Bitcoin investors’ ‘Now or Never’ attitude replaced by ‘Now and Always’

How does one identify if a market is healthy or not? Well, that is a question with no right or even one answer.

What can be expanded upon here, however, is the nature and attitude of the investor class – a crucial characteristic of a healthy market. How has that changed over the years and how has market maturity been affected?

A recent report by OKEx, compiled in partnership with Catallact, drew a comparison between the present-day Bitcoin market and the state of the same in the years prior. However, while the report’s focus was on markets, it did have a lot to say about its investors, both past and present, too.

It came to the conclusion that while Bitcoin’s market has evolved over the past few years, so has its investors and their attitudes.

You too UTXO?

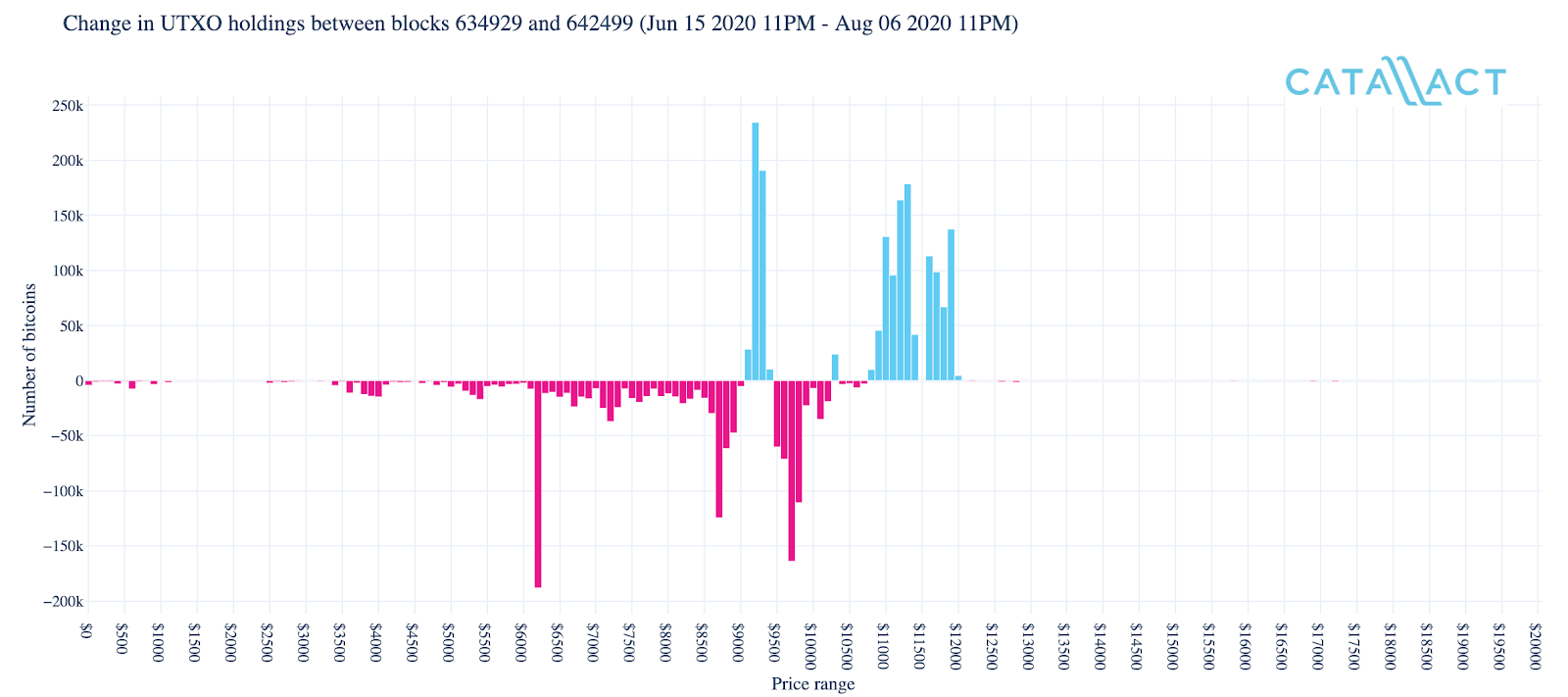

Look no further than UTXO locations and their buildups since these can be used to identify long positions and their entry prices. The report in question found two UTXO clusters – One for December 2018 and another for present-day, July-August 2020.

Now, this is an interesting finding. Not because of the timeframes that noted such clusters, but because of the timeframes that didn’t make the cut.

Source: OKEx

December 2018 was always expected to have such a cluster. After all, the month was the peak of the crypto-winter. What’s surprising, however, is the fact that between that period and present-day, there weren’t any important clusters of note.

What does this tell us? Well, two things. For starters, this reveals that over much of the period, most investors in the market were unconvinced about Bitcoin’s ability to climb over and sustain itself above $10K. This changed, however, not when Bitcoin crashed in March, but in July and August, with more and more people opening long positions at high entry prices, a sign of their confidence in Bitcoin’s long-term prospects.

Secondly, it tells us that investors have grown smarter. They haven’t been trigger-happy and were patient enough to see which direction Bitcoin was taking before opening these positions. Such kind of behavior is very unlike what one would have expected a few years back.

Confidence on the up

Then there is the matter of UTXO holdings. Over the past few months, many older positions have been closed after many of them realized their profits. This has opened up a vacuum that is being filled by new investors who are happy to open positions at higher prices.

Source: OKEx

The rush of new investors doing so has allowed these levels to emerge as strong support levels for Bitcoin. This is perhaps one of the reasons why Bitcoin has been able to hold its price position on the charts, with this investor class allowing BTC to consolidate before attempting to breach its next resistance.

