Bitcoin

Bitcoin Futures volume gains strength despite falling market

The cryptocurrency market that was up to a great start in 2020, has now switched sides. The optimistic market has turned into a fearful one, according to the Fear and Greed index that reflected that the investors are worried now. However, it also highlighted a buying opportunity.

Source: Alternative.me

While Bitcoin fell to close to $9.1k on 26 February, the impact was felt by the alt-coin market, which, until recently, had fueled calls of an altseason. However, with the great plunge BTC’s price has been taking lately, the market will require more time to acquire stability.

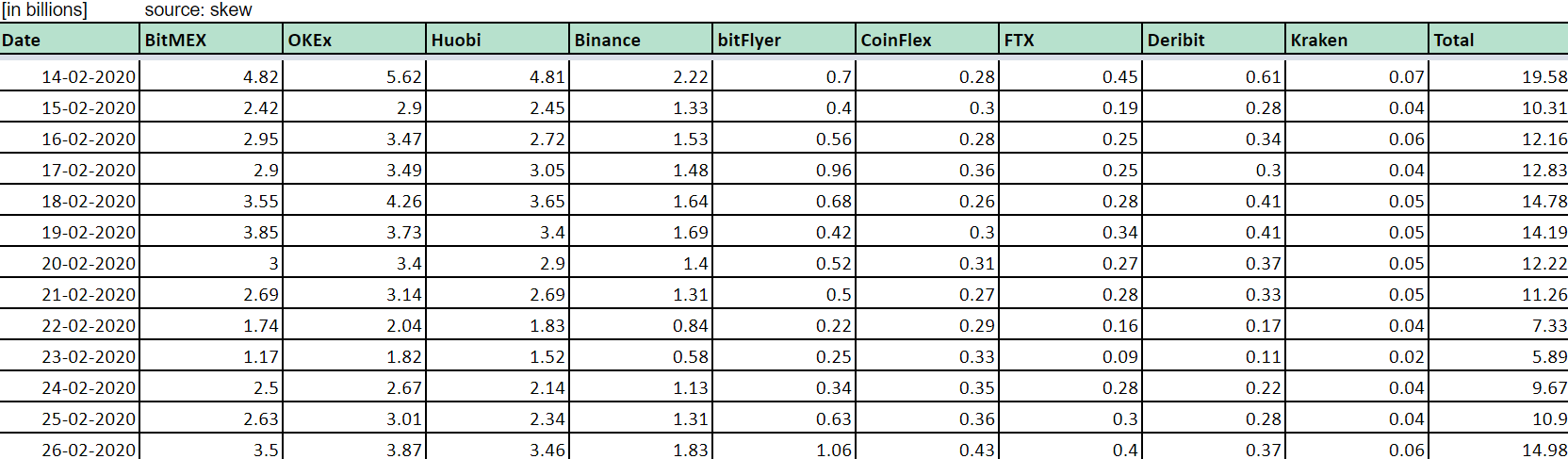

The falling spot price pointed towards a strong Futures trading volume for Bitcoin which was last seen on 14 February. According to data, the BTC Futures trading volume on 26 February was reported to be $14.98 billion, a figure that was the highest over the past eleven days.

BTC Futures Trading volume

The Bitcoin Futures were exuviating volume more steeply over the past few days and it was reported to be the least on 22 February, with $7.33 billion. Data provider Skew also noted a rise and fall in the BTC Futures aggregated daily volumes, with the recent chase pushing the volume over $10 billion.

Source: Skew

This rising trading volume hinted at an active market, one where the traders are trading and not many positions are closed. The fall of the coin has once again, paved the way for buyers to enter the market as the Open Interest on the BitMEX market appeared to be rising.

Source: Skew

Due to the drastic fall in price on 25 and 26 February, the aggregated Open Interest appeared to be a little over $4 billion, at press time. Further, the CME BTC Futures noted a drop in Open Interest, along with its volume.

Source: Skew

The trading volume had been on a decline since 18 February, a day when the volume was $1.1 billion. After an abrupt fall to $118 million on 21 February, the BTC Futures volume soared, with the same recorded to be $272 million on 25 February. However, the Open Interest was still down at $262 million.