Bitcoin, Ethereum lose August’s first round to small-caps

Two of the market’s top cryptocurrencies, Bitcoin [BTC] and Ethereum [ETH], have been witnessing a strong surge in their values over the past few weeks. This week, however, the BTC and ETH markets appeared to be taking a break as the overall percentage change in the value of the top two crypto-assets was just 5% each, while small-cap assets were once again making a comeback.

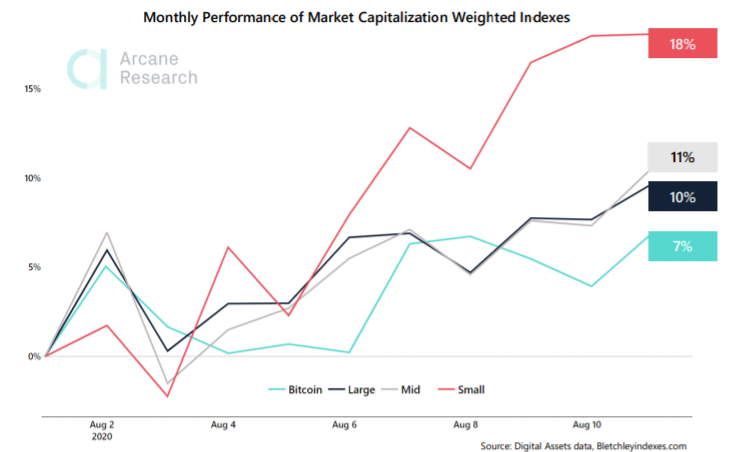

According to data provided by Arcane Research, small-cap assets were already up by 18% within the first ten days of August, outperforming their July value of 12%. On the contrary, the mid-cap assets that led the market in July were back to the second position after reporting 11% in growth on the charts for the month.

Source: Arcane Research

In fact, large-cap assets, in general, maintained their strong performance on the charts and recorded more than 10% in returns for the month, while Bitcoin lagged behind with just 7%.

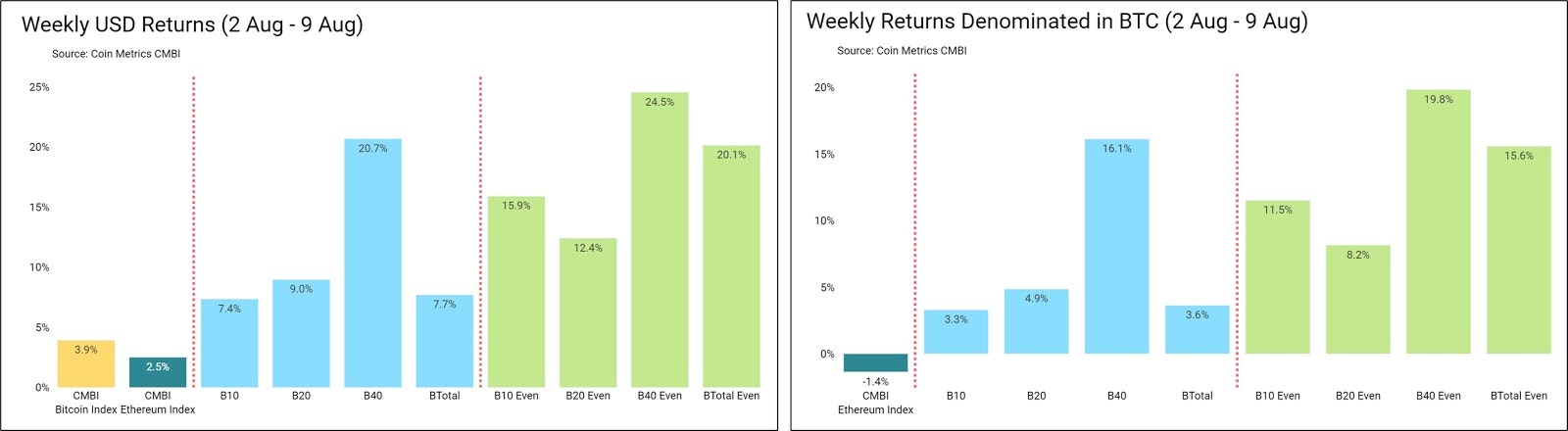

The reasons for the same can be largely attributed to the DeFi rally, one that diverted traders’ attention to altcoins once again, following which, Bitcoin’s market noted a prominent downtrend. This was evidenced by the CMBI Bitcoin Index as it was reporting just 3.9% in returns over the last week, followed by the CMBI Ethereum Index with 2.5%.

On the contrary, altcoins, especially the Bletchley-40 [small-cap assets], were reporting great returns of 20.7% for the week. Such exponential market growth was led by the likes of Synthetix and Ampleforth, both of which registered double-digit hikes recently on the hourly charts.

Source: CoinMetrics

Further, even the Bletchley-20 [mid-cap assets] and Bletchley-10 [Large-cap assets] were reporting better returns of 9% and 7.4% respectively, compared to single asset indexes, namely, Bitcoin and Ethereum.

Finally, with small-cap assets once again exhibiting their inverse proportionality to Bitcoin’s price, the greed in the market was observed to be climbing.

Source: Arcane Research

The Fear and Greed Index was noted to be around 84, pushing above 80 in over a year. With the crypto-market going through a period of positive volatility, it is important for the traders to be careful. Historically, periods of extreme greed period have been short-lived and a similar trend could be expected now as well.