Bitcoin, Ethereum futures: Buyers re-building market?

In an effort toward recovery, BTC surged by 15.01% on 19 March, which took its valuation from $5,475 to $6,296. Bitcoin has once again breached the $6k barrier and was trading at $6,225.85, at press time. It will be important to see if the coin is able to hold ground above $6k or is met with strong resistance going forward.

Source: BTC/USD on Trading View

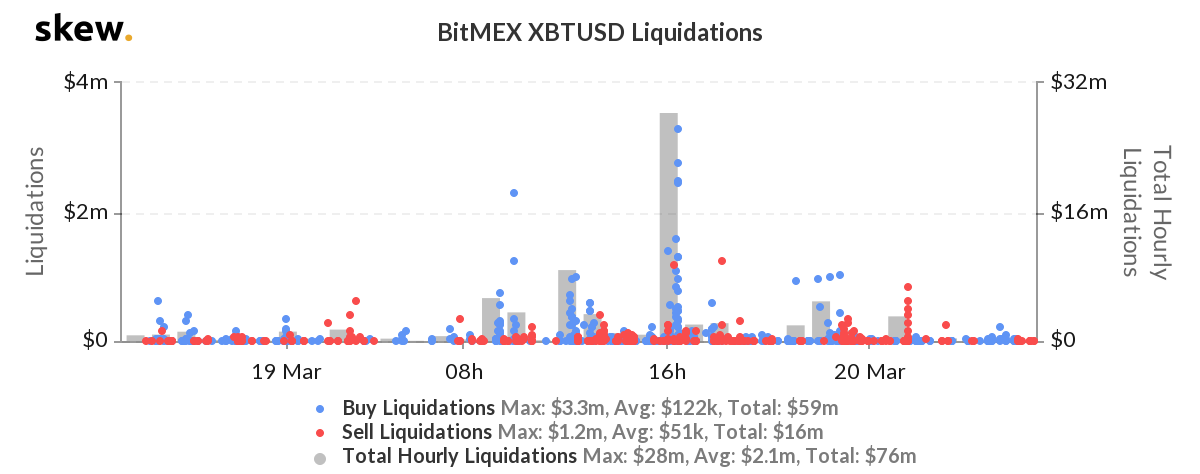

As the price of Bitcoin surged in the market, BitMEX’s Bitcoin futures saw buyers flooding in the market and going long on the coin. According to data provided by Skew, BitMEX’s platform reported total liquidations of $76 million, with $59 million being the Buy liquidations and the remaining $16 million were Sell liquidations.

Source: Skew

The rise in BTC price also caused the price of other major cryptos to rally along. Ethereum, highly correlated with BTC, noted an acceleration in its price by 15.59% since the beginning of 19 March. The price of the crypto moved from $120.49 to $139.28. At press time, Ethereum maintained its value at $137.23.

