Bitcoin Futures on CME reflect a rise in Open Interest

Bitcoin’s market has been experiencing turbulence recently, with the coin diving by almost 7% and pulling Bitcoin’s price down to the $8.5k level on 19 January. At press time, however, Bitcoin was consolidating its position just below the $9k mark and was priced at $8,786. It had a 24-hour trading volume of $9.9 billion, having gained by 1.7% over the past day.

Source: Coinstats

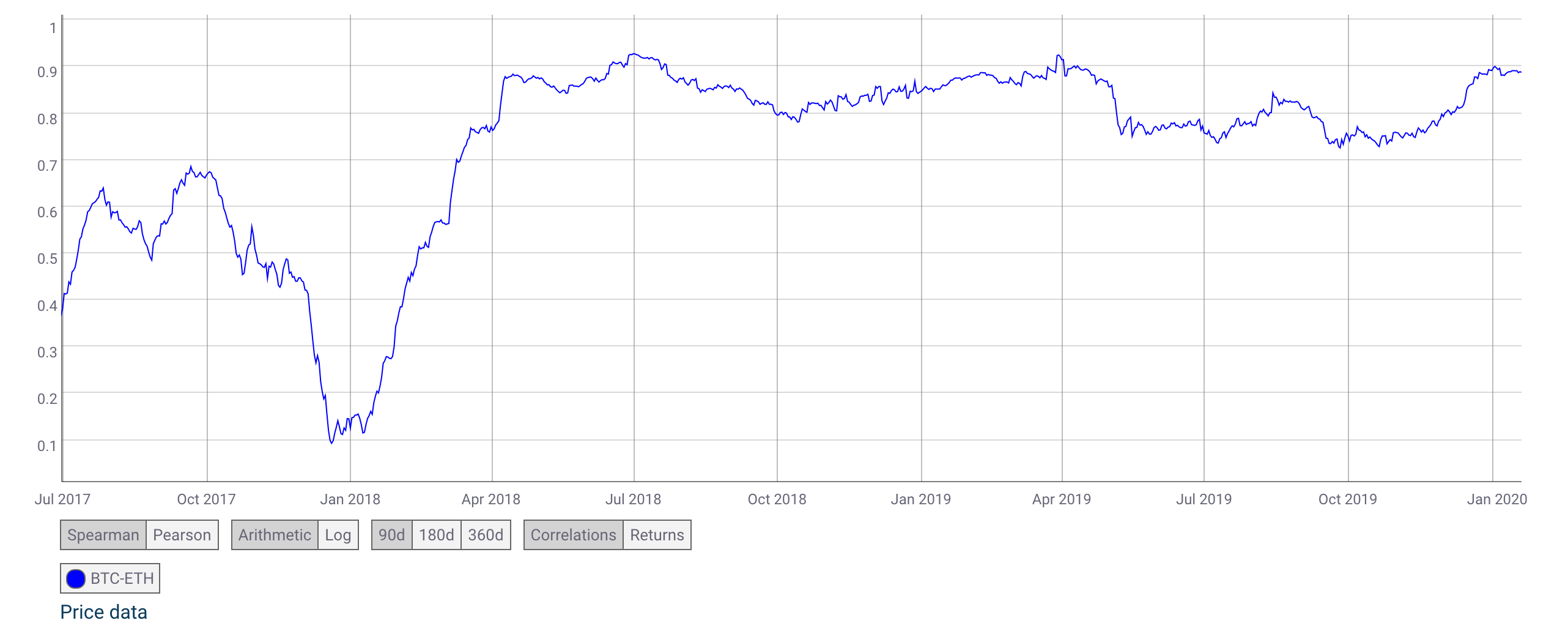

Despite bearing quite a few blows from the bears in the market, Bitcoin‘s correlation with other major cryptocurrencies remains strong. According to the charts provided by Coin Metrics, BTC and ETH have a positive relationship with the correlation coefficient of their prices being 0.88.

Source: Coin Metrics

The market observer, Skew markets, also noted that the correlation between the top two cryptos had reached levels first consistently seen in 2018. Skew Markets’ tweet read,

“The market entered in 2018 a high correlation regime between bitcoin and ether

Will it ever end?”

Source: Skew

BTC and ETH both have a strong correlation with other altcoins too and a positive spin in the market might lead to an altseason soon, something that a lot of altcoiners have been looking forward to for a long time.

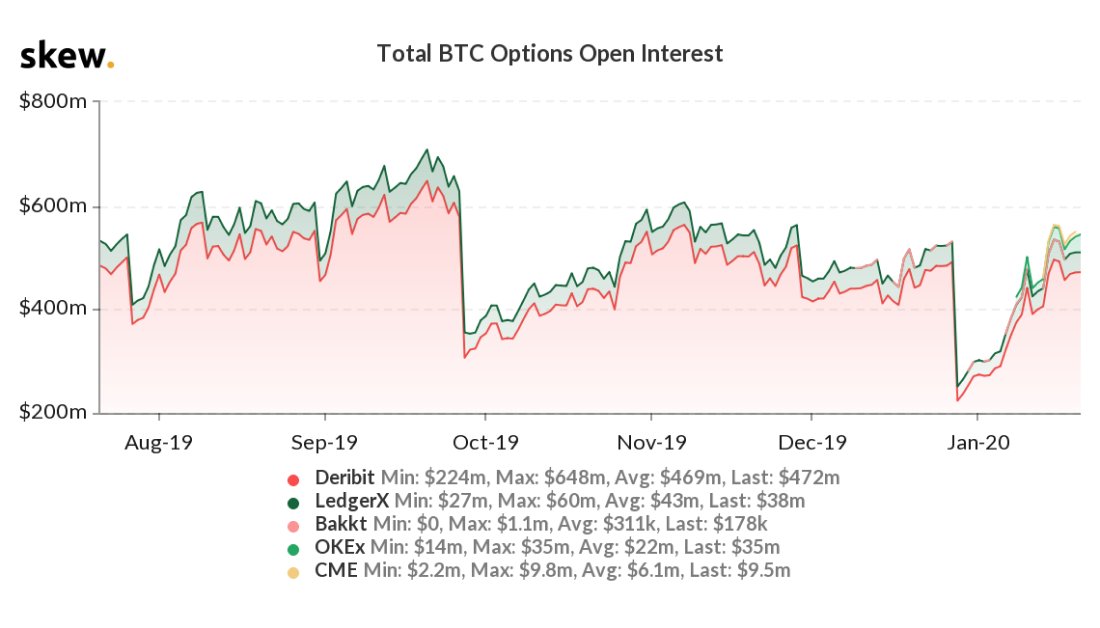

The overall health of the cryptocurrency ecosystem has been strong, especially for Bitcoin Futures as BTC Options on CME doubled their trade volume within the first week it went live. On 17 January, 610 Bitcoin options were traded, which were equivalent to $5.27 million. The Open interest was also noted to be on the rise.

Skew tweeted,

“Market on aggregate has already filled the gap from the December expiry

Growing!”

Source: Skew

According to data provided by Skew, the Open Interest for BTC Futures on CME noted a 101% increase between 1 January and 20 January. CME declared its success with Options upon its launch as many commentators speculated incoming institutional commitment to Bitcoin Futures.

Bakkt, another Bitcoin derivatives platform, also noted a rise in the BTC Futures’ open interest. On 1 January, the Bakkt market recorded interest of $3.8 million, a figure that spiked to $7.8 million on 20 January, a dramatic rise of 92.10%.