Bitcoin: As BTC profit-taking rises, can it lead to a market correction?

- Profit-taking activity gains traction as BTC’s price lingers in a tight range.

- Short and long-term holders have mostly realized profit on their investments since coin distribution began.

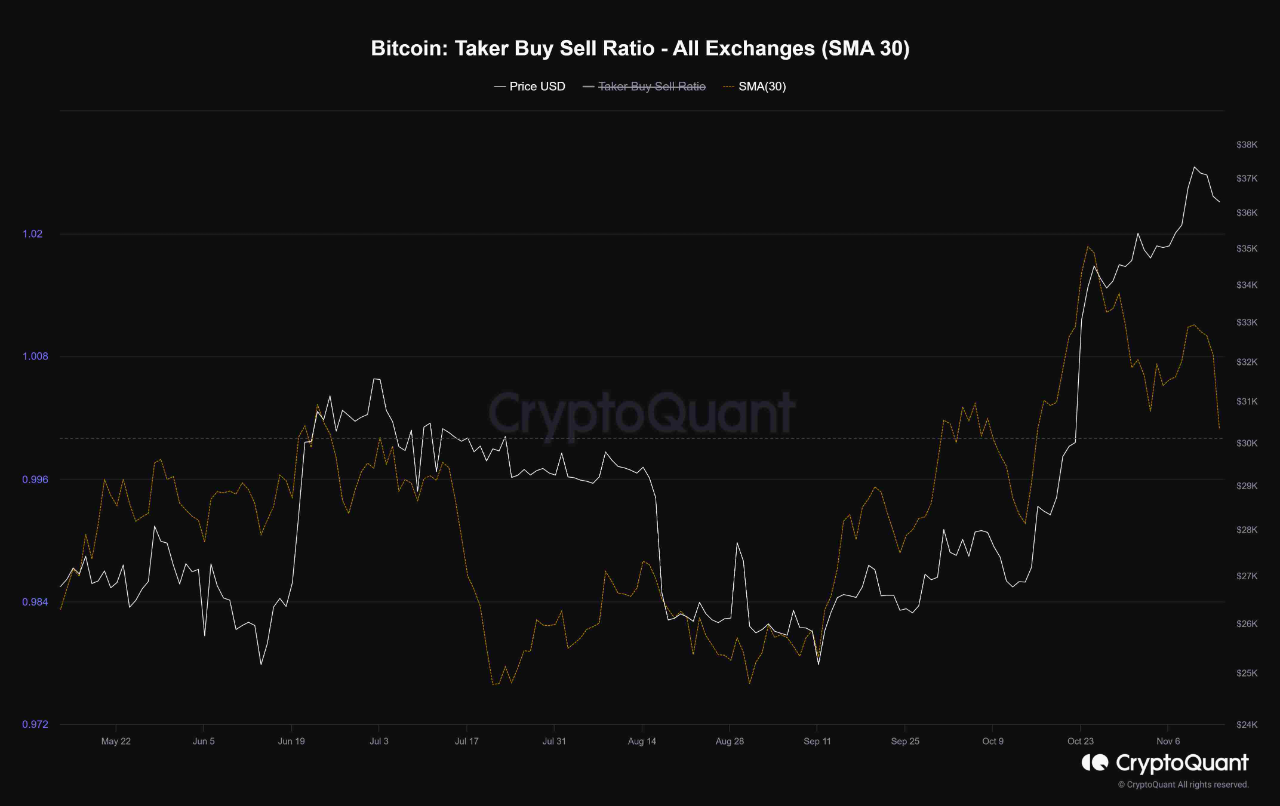

Bitcoin’s [BTC] taker buy-sell ratio assessed on a 30-day simple moving average (SMA) has initiated a decline, suggesting that profit-taking activity is beginning to gain momentum, data from CryptoQuant revealed.

BTC profit-taking activity rallies

The taker buy-sell ratio is a metric that measures the ratio between the buy volume and sell volume in an asset’s futures market.

A value greater than 1 indicates more buy volume than sell volume, while a value less than 1 indicates more sell volume than buy volume.

In a recent report, pseudonymous CryptoQuant analyst Greatest Trader found that the metric trended upward while BTC’s price rallied in October.

However, with the leading coin’s price stagnating at $36,500 in the past few days, “the metric reversed its trend and started a downtrend, approaching the threshold of 1.”

