Bitcoin miners’ fortunes set to soar again?

- Bitcoin’s jump over $41,000 lifted the miners’ hashprice.

- Nearly 11% of block mining rewards came from transaction fees.

Weekend fun got bigger for crypto enthusiasts as Bitcoin [BTC], the world’s largest digital asset by market cap, went north of $41,000 for the first time since April 2022.

At the time of publication, BTC was exchanging hands at $41,322, AMBCrypto spotted using CoinMarketCap’s data.

The optimism around spot ETF approvals has been a major catalyst behind the pump, as AMBCrypto has reported in several of our recent articles.

Miners celebrate high ROI

Like other participants, Bitcoin miners too were in festive mode.

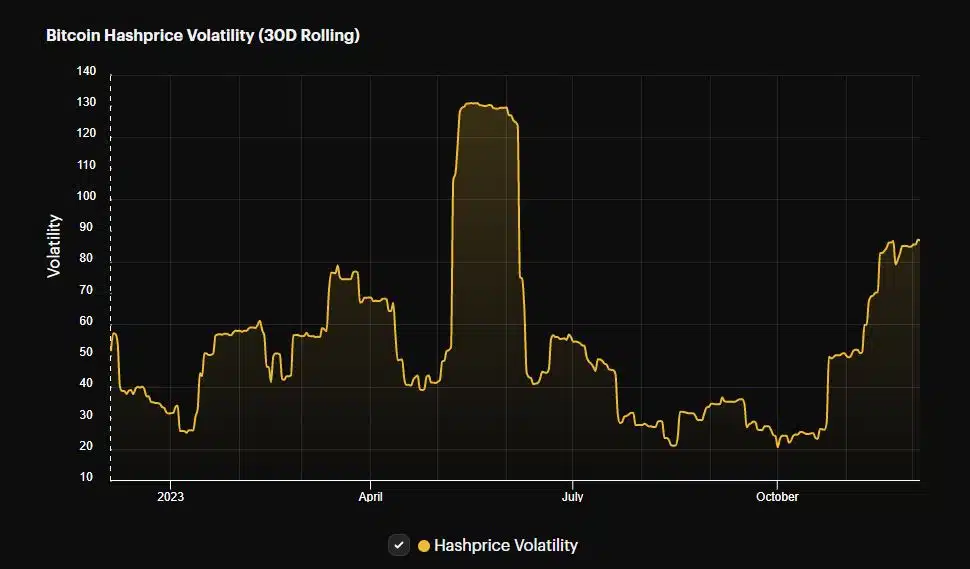

Hashprice, considered an important barometer of miners’ profitability, jumped to a six-month high of $87 per PetaHashes per second per day (PH/s/day), data fetched from Hashrate Index revealed.

In fact, as of this writing, the hashprice has more than tripled in value since the start of the rally in mid-October.

Hashprice is a well-known mining metric that quantifies how much a miner can expect to earn from a specific quantity of hash rate. It is positively correlated with changes to Bitcoin’s price, thus explaining the significant jump in value.

The higher returns on investments made in expensive mining equipment indicated sustainability in the mining sector. The lucrativeness could pave the way for the entry of more players into the industry.

Network fees rise

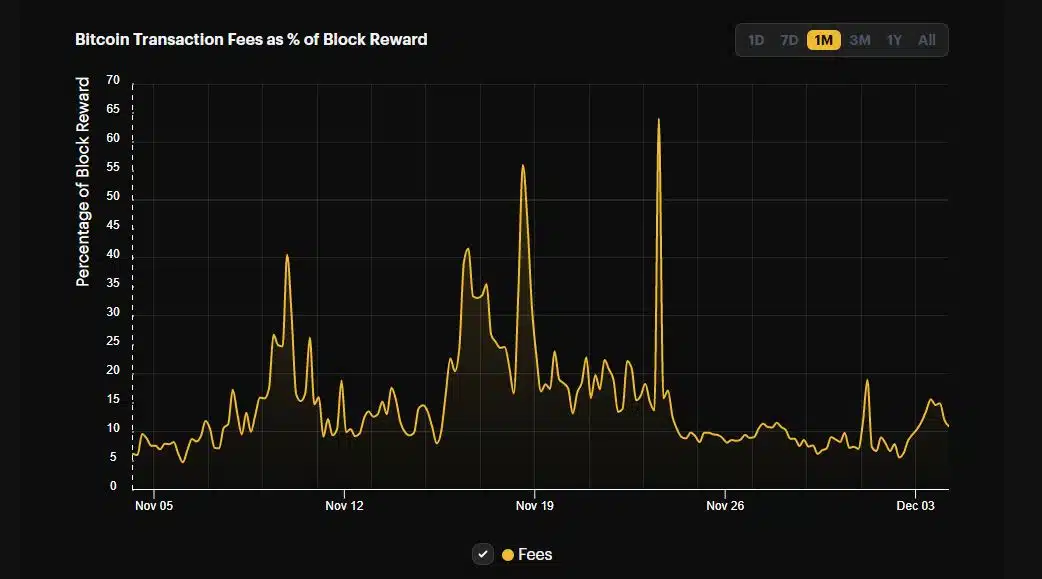

Apart from Bitcoin’s price, hashprice is also directly related to transaction fees earned by miners. As of this writing, nearly 11% of mining rewards came from fees, marking a significant uptick over the last few days.

