$16K and zero hype – Where is Bitcoin going next?

Bitcoin’s price rallied from $15,500 to $16,000 in less than seven days. Based on data from CoinMarketCap, the last time the price crossed $16,000 was way back in January 2018. However, notwithstanding Bitcoin’s recent price performances, the hype around the hike in 2018 was much higher than the one we are seeing today, in 2020.

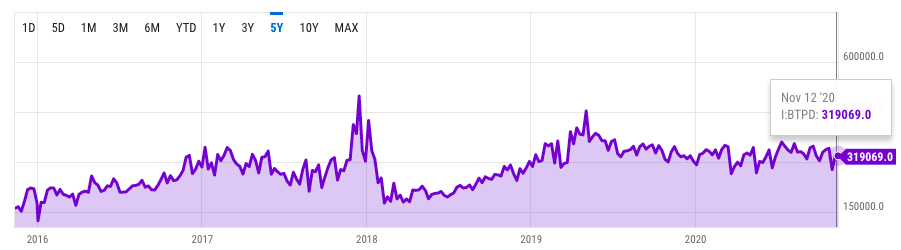

In fact, back in January 2018, the number of “Bitcoin Transactions per day” had hit an ATH of 498,327. In Q1 of 2019, the same metric also hit a similar level. However, at the time of writing, with BTC valued at $15,946, the number of daily transactions was a mere 319069.

This press time level is a mere 64% of the ATH. Interestingly, while the number of active wallet addresses with a balance of 0.1 Bitcoin has grown consistently, the number of transactions has remained steady, well within the range of 30000 – 360264.

Search results for Bitcoin in 2017 || Source: YCharts

Many experts have drawn a comparison between the present price rally and the historic bull run of 2017, however, if the 2017 bull run was tulips, this one is far from it. The two are different in many ways – from Google search trends to the number of Bitcoin transactions and the market capitalization of the crypto-asset.

It should be noted here that the 2017 bull run was also characterized by speculations that the price rally was triggered by a single whale by manipulating the price through Tether. However, there never was enough evidence presented to support the claim, and the supply of Tether or issuance of new Tether may have no impact on Bitcoin’s prices.

That being said, it plays a pivotal role in providing an alternate store of value, generating new demand on spot exchanges. As a digital alternative to fiat, stablecoins offer an option with relatively stable prices and low risk. This is lucrative to stock market traders or new traders on fiat exchanges. The option of holding crypto-assets in Tether allows exchange and transfer at low fees, and all these factors contribute to the demand for Bitcoin every cycle. This way Tether has played a critical role in the adoption cycle, while also generating demand.

The market capitalization of Tether climbed by 862% from June 2017 to Jan 2018. In 2020, the market cap for Tether has risen by over 100% only since June 2020. Further, new demand generation on spot exchanges has risen consistently as well. This is evidence of no hype or relatively way calmer hype, when compared to 2017.

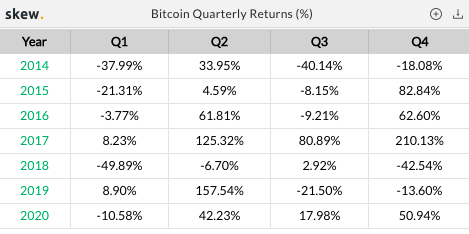

Besides, Bitcoin’s quarterly returns were 125% and 210% in Q2 and Q4 of 2017. However, in 2020, the returns so far have been consistent and observed to be 42% and 50% respectively.

Bitcoin Quarterly Returns || Source: Skew

Despite hitting $16k, the cryptocurrency’s highest price level since 2019, BTC’s value at press time was 97% away from John McAfee’s prediction of $500k by the end of 2020. Fanciful optimism aside, it doesn’t seem likely that the price will rise by 97% in the last 50-55 days of 2020.

Source: Coinstats

In fact, more recently, Tyler Winklevoss predicted 17k and to the moon. Further, the closing price for the crypto-asset has been consistently higher than the previous day’s since 24 October and it is likely that this will continue. However, the question of whether the price will indeed hit any of the targets mentioned in the aforementioned predictions is still a long way from being answered.