Bitcoin finds altcoins at its coattails again

Bitcoin, to the outside world, is synonymous with ‘blockchain,’ ‘scam,’ ‘monopoly money,’ and ‘manipulation.’ But within the world of cryptocurrencies, one of the words most associated with Bitcoin is ‘altcoin.’ The minority swath of thousands upon thousands of alternates to Bitcoin maintains a prominent part of the cryptocurrency narrative, forgotten by the mainstream audience, and left in the shadows of Bitcoin.

For a year, during the hey-days of Bitcoin, the altcoins found movement, less in its own surges, and more with the tug of the king coin. Now, it looks like that tug has returned, and Bitcoin has found a familiar friend riding on its coattails. While this long-lost friendship is rekindling, Bitcoin’s tethering with the top stablecoin in the market is teetering.

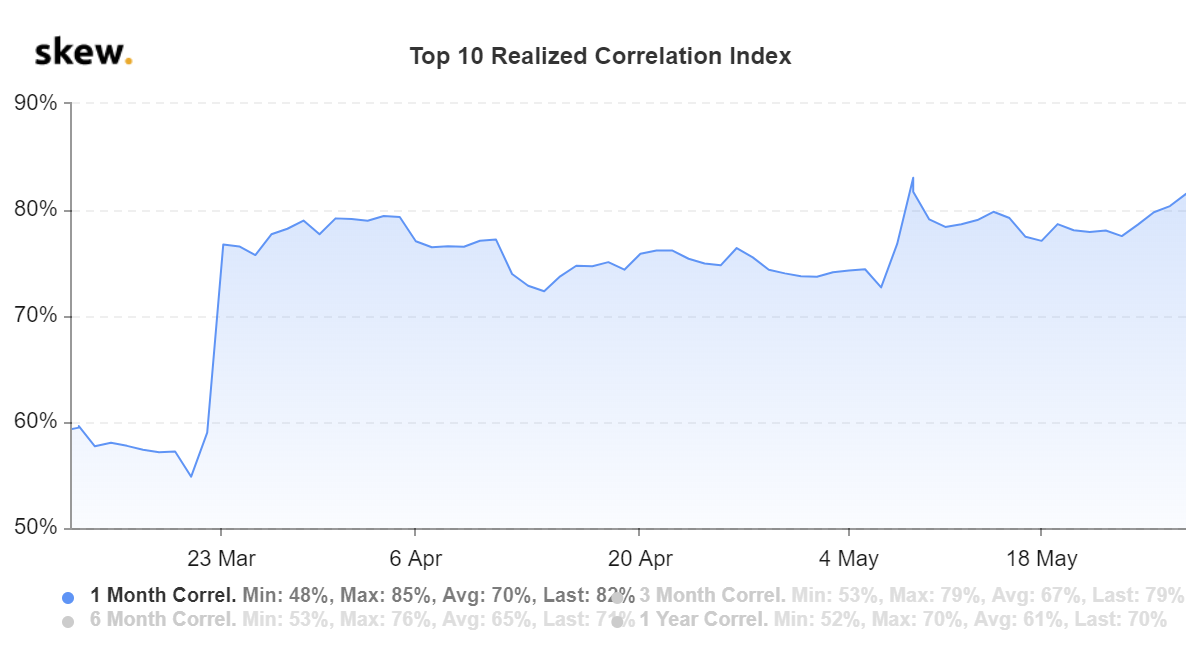

According to data from skew markets, the correlation between the top-10 cryptocurrencies in the market is increasing. On February 14, there was no love lost between the top-10 coins, as the 1-month correlation between them dropped to its lowest point in 8-months at 43 percent. Since then, even after the events of Black Thursday and Bitcoin’s third block halving, the correlation has not only resisted but grown to as high as 82 percent, in the past 3-months.

Top-10 realized correlation index | Source: skew

Given the shuffle in the past few months, it is important to note which cryptocurrencies are the largest among market capitalisation, at press time. They include, in order – Bitcoin, Ethereum, Tether, XRP, Bitcoin Cash, Bitcoin SV, Litecoin, Binance Coin, EOS and Tezos.

A look at the 1-month correlation matrix of the top-10 coins suggests that Bitcoin and the altcoins trade in tandem, for the most part. Bitcoin’s highest correlation was with Ethereum, EOS and Litecoin, and least correlation with Tezos, Bitcoin SV [quite ironic] and XRP.

