Bitcoin Futures’ resurgence on Binance sparks sole derivatives recovery

For the Bitcoin Futures market, the going has been tough, and a look at the field tells you that. Binance, the relative fledgling in the Bitcoin derivatives exchange game is now leading the pack in not just trading, but also recovery.

According to data from skew markets, the exchange has mounted the most resurgent recovery of all the top-7 exchanges to offer contractual Bitcoin. Both the volume and the open interest on Binance has been trending upwards, in stark contrast to the rest of the market players.

The recovery, in question, is from the March 12 drop, which had a two-fold effect. Firstly, the spot price of Bitcoin dropping from over $7,700 to under $4,000, despite pulling back to $5,500, it marked the biggest single-day drop in the crypto’s price for over 7 years. Secondly, open interest across derivatives exchanges began peeling off, as traders closed-off positions fast expecting further drops.

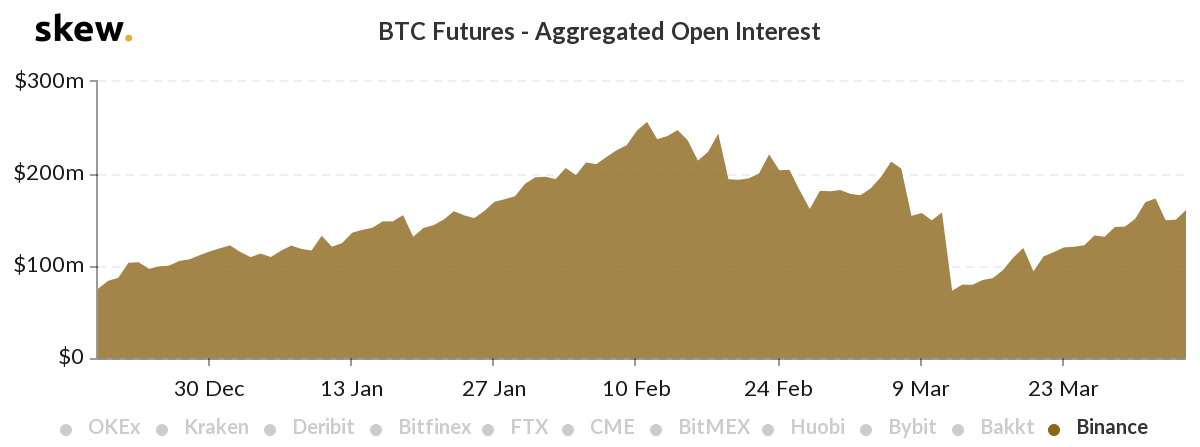

Bitcoin Futures OI on Binance | Source: skew

Binance’s OI chart is in stark contrast to the market. On March 13, following the price plummet, OI on its coffers dropped from $158 million to $73 million, a 53 percent drop, and in the two weeks following the plummet, the open interest rose by 136 percent, up to $173 million, higher than before the drop. At press time, the OI stands at $161 million.

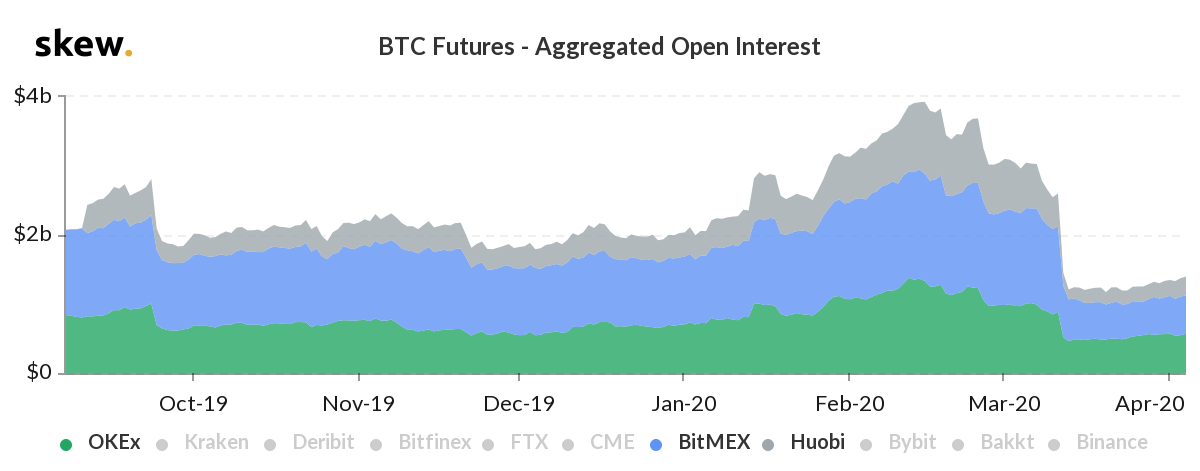

In comparison, the other exchanges have barely seen a recovery. In fact, BitMEX, one of the biggest derivatives exchanges has not only lost its perch as the derivatives exchange with the most volume, but its OI is still down by 53 percent since the March 12 drop. OKEx and Huobi have seen meager recoveries of 27 percent and 89 percent, but they are still below their March 12 high by 38 percent and 77 percent respectively.

Bitcoin Futures OI on BitMEX, OKEx and Huobi | Source: skew

While Binance, with $160 million open positions, maybe fairing better on marginal terms, in absolutes it is still fourth on the Open Interest ladder. OKEx has the top spot with $570 million in active positions followed by BitMEX at $560 million and Huobi at $280 million.

Further, according to the latest report by Arcane Research the share of total open interest for the week ending on 29 March, saw BitMEX’s OI share drop off the first spot with OKEx taking 28.36 percent of total OI to BitMEX’s 27.04 percent. The report attributed this drop to the “long squeeze and liquidation loop of March 12th.”