Bitcoin: Has the bull run finally arrived?

Any Bitcoin price surge has often been speculated to bring about a bull run in the market, however, this has been true only a few times. Since the 2017-18 bull run, the Bitcoin market has noted many and frequent spurts of growth. Alas, none of them were sustained over a long period of time and none of these ‘bull runs’ managed to breach the previously-set level of $19k. However, as Bitcoin’s price once again rallied to breach $10k, the market was once again hopeful.

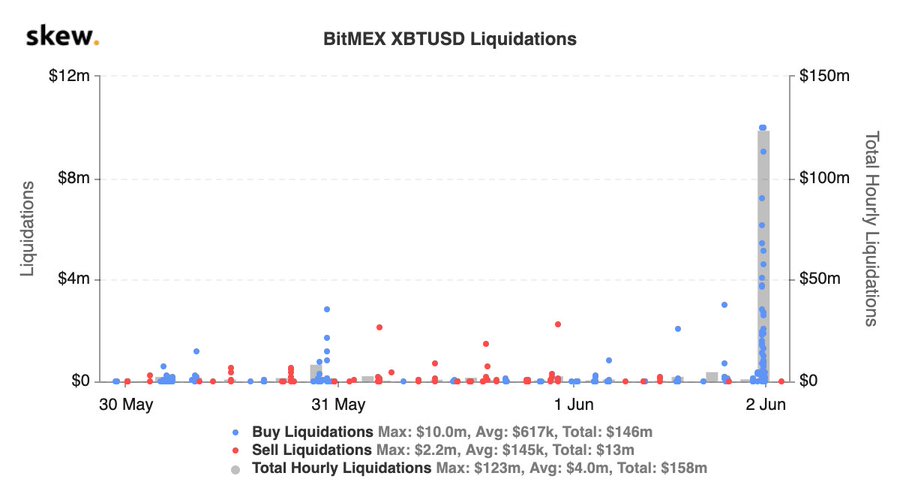

On 1 June, BTC surged past its resistances in the $9k zone and broke above $10,429; however, this was not a volume-supported rise. This surge of almost 8% on Monday night saw great activity in the BTC derivatives market. According to data provider skew, the buy liquidations surged past $130 million on BitMEX, reporting the highest daily total for the year 2020.

At the time of writing, the price of the coin had slid down to $10,093, at press time.

Source: Skew

Despite the surge in buyers in the market trying to push the price of the world’s largest digital asset, there were more sell liquidations in comparison. As per data, over the past month, liquidations worth $1.2 billion took place on BitMEX, out of which $765 million were sell liquidations, while only $400 million were buy liquidations.

Interestingly, while Bitcoin’s price surged by 21.04% over the past month, instead of building the price of the crypto-asset, the market was selling BTC.

Last year in 2019, the Bitcoin market saw growing momentum that was eerily similar. However, not all traders were able to spot it. BTC’s price appreciated from the beginning of April at $4,052.56 and kept at it till 26 June to touch $13,880. This was a mini-bull run and the traders who entered the market at $4k were able to reap at least 200% in returns by June. Alas, it wasn’t a wild bull run as speculated by analysts and traders as the coin failed to surpass the previous $19k high.

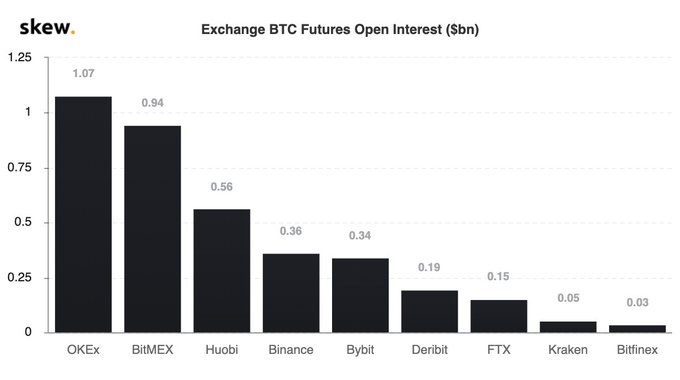

Therefore, it is still too soon to say whether Bitcoin’s present movement will be the definite precursor to its latest bull run. However, it would be too soon to dismiss the possibility of a bull run too. As noted by skew markets, popular crypto-exchange OKEx saw a renewed interest in its BTC Futures market. According to the same, open positions on OKEx surpassed $1 billion for the first time after the unfortunate market fall in March.

Source: Skew

At press time, the spot, swaps, and Futures contracts were all being traded at a price higher than $10k, indicating a positive outlook of the traders in the Bitcoin market.