Bitcoin may be checking off its political, economic manifesto by acting as a hedge against the world

When the dust settles, what will remain?

Bitcoin, it can be argued, was created as a reactionary tool against the financial markets that laid waste to global economies and wrecked the world order during the recession of 2008. Political and economic turmoil heralded Bitcoin into existence and by the looks of things, political and economic turmoil have buoyed the BTC price with every ripple they send out into the world economy.

At first, cynics opposed to the financial world and those envisioning an economic meltdown were drawn to the cryptocurrency world. As time went on however, that cynical attitude was replaced with one laced with common sense. With growing financial, economic, trade-related, and political uncertainties ravaging markets and governments for the past few years, Bitcoin, like many other safe-haven financial assets, began gaining popularity.

In a year of stock market volatility, currency manipulation, and a global trade war(s) between economically prominent countries, a currency that is decentralized from larger financial ethos would seem like an effective hedge against the world’s political turmoil.

SAFE AND SOUND

Bitcoin has been the most volatile financial asset over the past few years, with regular rallies and free-falls. It would at first, seem absurd to label the cryptocurrency as a ‘safe asset haven.’ However, in light of recent political shifts causing economic uncertainties, Bitcoin is being likened to an anchor.

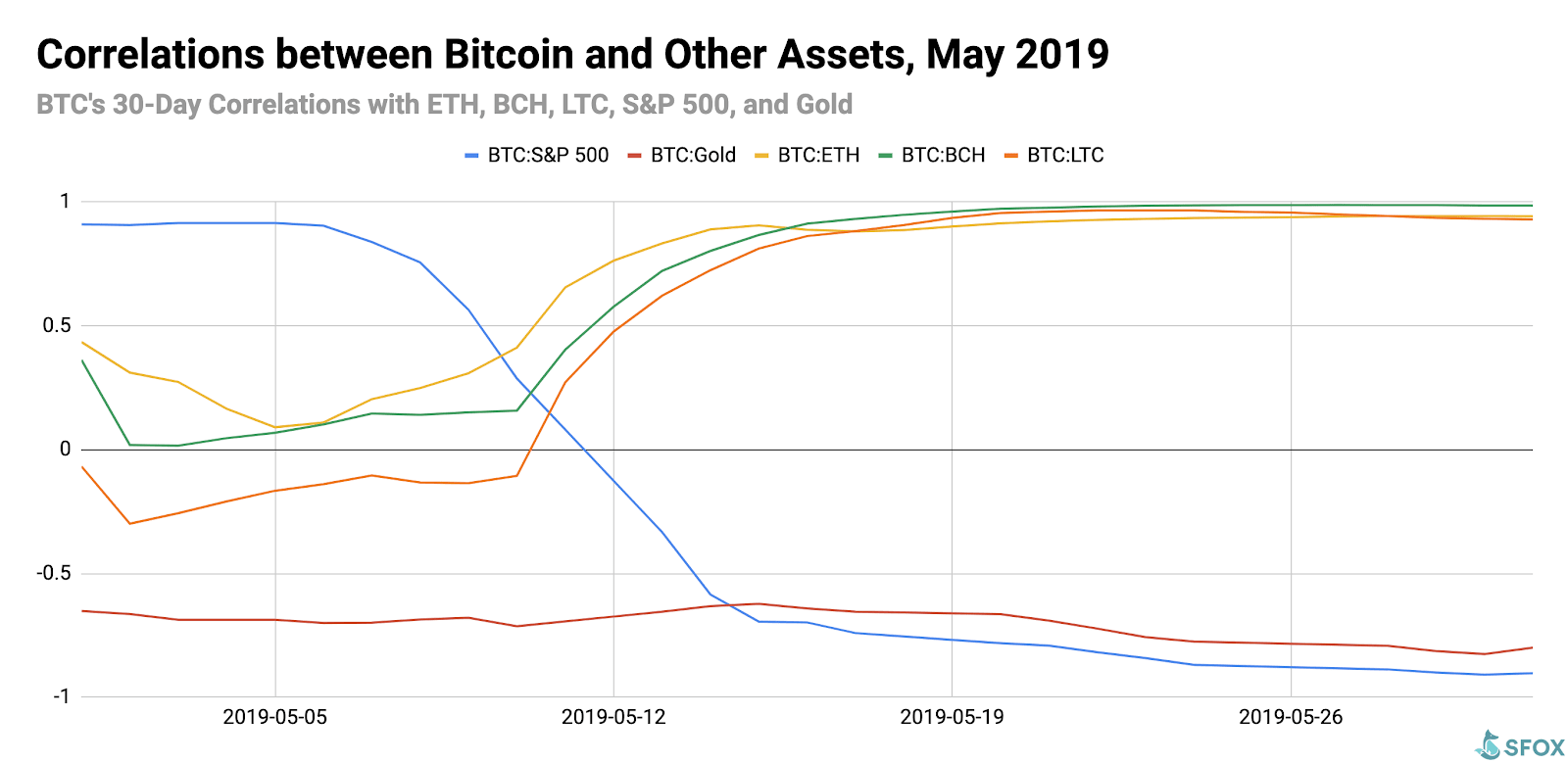

Tom Lee, Head of Research at Fundstrat and all-around Bitcoin bull, is of the belief that this uncertainty stemming from political and economic turmoil manifested on global financial charts could be good for Bitcoin and could position it as a hedge against the same. Veering away from its inverse correlation with the U.S dollar, Bitcoin has changed its colors in 2019, claimed Lee. Bitcoin has moved to a negative correlation with the stock market and surprise-surprise, digital gold has seen ‘positive correlation’ with gold. He added,

“Bitcoin is proving itself to be a hedge against global risks…that makes it authentic institutional source of diversification.”

What was once the volatile ‘fool’s gold,’ is now being likened to actual gold, and not just by Lee, but by the price charts as well. In 2019, despite several campaigns and debates pegging the cryptocurrency against commodities, Bitcoin and Gold have been following the same correlation as Bitcoin and other prominent virtual currencies like Ethereum [ETH], Bitcoin Cash [BCH], and Litecoin [LTC].

