Bitcoin – How risky is the institutional investor’s favorite?

Bitcoin has been, by far, one of the market’s best-performing assets, despite periods of stagnation in 2020. Given the present economic condition and the uncertainty that is prevalent, Bitcoin has been pitted to be the go-to store of value asset, giving the likes of monetary metals like gold stiff competition. This has also led to institutional investors flocking into the digital assets market over the past few years.

While the overall narrative is largely positive for Bitcoin, there may be challenges that may need to be ironed out if this momentum were to sustain itself in the long run.

Speaking on a recent episode of The Scoop podcast, Martin Green, Co-CIO and CEO of quant trading firm Cambrian Asset Management, elaborated on the challenges faced by institutional investors when it comes to the digital assets market. Green noted that when compared to traditional markets, crypto and the digital markets space come with quite a few challenges and increase the risk factor for many who are looking to boost their portfolio’s exposure to assets like Bitcoin. He said,

“There are a lot of risks that are unique to digital assets and I think the first is counterparty risk. And so there are a lot of firms that are trying to build a digital asset prime brokerage firm with all of the services but it doesn’t yet exist in digital assets.”

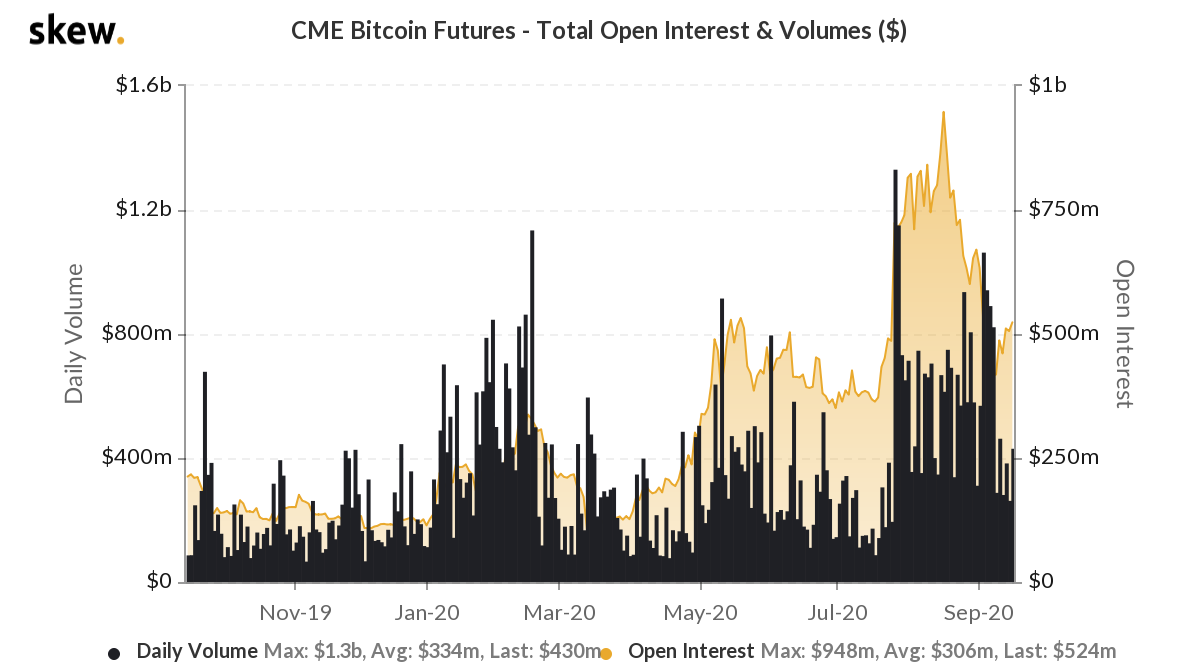

Source: skew

In recent times, Bitcoin has been considered to be the go-to asset for institutional investors. Market data from Skew shows that in the past year, Bitcoin Futures on CME have seen a substantial surge in terms of Open Interest and volume. In fact, BTC Futures on CME saw its OI rise from $86 million to a high of $948 million. Taking into account Green’s comments, once the challenges are fixed for institutional investors, the digital market space may see an even greater boom.

However, according to Green, counterparty risk will remain a major concern for institutional investors, with the exec claiming that “compliance risk or counterparty risk” actively prevent institutional investors from entering the space, adding that the two are connected to each other.

At the same time, Green argued that as things stand, crypto is fundamentally undergoing a transition period and may see increased institutional interest going forward. Contrary to popular opinion, he said that at the moment, institutional investors coming in are doing so at a rate much slower than most people in the crypto and digital assets industry would like it to. He concluded,

“I would say that the institutional interest is potentially moving more slowly than many in the crypto world would like it to, but make no mistake we’re undergoing a transition for sure from crypto being one of those things that institutions view as a third rail.”