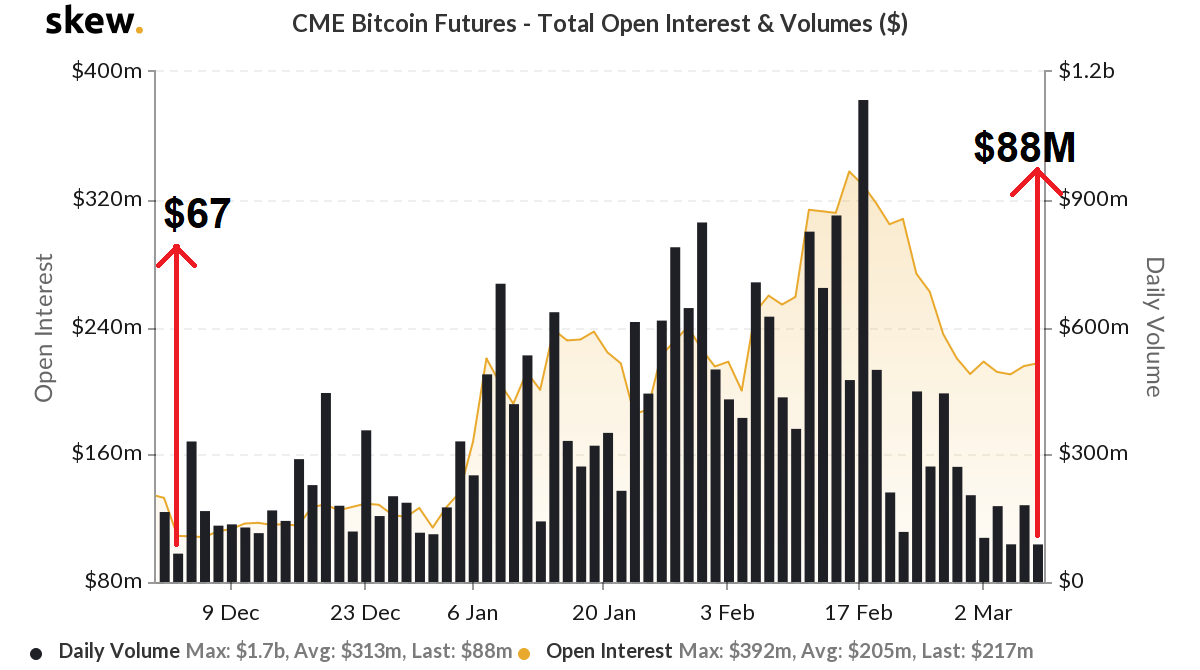

Bitcoin Futures volume on CME records new 2020 lows; Coronavirus effect in play?

CME’s Bitcoin futures volumes are depleting and so is the Open Interest [OI]. At press time, the volume for Bitcoin Futures on CME [March 06, 2020] was at $88 million. The last time it was this low was on December 03, 2019, when the volume was $67 million.

OI, however, is holding up better than the volume. On March 06, 2020, OI was above $200 million [$217 million]. Considering the worsening macroeconomic situation, it seems more than normal; with stock markets plunging to record levels, this drop in Bitcoin Futures volume is acceptable.

Institutional investors might be reacting to the Coronavirus scare. The lockdown in Chinese markets and other countries around the world has caused the financial markets to experience a jerk.

CME Bitcoin Futures

Source: Skew

Although Bitcoin is, theoretically, supposed to be uncorrelated, a gush of institutional investors has severed this narrative. Especially since the inception of Futures, Options, and other institutional products, this has caused a gradual increase in BTC’s correlation to the financial markets.

This correlation was noticed when Bitcoin dropped by $1,200 in a day when stock markets also took a dive. While some argue that this is a correlation, others consider this to be an isolated incident. Gold, which is considered to be a safe haven asset has also seen a dip in its value. However, it has surged equally fast since its drop.

Arcane Research’s report attributes this to the pandemic as well. The report noted.

“It looks like institutional traders are taking a break from bitcoin, in this unstable period with growing fear related to the coronavirus. While de-risking is a potential motivation, it’s likely that the sudden drop in the stock market had an effect through margin calls leading to a short-term liquidity squeeze.”

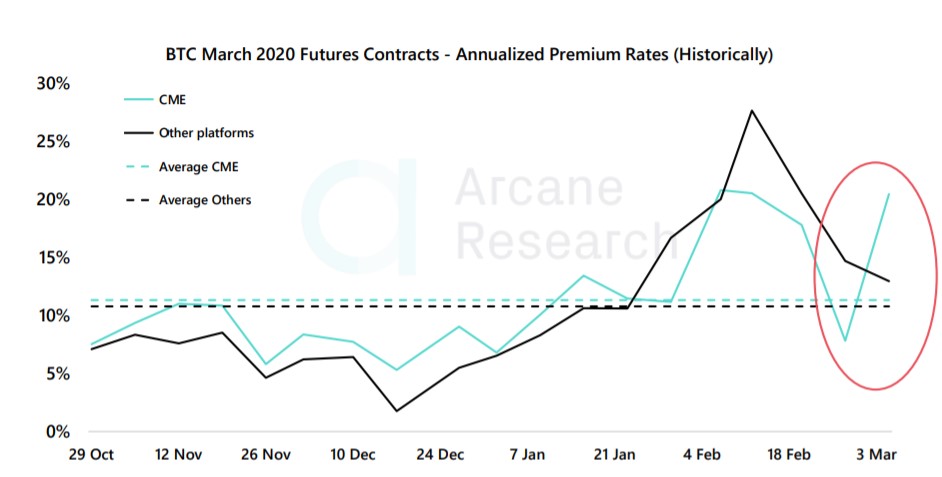

Bitcoin Futures’ Premium

Source: Arcane Research

Premium also plays an important role in determining demand. More premium an investor is willing to pay for a certain asset invariably shows the demand the product has. For CME Bitcoin Futures, the annualized premium rate is up by 20.5%, which depicts a story in itself. However, a stark observation is that on retail platforms, the same premium has gone down to 13%.

In comparison to the March 2020 premium rates for CME, it has increased by 1.25% since the last week. In both cases, there is a stark increase in premium during a time when the OI and the volume have both reduced. Perhaps, a lack of liquidity is to be blamed.

A credible takeaway from this could be that the COVID scare has had a greater impact than previously anticipated.