Source: ETH/USD on Trading View

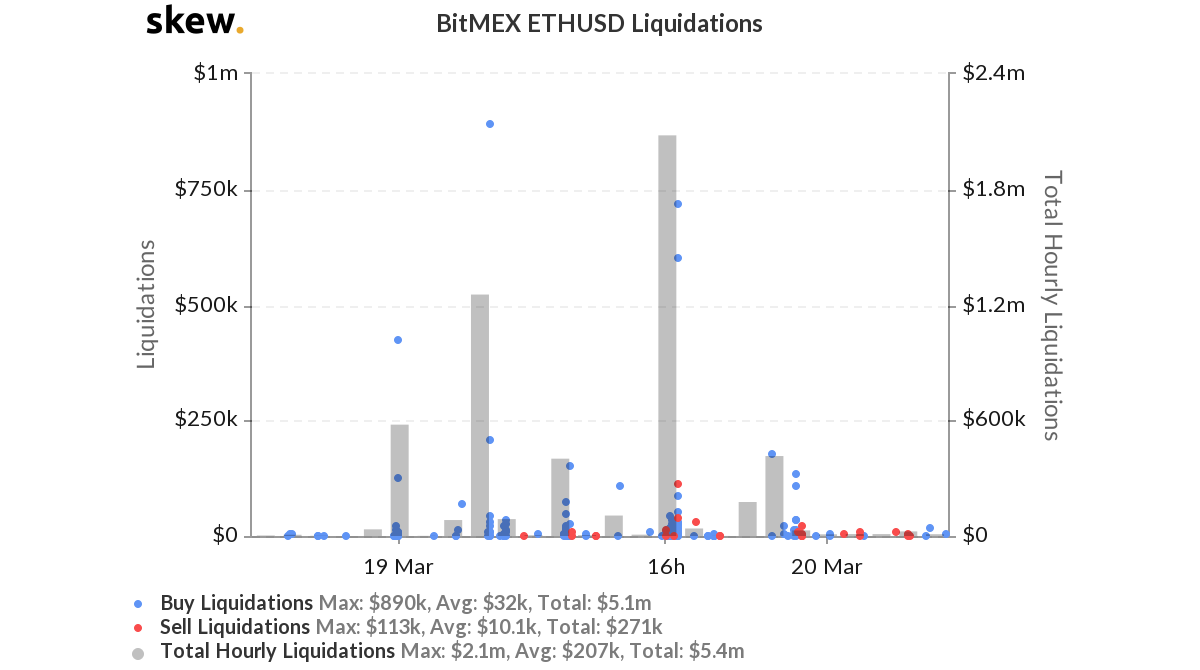

Ethereum’s futures market on BitMEX also reported an increased liquidation. Skew reported total liquidation of ETH futures was worth $5.4 million, and $5.1 million accounted for Buy liquidations with $271k sell liquidations. This was an affirmative action from the traders in the market and might be reflective of upcoming growth.

Source: Skew

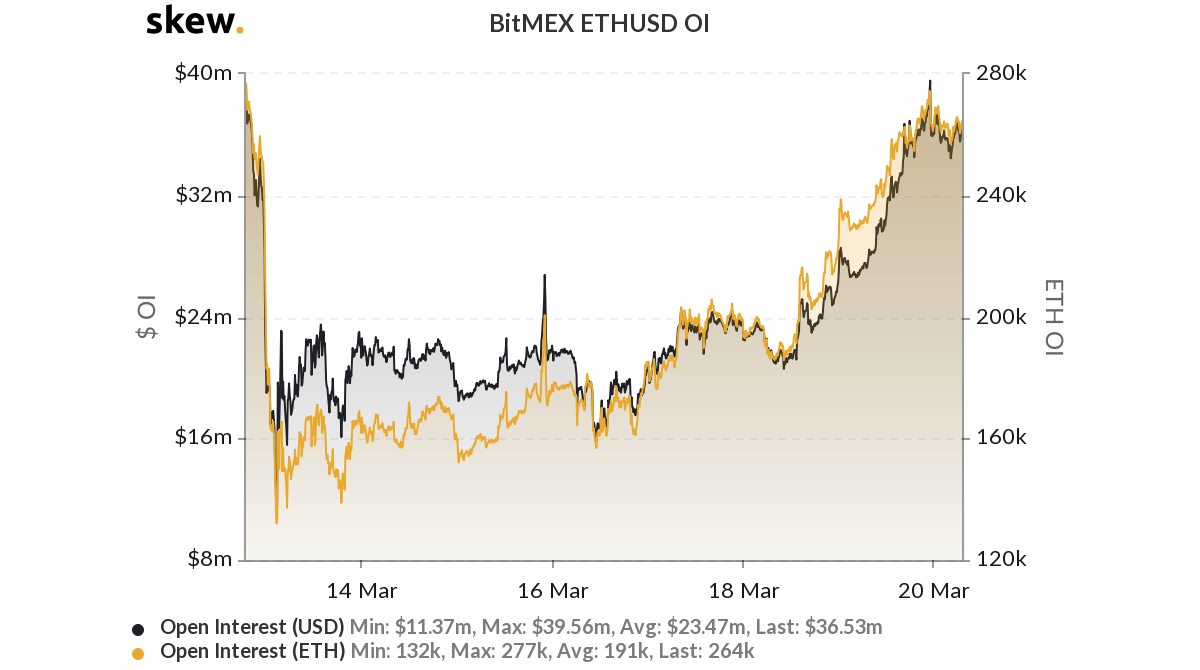

Market interest was also reflected in the rising Open Interest marked on BitMEX exchange. According to Skew, OI had taken a serious hit to $12.93 million when the price of ETH fell on 12 March, however, it has noted a significant rise of 181% since.

Source: Skew

OI on 20 March was reported to be $36.55 million.