According to the analyst:

“This decline suggests that participants are increasingly inclined to take short positions and realize profits. Notably, this shift in the metric aligns with the market’s recent consolidation and its struggle to move higher. The convergence of these events suggests that participants are more interested in short-term gains during this phase of price stability.”

BTC’s taker buy-sell ratio (30d SMA) was 1.007 at press time.

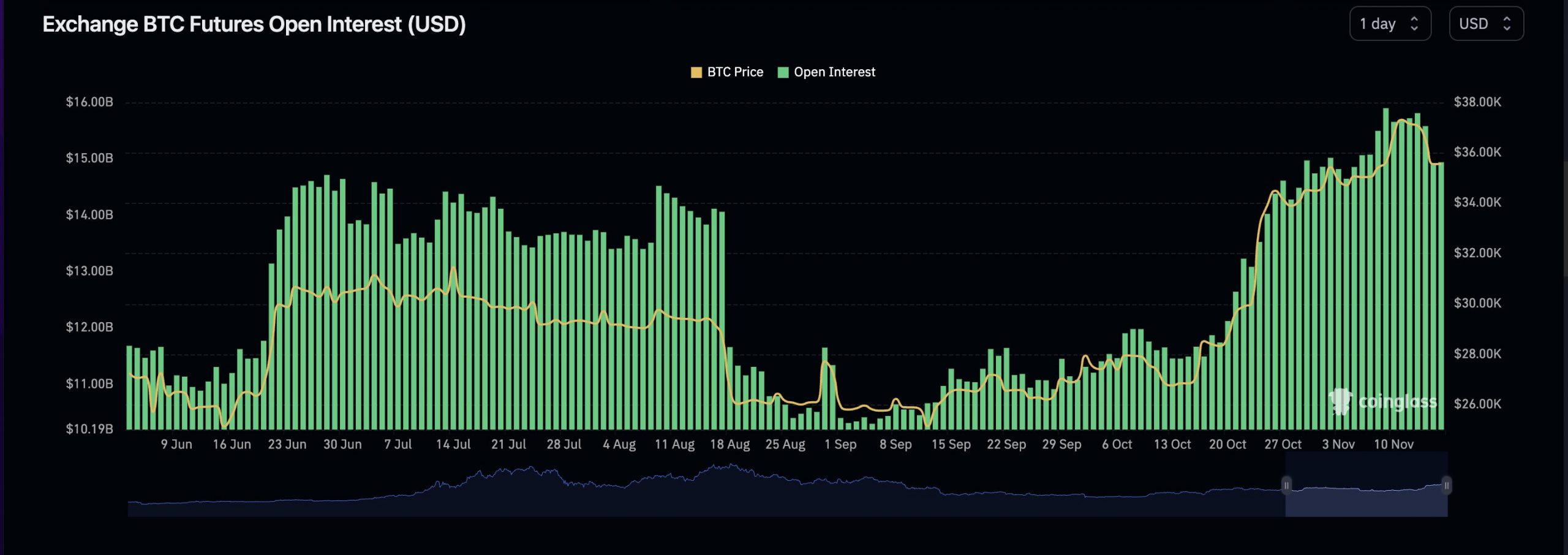

The steady decline in BTC’s open interest in the futures market confirms the analyst’s position. Data from Coinglass showed that the coin’s open interest has declined by 6% since 9th November. At press time, BTC’s open interest was $14.94 billion.

Whenever BTC’s open interest decreases in this manner, it signals that traders are closing out their positions. This often leads to a potential reversal in the market’s direction.

Short and long-term holders selling above their cost basis

An assessment of the spent output profit ratio (SOPR) for short and long-term BTC holders revealed that both cohorts of investors have so far realized profits since they commenced coin distribution.

An asset’s SOPR measures the degree of profit and losses incurred by its holders over a given period of time. When the metric returns a value higher than one within a particular period, this means that those that sold during that period did so at a profit.

Is your portfolio green? Check out the BTC Profit Calculator

Conversely, when an asset’s SOPR is less than one within a specified window period, those that sold within that time frame incurred losses.

As of this writing, the short-term holder SOPR on a 30-day moving average was 1.01. Regarding long-term holders, the SOPR was 1.28, according to data retrieved from CryptoQuant.