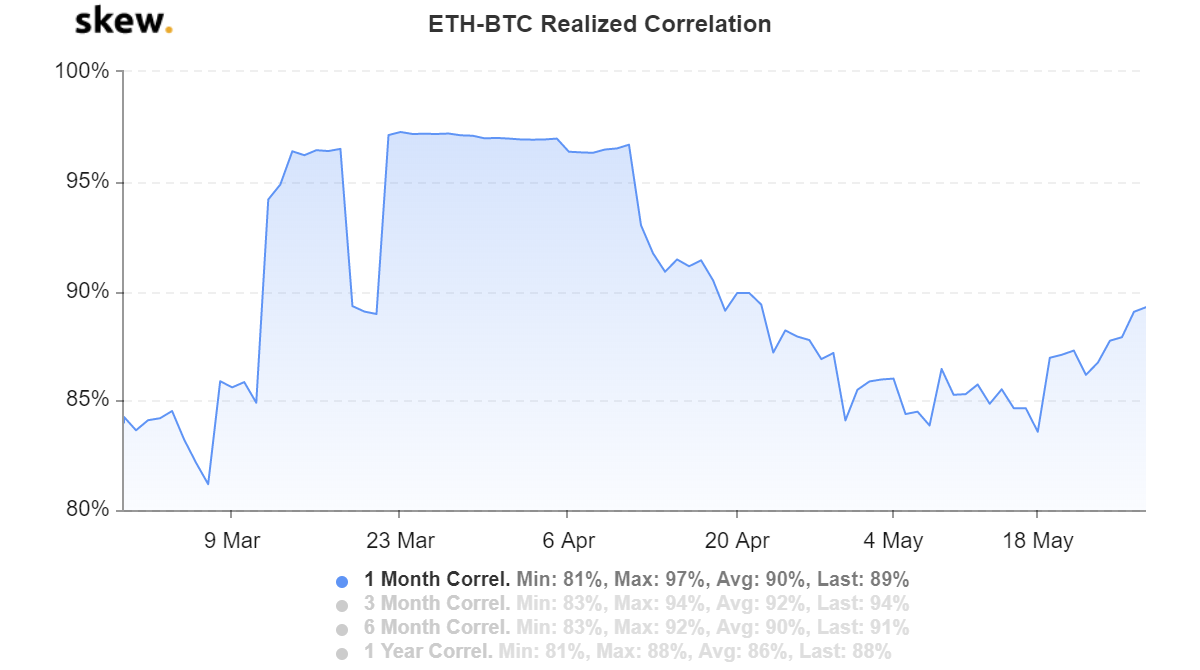

Interestingly, the correlation between the two largest cryptocurrencies in the market is rising. Bitcoin and Ethereum’s 1-month realized correlation is at 89 percent, its highest point in over a month and increasing consistently since the halving. In two phases in 2020, the correlation between Bitcoin and the top-altcoin was sinking – at the beginning of the year when Bitcoin acted akin to gold as a safe-haven asset, while Ethereum trended upwards and a month prior to the halving when Bitcoin’s price soared in anticipation, while the altcoin traded flat.

Ethereum and Bitcoin realized correlation | Source: skew

In addition to Bitcoin and altcoins, the third type of cryptos in the market are stablecoins, with the pick of the lot being Tether [USDT]. The top-stablecoin with a 24-hour trading volume of over $30 million currently has the least correlation with both Bitcoin and the altcoins. Tether’s correlation with the top-10 stretches from the range of 0.04 to 0.26 with the Bitcoin – USDT 1-month correlation standing at 0.15.

Looking at this divergent move between Bitcoin and stablecoins, it is interesting to observe the same play out with exchanges. According to data from Glassnode, for the past few weeks, Bitcoin is moving out of exchanges and into private wallets as hodling as become the new norm. On the other hand, USDT is moving back into exchanges, as traders are either fearing a Bitcoin [and hence, altcoin] price fall after the halving, as price and mining pressure combine or are expecting a volatile period which will cater to swing trading.

? $USDT Number of Exchange Deposits (2d MA) increased significantly in the last 24 hours.

Current value is 524.167 (up 55.1% from 337.958)

View metric:https://t.co/W7z6FP2MNt pic.twitter.com/dKIMXiKVlC

— glassnode alerts (@glassnodealerts) May 27, 2020