The chart below shows Bitcoin’s like for like movement with three financial asset classes, equities, commodities, and cryptocurrencies.

Source: Substack

Further, CEO of a crypto-focused info platform Nugget News, Alex Saunders, charted the correlation of the two financial assets i.e. Bitcoin and Gold, and also portrayed the inverse movement of the S&P 500 Index.

The inverse correlation between $SPX (blue) & #Bitcoin (Candles) / #Gold (orange) remains strong. My thesis is money will continue to flow into these assets in a slowly declining market. If it turns into a crash they may get sold off in a scramble for liquidity. pic.twitter.com/xsS7iuTURY

— Alex Saunders (@AlexSaundersAU) August 5, 2019

From the above statements and charts, Bitcoin’s has been increasingly stable as compared to other remnants of the traditional financial realm, and in that sense has been able to hold its own against political and economic turmoil in the past. With the price of Bitcoin surging by over 300 percent in 2019 alone, institutional adoption on the rise and no sign of turmoil letting up, the case of Bitcoin as a ‘safe haven’ asset is only growing stronger.

TRIALS AND TRIBULATIONS

Bitcoin’s tryst with global political and economic turmoil did not begin with the US-China trade war, and will certainly not end with the same. In the past week, two key macro-economic decisions have been taken by Beijing and Washington D.C, leading to the world’s markets going topsy-turvy. Bitcoin, at first, stood resolute, before rallying post the yuan devaluation.

Andy Cheung, Head of operations at OKEx, one of the biggest cryptocurrency exchanges used by Chinese residents, told AMBCrypto that the price of Bitcoin will be “supported by this [the US-China trade war] risk-off sentiment.” Highlighting the cases of the yuan devaluation of 2015, and even Brexit’s effect on the BTC price, Bitcoin has “benefited” by ongoing economic tensions, albeit in the “short/medium term” only, he said. Hence, it will bear significance to look at these cases.

RMB Devaluation 2015

On August 11, 2015, the People’s Bank of China [PBoC] devalued the yuan, dropping the fiat currency by 3 percent of its value. At the time, Bitcoin was trading at under $300 and within two weeks of the currency devaluation, it dropped from $272 to $209 in a whopping 22 percent decline. However, it managed to rise above the $300 mark before the close of October 2015.

