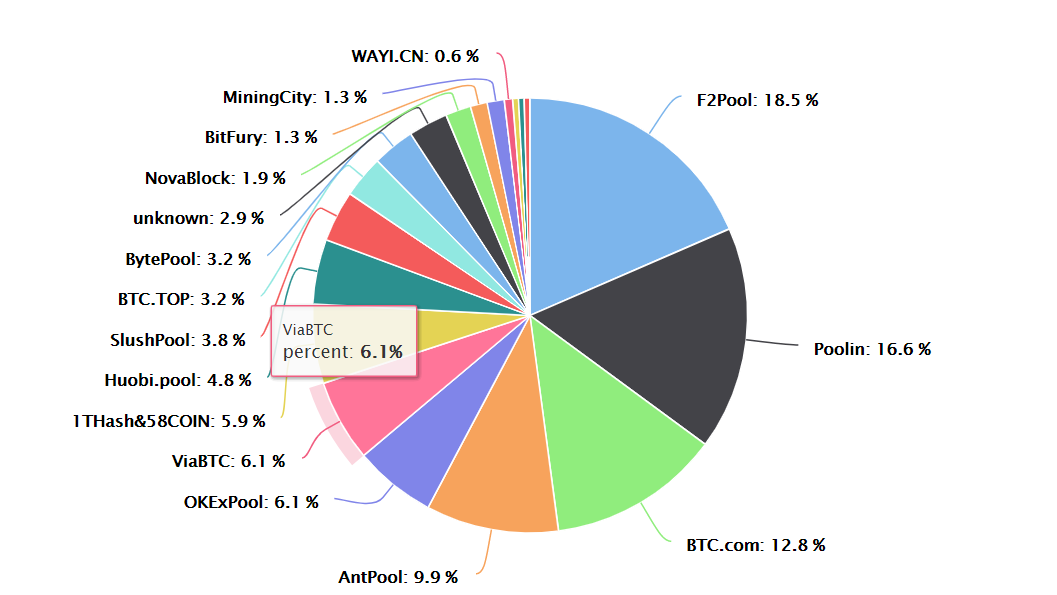

As the hash rate continued to rise, a market observer recently noted that four mining pools had the largest hash rate accumulation. The mining pools were Antpool, BTC-com, Poolin, and F2Pool and they made up for >50% of BTC’s hashrate.

Source: BTC.com

At press time, Antpool had 9.9%, BTC.com had 12.8%, Poolin had 16.6% and F2Pool had the largest 18.5% of the hash rate.