Binance releases proof of reserves report – Can it dispel the FUD

- Binance posted proof of reserves to calm down the FUD surrounding it.

- It withdrew its application for a license in Abu Dhabi, price of BNB remain unaffected.

Even though the last few quarters have been fairly positive for the crypto market, with both blue chip coins and altcoins rallying, there has been one exchange that has been negatively impacted the most, Binance[BNB].

Increased regulatory scrutiny, layoffs and other problems plagued the exchange over the last few months.

To respond to this FUD and to mitigate it, Binance published its proof of reserves recently.

Binance backs it up with receipts

When referring to Proof of Reserves, it specifically denotes the assets held in custody by Binance for users. This demonstrates evidence that Binance possesses funds to cover all user assets 1:1, along with additional reserves.

For every deposited Bitcoin by a user, Binance’s reserves increase by at least one Bitcoin, ensuring complete backing for client funds. It’s important to clarify that Binance’s corporate holdings are maintained on a distinct ledger.

In practical terms, this signifies that Binance maintains all user assets 1:1, with additional reserves. It carried no debt in its capital structure. Furthermore, there exists an emergency fund (SAFU fund) for extreme situations.

On 1st December, Binance issued its thirteenth reserve certificate, reflecting a month-over-month net inflow of $311 million. The user’s BTC assets amounted to 561k, marking a 4.05% decrease (23,656 BTC).

ETH assets were 3.88 million, experiencing a 0.67% decrease. USDT assets increased by 5.67%, reaching 16.1 billion, equivalent to a growth of 866 million USDT.

Even though the reserves on Binance have fallen, this report may help users gain trust in the platform. Binance’s transparency may allow users to keep their holdings in Binance without any stress.

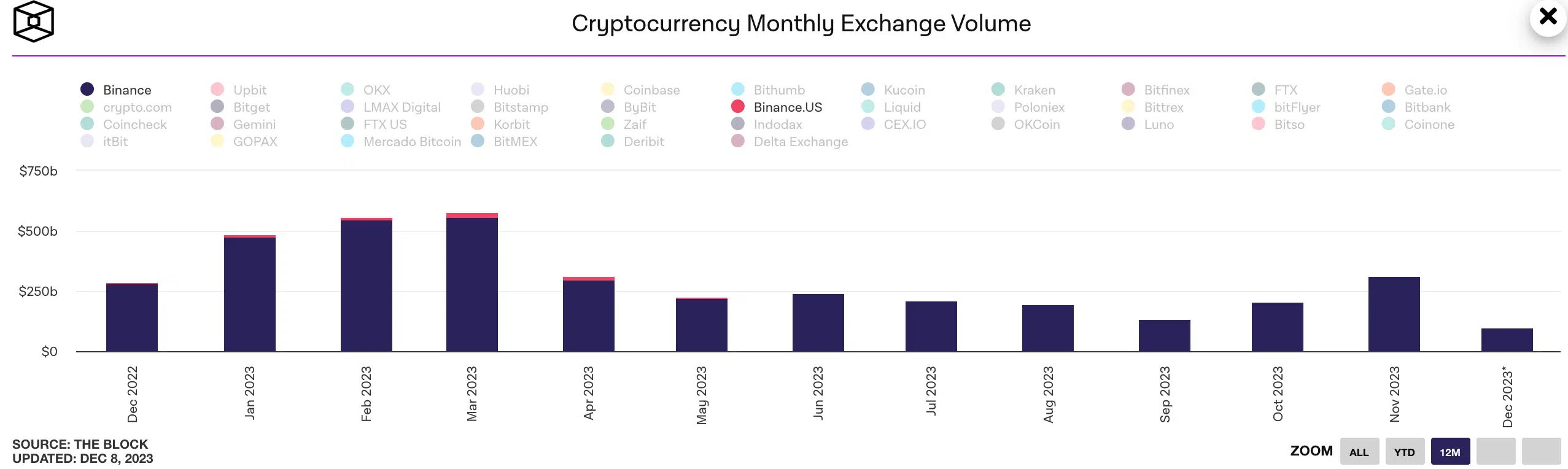

Another reason to be optimistic around Binance would be the fact that there was a a surge in volume observed on the platform in November. If the trend continues in December, it could be a sign of healthy growth.

Not all roses and sunshine

However, there were some signs of problems being faced by Binance. It withdrew its pursuit of an investment management license in Abu Dhabi, citing it as unnecessary for the company’s “global needs.”

The exchange, however, maintains an application to provide digital asset custody for professional clients, as stated on its website.

Read Binance Coin (BNB) Price Prediction 2023-24

It is yet to be seen how these factors will affect BNB in the long run. At press time, BNB was trading at $235.30 and its price had grown by 1.91% over the last 24 hours.