Such behavior highlights two aspects – Not only the degree of confidence (again) but also the willingness to take risks at higher positions.

Down the memory lane

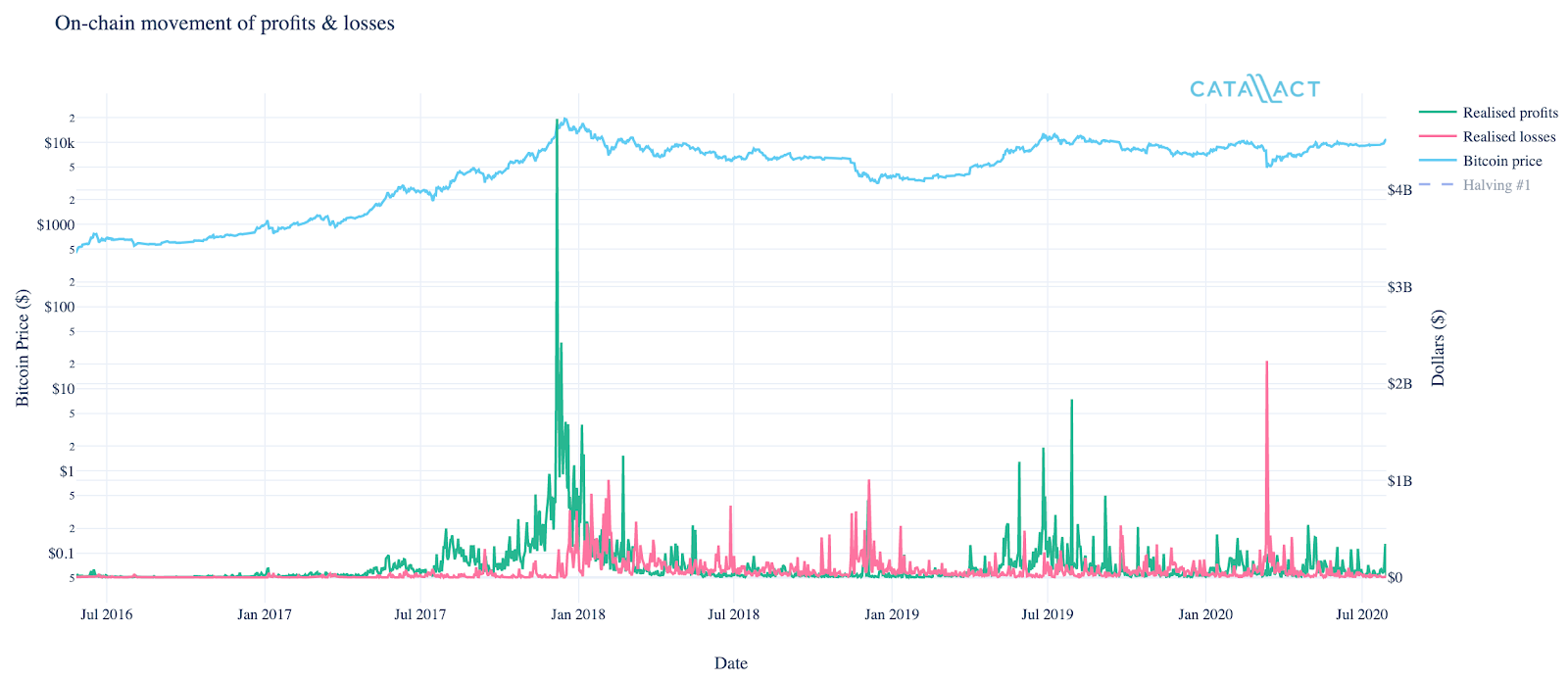

Finally, just recall how many reacted to the 2017 bull run and the crash in March for juxtaposition. While 2017 saw most embrace the “Now or Never” attitude to jump on the crypto-bandwagon, March 2020 saw panic-selling that was more or less “Do or Die.”

According to OKEx and Catallact, that doesn’t seem to be the case anymore. According to their report, such attitudes have been replaced by a steadier investor class. A look at the Realized Profit and Loss charts backs this assumption as Black Thursday saw all the ‘weak hands’ weeded out.

Source: OKEx

Since then, not only have realized losses dropped significantly, but so have realized profits. What does this mean? Well, it means that fewer traders and investors are selling. Simply put, very few of them are exiting profitable positions and cashing out, choosing instead to stay on.

What does this say about our investors? The report concluded,

“Traders and investors clearly don’t think current levels are unreasonable or unsustainable.”

The Asterisk

It should be noted, however, that none of this is supposed to mean that there aren’t people cashing out. And yet, despite these sell-offs, Bitcoin is holding. In fact, a recent report by Chainalysis had noted that “People are currently taking profits at a high rate and the price is being maintained,” citing the increasing demand for Bitcoin.

Each of these metrics and indicators points to a bullish industry and an investor class that has evolved and grown to be the mature backbone of the market. Sounds like everything’s hunky-dory, right? Well, not exactly, because investor attitudes alone don’t count. Their nature does too.

This was recently highlighted by Arca CIO Jeff Dorman when he implied that of the four types of digital asset investors, three of them (Bitcoin-only investors, Algo/Quant Funds, and Venture Capital Investors) aren’t critical to the sustainability of the ecosystem.

Bitcoin-only investors, he said, are only interested in profit margins and not in the evolution of the asset class while Algo/Quant Funds don’t care about its constitution. VCs, on the other hand, are just too happy to place long-term bets on projects that don’t even have a market product.

Ergo, if you thought investors were enough for a healthy market and that the crypto-industry is one, well, think again. After all, evolution is a process, not a leap.