Bitcoin, Litecoin, XRP markets show signs of maturing despite lower 2019 YTD gains than 2017

The cryptocurrency industry continued to mature while eliminating FOMOs and FUDs at all stages. With the FOMO-fuelled spectacular but short-lived crypto rallies and FUDs-led dumps, the industry has begun to show signs of maturity. The market started off on a slow note in 2019 after the infamous Bitcoin crash the previous year. The market, however, saw significant recovery after consistent bull runs by mid-year.

The comeback

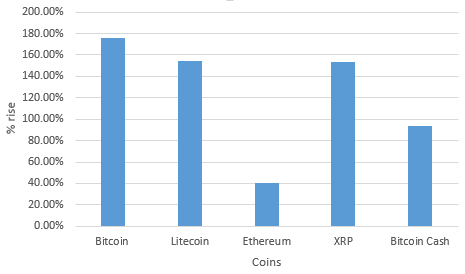

Bitcoin recorded the highest YTD gains of 175.52%. The silver coin to BTC’s gold, Litecoin followed suit posting 154.5% YTD gains. Ripple’s native XRP was positioned third with 153.5%. The contentious Bitcoin hard fork, BCH stood fourth with 94.15% YTD gains while Ethereum, which is the second-largest crypto by market cap stood fifth with just 39.99% YTD gains.

Year to Date [YTD] returns of top five cryptocurrencies

A sign of market maturity?

Even as the legal status of digital currencies remains vague, the cryptocurrency market has ostensibly matured. The harsh crypto winter took a toll on numerous promising projects which failed to yield profits. Substantial crypto projects continued to encourage investors to remain optimistic about the future of the industry.

The likes of JP Morgan, Facebook, Nike’s entry into the crypto space provided a necessary momentum, which was earlier associated with the darknet web and perceived as scams by outsiders. In the current regulatory scenario, the narrative of the industry replacing the legacy market is far-fetched; however, massive disruption in the traditional institutions by leveraging the digital currencies and the underlying tech [DLT] is what seems plausible.