Bitcoin, Ethereum are not facing another “crypto winter” just yet

A common topic of discussion over the past couple of months has been the stalling price of Bitcoin. After its halving in May, the major asset repeatedly failed to breach $10,000, and other than short-term consolidation above the resistance, BTC was unable to sustain a higher position.

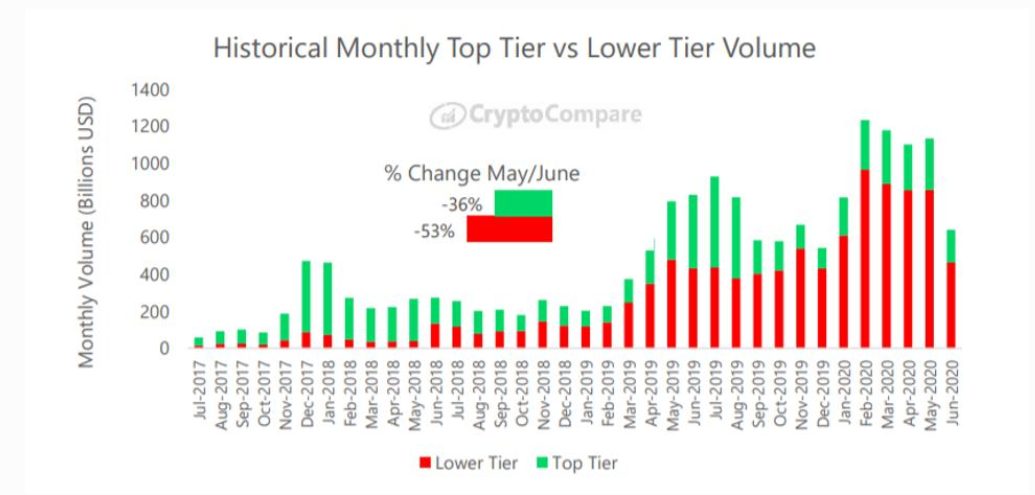

Source: CryptoCompare

London-based data service CryptoCompare revealed in their June 2020 analysis report that Bitcoin trading volume was down by 36 percent in June from May.

Right after the squeeze in supply, BTC spot volumes started to take the plunge through Mid-May and the majority of June, and the report suggested that BTC volumes had dropped down to 50 percent from the previous month.

Now many expected the low trading volume to continue into July as the situation was suddenly becoming more reminiscent of the bearish “Crypto Winter of 2018.”

However, those concerns might start to ease off as Coin Metrics’ report suggested a positive turn of events over the past week. The State of the Network report suggested that there is a 38 percent uplift in spot volumes over the past week in the crypto ecosystem and in spite of the historically low volatility range of BTC and ETH.

Other altcoins were starting to take control of the markets as few key altcoins such as Dogecoin, Cardano, and Chainlink accumulated 20 percent of the past week’s trading volume.

From a Bitcoin trading point of view, it might not directly reflect a profitable scenario for Bitcoin just yet, but considering the fact that traders are still active in the digital asset space is a positive sign for any asset that is undergoing a correction period.

Bitcoin and Ethereum together make up for more than 75 percent of the market cap hence, a return of bullish momentum for these coins is only a matter of time and the active trading volume for other altcoins is largely beneficial for these major top two assets as well.

Traders and potential investors are unlikely to look past BTC and ETH in the near future and considering the industry is active while the top coins catch their catch, can be a healthy scenario.

With the fundamental properties of Bitcoin still accruing positive impact and movement, the concern of another “Crypto Winter” is little far-fetched at the moment.