At first, this would seem like a major price movement, but in the larger context, the stock markets saw more severe tremors. The S&P 500, the premier trillion-dollar market index of the US and indeed the world, saw a massive 11.15 percent drop within the space of three days over the same period, following the devaluation of the yuan, while other domestic indexes also fell.

Source: Trading View

It should be noted that in this period, Bitcoin was still in its infancy. Its market cap was still struggling to break the $5 billion market in terms of total capitalization, as compared to its $300 billion market cap of today. Hence, the Bitcoin drop of 22 percent is strikingly pale in comparison to the double-digit fall of a market index that is capitalized at $25 trillion today.

Source: Trading View

In the past week, SPX has fallen by almost 6 percent owing to both the Federal Reserve rates cut, as well as the response of the Chinese slashing their currency down to 7 percent to the U.S dollar. In response, Bitcoin, which was trading at under $10,000, pumped to over $12,000 and now stands stable around the $11,500 mark.

BREXIT Breakout 2016

In June 2016, as citizens of the United Kingdom voted to leave the European Union [EU], Bitcoin stepped up again after the Great British pound [GBP] fell and PM David Cameron resigned. The same was eluded to by OKEx’s Cheung who likened the Brexit issue to the yuan devaluation a year before, exemplifying how Bitcoin can act as a safe haven asset during political turmoil.

Source: Trading View

As was seen in the previous case, Bitcoin dropped by 20 percent immediately after the referendum, but was brought back up by around 17 percent within the following week. On the other hand, the GBP dropped by over 13.52 percent against the USD post the referendum and has still not managed to reclaim its earlier position.

Source: Trading View

Due to the long, drawn-out question of UK’s exit and several political resignations, the currency is yet to regain its pre-2016 highs, while Bitcoin, within the same period, has risen by a whopping 1680 percent from under $650 in June 2016 to over $11,600, at press time. It should further be noted that the market capitalization of the collective cryptocurrency market was hovering close to $15 billion during the time of the Brexit referendum.

Hong Kong protests, 2019

Another key political issue grasping the world’s attention today is the protests in Hong Kong over a proposed extradition law which allows ‘suspects to face trial in China,’ according to Reuters. In the midst of the heated drama, several business tycoons in Hong Kong have begun to shift their capital off-shore. Coincidentally, Bitcoin on Hong Kong exchanges was trading at a premium to the global markets, adding further evidence of BTC as a ‘safe haven’ asset.

The price of Bitcoin on the Hong Kong-based LocalBitcoins was over $9,300, which was a good $150 higher than the global value. Further, during the second week of June, the BTC/HKD trading pair saw volume growing consistently, suggesting that a significant amount of HK residents had begun to consider Bitcoin as a hedge against ongoing political uncertainty.

Mati Greenspan, Senior Markets Analyst at eToro, called this the “safe haven play” of Bitcoin, highlighting the HK premium.

Bitcoin is trading at a premium of about $160 in Hong Kong.

Pictured is the HK exchange TideBit where a single BTC is going for 73,120 HKD ($9337). A total of $159 above Coindesk’s current rate.

This is where the safe haven play comes in. pic.twitter.com/HNZWQkJ61j

— Mati Greenspan (@MatiGreenspan) June 17, 2019

Speaking to AMBCrypto on the question of Bitcoin’s action or reactionary effect to the political and economic turmoil of the world, Greenspan said,

“More likely people speculating on a narrative that might we’ll be true but the speculation itself regardless of the validity of the underlying theory can potentially impact prices.”

During the birth of Bitcoin and even today, its proponents cry out the main principles of Bitcoin as a store of value and a medium of exchange, tenets that are mandatory for the creation of a global currency. However, its ability to not only withstand political and economic uncertainties, but also to rise above them and act as a hedge, much like what gold did in the earlier days, does lead to another reason to hodl Bitcoin and trust in the world of decentralised currency as a hedge against the traditional financial world.

Brad Pitt playing Ben Rickert in The Big Short said it best,

“You just bet against the American economy.”