Bitcoin might share an ‘asynchronous’ relation with majors alts’ price action

For the longest time and for the probable future, Bitcoin is likely to be the most dominant cryptocurrency out there. Historical data regarding price action highlights how altcoins are often quick to mimic and react to price movements of Bitcoin. But, are there exceptions to the norm? And if the answer is in the affirmative, what contributes to altcoins having price movements independent of those noted by Bitcoin.

A recent research paper titled “Proxy-Hedging of Bitcoin Exposures With Altcoins,” published by researchers from the University of Paris, sought to shed light on Bitcoin’s hedging capabilities and its unique relationship with other cryptocurrencies in the market. The study noted,

“Despite Bitcoin being considered the benchmark digital currency while all other cryptocurrencies are highly correlated to it, [it also] shows that every major coin exhibits its own behavior due to idiosyncratic events.”

While the study did not pinpoint what constitutes these idiosyncrasies, it did suggest that each coin’s ecosystem reacted differently to major events like market crashes, such as the now-infamous Black Thursday crash in which Bitcoin lost half of its value in under an hour.

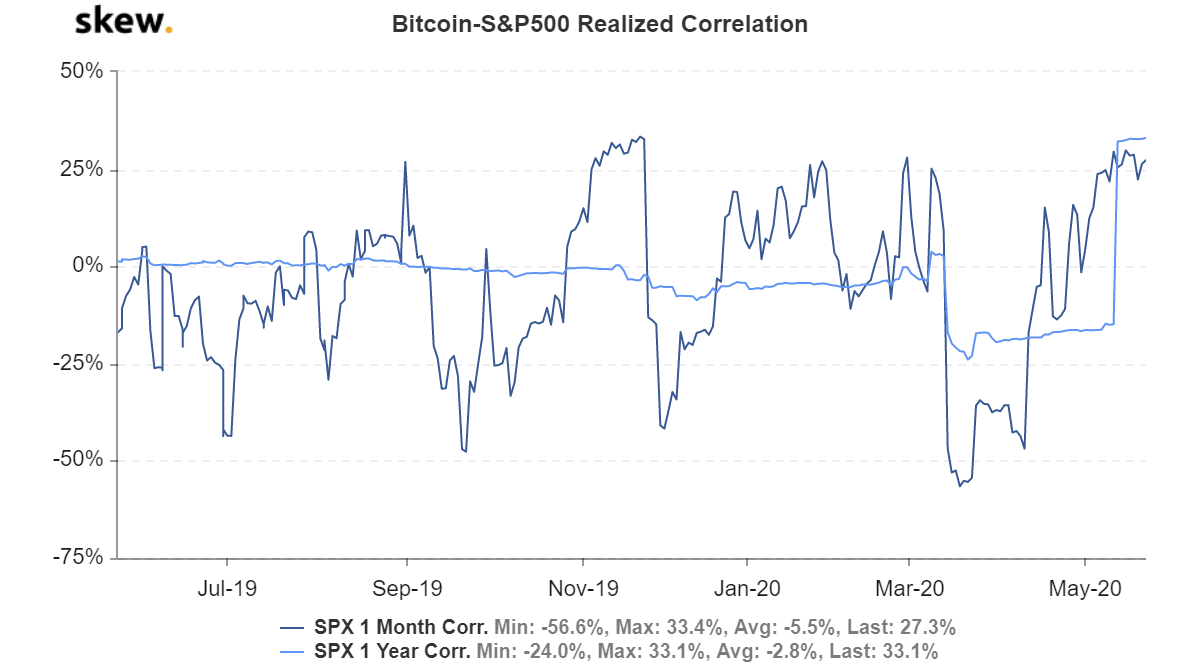

Source: Skew

Interestingly, even when compared to traditional assets like the S&P 500, over the past 30 days, Bitcoin’s correlation has grown rather significantly and systematically. This, in turn, raises questions pertaining to the king coin’s ability to shield itself from external market shocks.

With regard to its hedging abilities, the study noted that altcoins can help Bitcoin investors hedge ‘partial risk’ as the possibility of its price correlation, in the long run, is well established. The paper highlighted,

“Bitcoin investors and miners attempt to hedge only partially their risk. Mostly, they do this by purchasing Altcoins including Ether, Bitcoin Cash, or Bitcoin Satoshi Vision. The prices of these Altcoins with Bitcoin are correlated in the long run, however, in the short term, price co-movements are asynchronous.”