With Bitcoin block rewards dwindling every four years, miners’ reliance on fees was certain to grow. In light of this, the increase in fees was a positive development.

Read Bitcoin’s [BTC] Price Prediction 2023-24

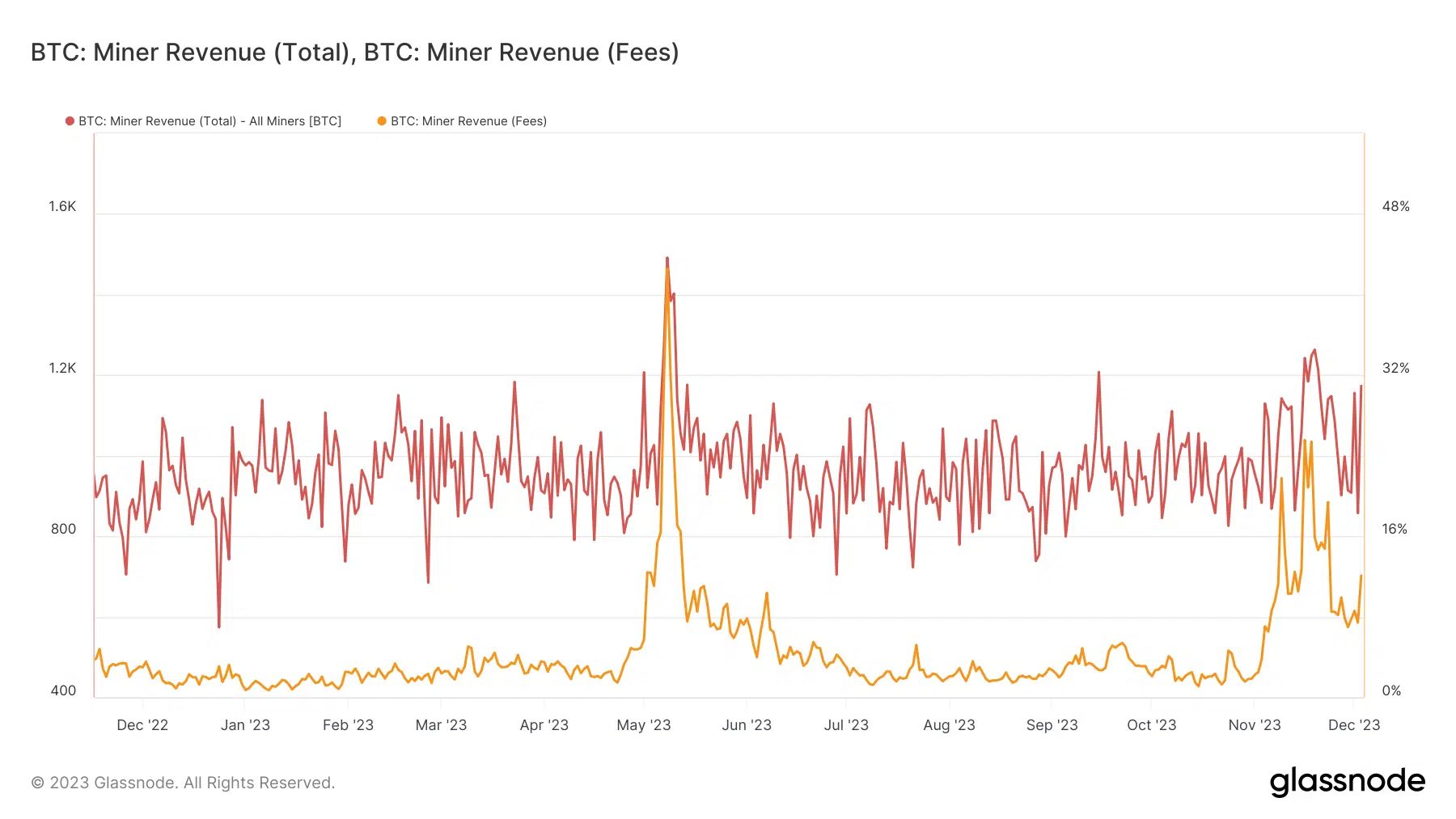

This was further scrutinized by AMBCrypto using Glassnode’s data. As shown below, fees trended lower for much of 2023, except for the spikes induced by Ordinals. The surge boosted miners’ overall earnings.

Going forward, sustained periods of high on-chain traffic, and therefore fees, could help offset the downsides of reduced rewards.