This prime signal is characteristic of a bull run for Bitcoin

The past few weeks have been quite favorable for Bitcoin’s price action. At press time, the coin was testing a key resistance around $13K, and if this resistance is breached, that would take Bitcoin to this year’s ATH. Interestingly, another metric that is quite favorable for many Bitcoiners is its UTXO profitability. According to data provided by data provider Glassnode, Bitcoin’s unspent transaction outputs [UTXO] profitability has reached a high last seen during the bull run of 2017, a time when the price of the king coin came close to touching the $20K-level.

Source: Glassnode

Almost all UTXOs in Bitcoin’s blockchain, 98 percent of them, are currently profitable, a figure that implies that those funds were received by users when BTC was at a lower price point than it is today, according to Glassnode’s data.

A UTXO is created when a user sends a Bitcoin transaction. For example, if a user owns two Bitcoins and they send one Bitcoin to another user, both coins are spent and one gets sent to the recipient of the transaction and the other gets sent back to the original user as a UTXO.

One of the reasons behind such a high level of profitability for BTC UTXOs could be the positive price action Bitcoin has seen over the past few days. At press time, Bitcoin had a trading price of $12,954, with the cryptocurrency looks well-positioned to go past the much-anticipated $13K-level.

Source: Glassnode

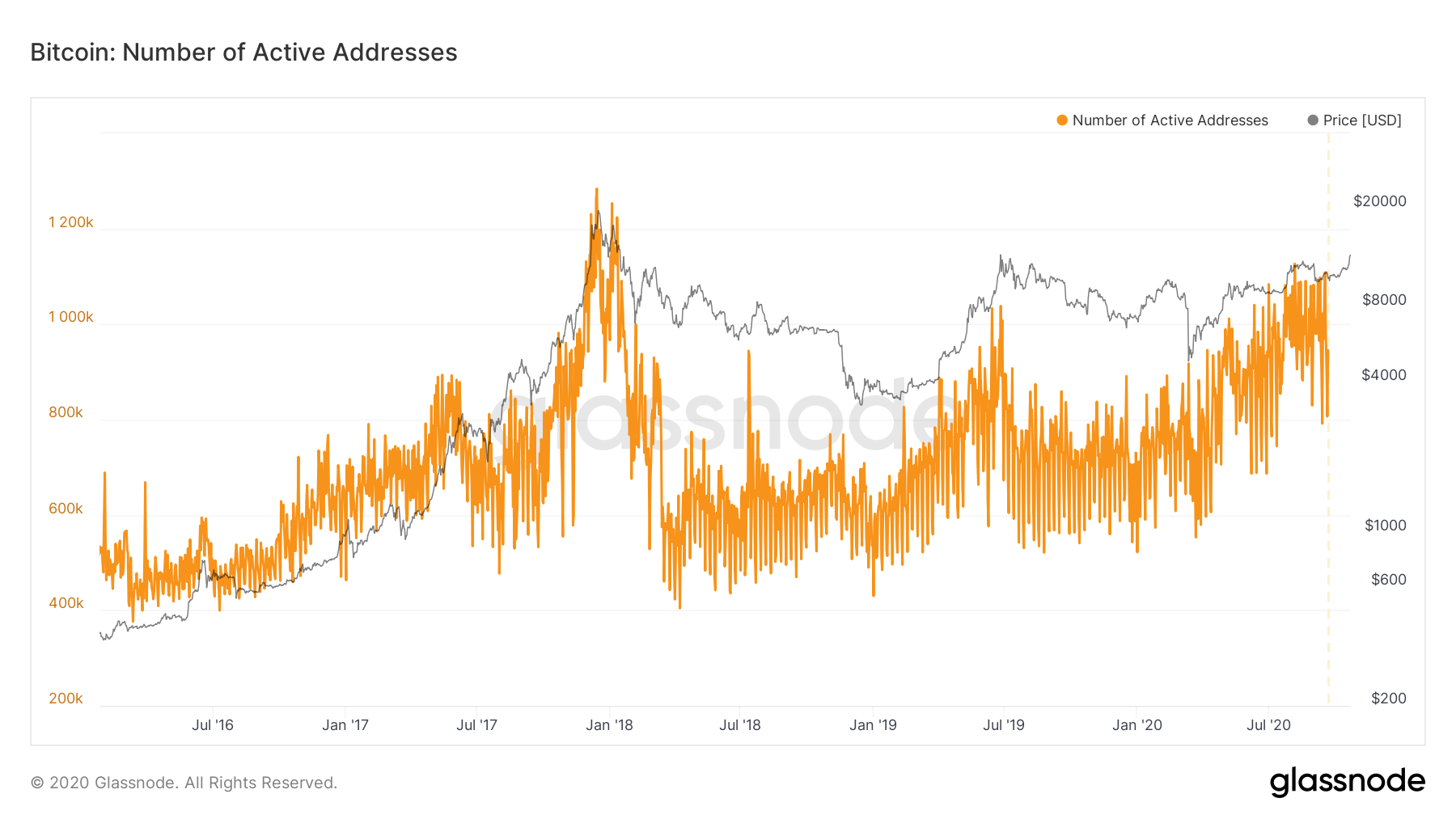

While 2020 was considered to be a monumental year for Bitcoin’s price, things have not always gone according to plan. However, given the overall market slump, and the heightened uncertainty across many economies, Bitcoin’s price action has been fairly promising. Other network metrics like the number of Bitcoin addresses seem to be reaching late-2017 levels, a development that can be considered to be yet another case for Bitcoin’s bullishness towards the end of the year.

However, the question does remain whether or not Bitcoin’s current fortunes will sustain themselves or if a reversal is imminent. In fact, a recent Longhash report had highlighted that there has been a steady drop in Bitcoin being held on exchanges over the past 7 months, implying how the number of sellers has been decreasing, while the demand for BTC has only gone up and seems to be reflecting in the coin’s current price fortunes.

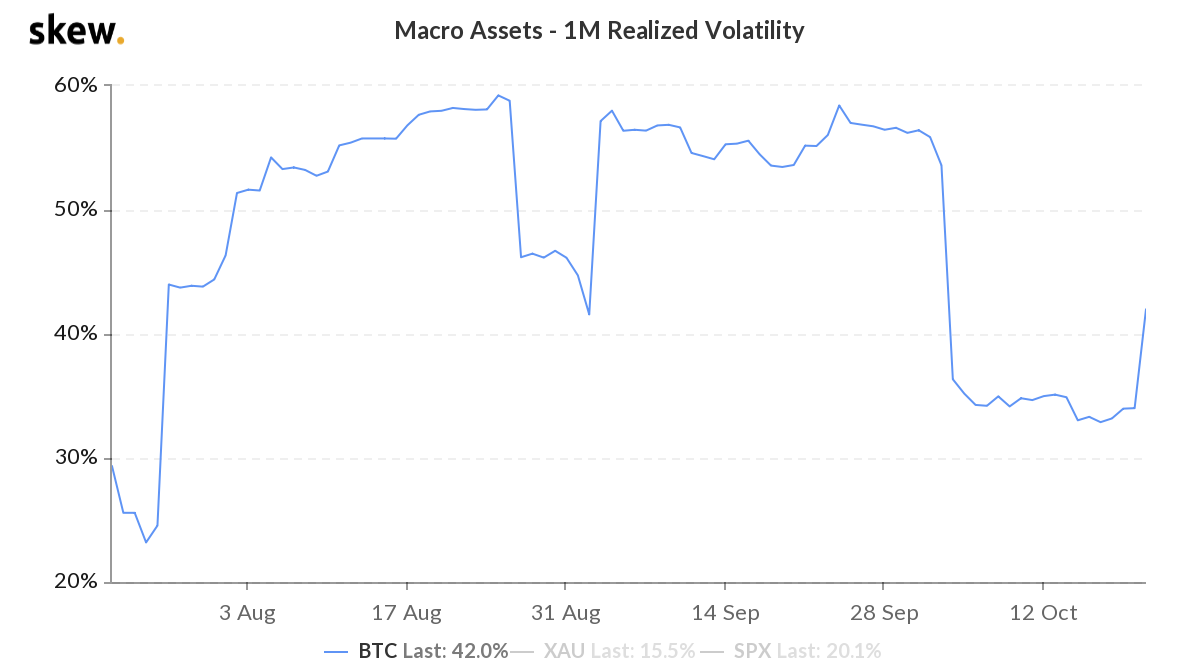

Source: skew

Further, market data provided by skew indicated that Bitcoin’s price may stabilize as it has noted a significant drop in realized volatility. This could mean that the coin’s price may consolidate in the present range. The 1M Realized Volatility for Bitcoin has fallen from 58 percent to 42 percent over the past three months.