Bitcoin futures hold ‘liquidity impact’, as spot volumes improve organic demand

Bitcoin’s rally in April-May 2020 did not attain cross $10,000 that was observed during the rally of May-June 2019. Although Bitcoin did cross $10k a couple of times this year, a sustained period of consolidation was clearly not seen.

However, what was lacking in terms of price, Bitcoin’s ecosystem made up for it, in terms of improving fundamentals and trading activity which outperformed a majority of the statistics registered during 2019.

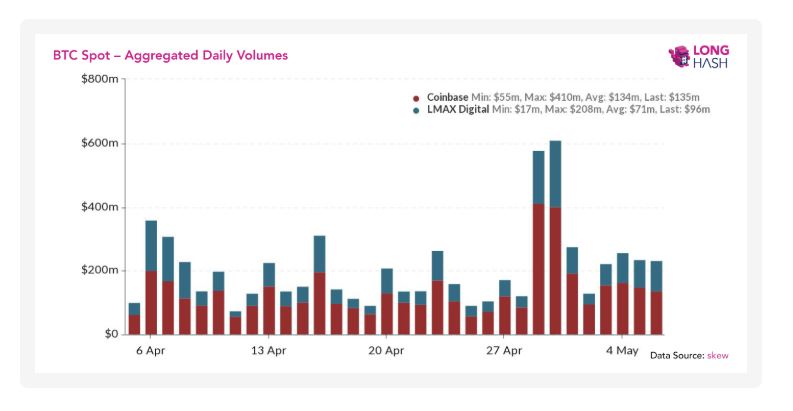

According to Longhash’s recent report, it was suggested that the Bitcoin spot volumes in the past couple of months were last exhibited during the end of December 2017 and January 2018.

Source: Longhash

The monthly volume registered on Binance for BTC/USDT back in 2018 was around 816,000 BTC. The trading volume was significantly larger in the recent rally, as Binance registered monthly volumes of over 2.5 million BTC.

Coinbase fell short of the trading volume of January 2018 by 118,000 BTC but it continued to be above the trading volume registered in June 2019.

An increasing amount of spot volumes underlines the fact that retail investors are accumulating Bitcoins in the current market and spot volumes often reflect organic demand for the asset. Since there was no additional leverage involved, the price driven by spot volumes has a stronger base.

Now, futures volume has also been the benefactor of the recent trend but the study suggested that buy orders on futures exchanges are placed in an attempt to continuously drive up the price of Bitcoin. When the price goes down, the orders are pulled, making it an inorganic uptrend.

Even though that statement holds true technically, the importance of Futures volume should not be taken lightly in the near future.

Major exchanges incurred higher futures volume than spot volume in Q1 2020

TokenInsights’s 2020 Q1 crypto derivatives report had indicated that Huobi, Binance, and OKEx exchanges had registered the highest amount of spot and futures trading in Q1 2020.

Between spot and futures volumes, futures trading had the upper hand across all the three exchanges. Huobi futures trading volume ratio is about 3.56 times of spot; Binance is approximately 1.34 times; OKEx is about 2.91 times.

Additionally, the report also predicted that the total futures volume is only going to increase in 2020, and by the end of the year, the total futures volume could possibly double that of spot.

The derivatives market has been growing steadily in the past couple of years and many speculated that futures trading is the final piece of the puzzle to bring institutional capital in Bitcoin.

An increase in institutional capital will directly improve Bitcoin’s liquidity multiple folds and that would indirectly improve Bitcoin’s valuation.