Binance Lending goes live: Here’s what you need to know

Binance became yet another player in the crypto-lending industry after it announced its plans for the same on 26 August. With its already extraordinary customer base, Binance might even go toe-to-toe with giants like Celsius and Genesis, if phase one goes well.

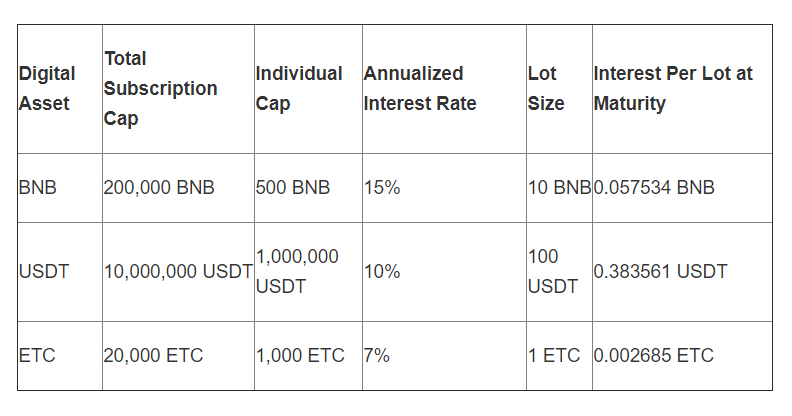

Unlike other players, Binance’s lending for the select few coins is capped; meaning, the exchange will stop accepting after the cap limit is reached. Based on their announcement, Binance Coin [BNB] will have the highest return of 15% annually, which will be followed by Tether [USDT] at 10%, and Ethereum Classic [ETC] at 7%.

The Lottery

Source: Binance

Unlike different lending platforms, Binance’s lending was on a first-come, first-served basis; meaning, whoever clicked faster and was lucky could get their lots placed for lending. Essentially, like a lottery. At press time, Binance had announced that BNB hit the cap 16 seconds after the lending service went live. USDT reached the limit in 3 mins, while ETC took over 9 minutes.

CZ tweeted,

We have a habit of underestimating demand, every time! https://t.co/GT5vfgNDvB

— CZ Binance (@cz_binance) August 28, 2019

The total payout, if a single person, could have lent the cap, would have been a whopping $1.7 million after 14 days. Yes, that’s it, in a matter of two weeks, one would earn more than a million. However, according to the above tweet, there were approximately 900 subscribers who got their lots filled.

Speculation: Why ETC?

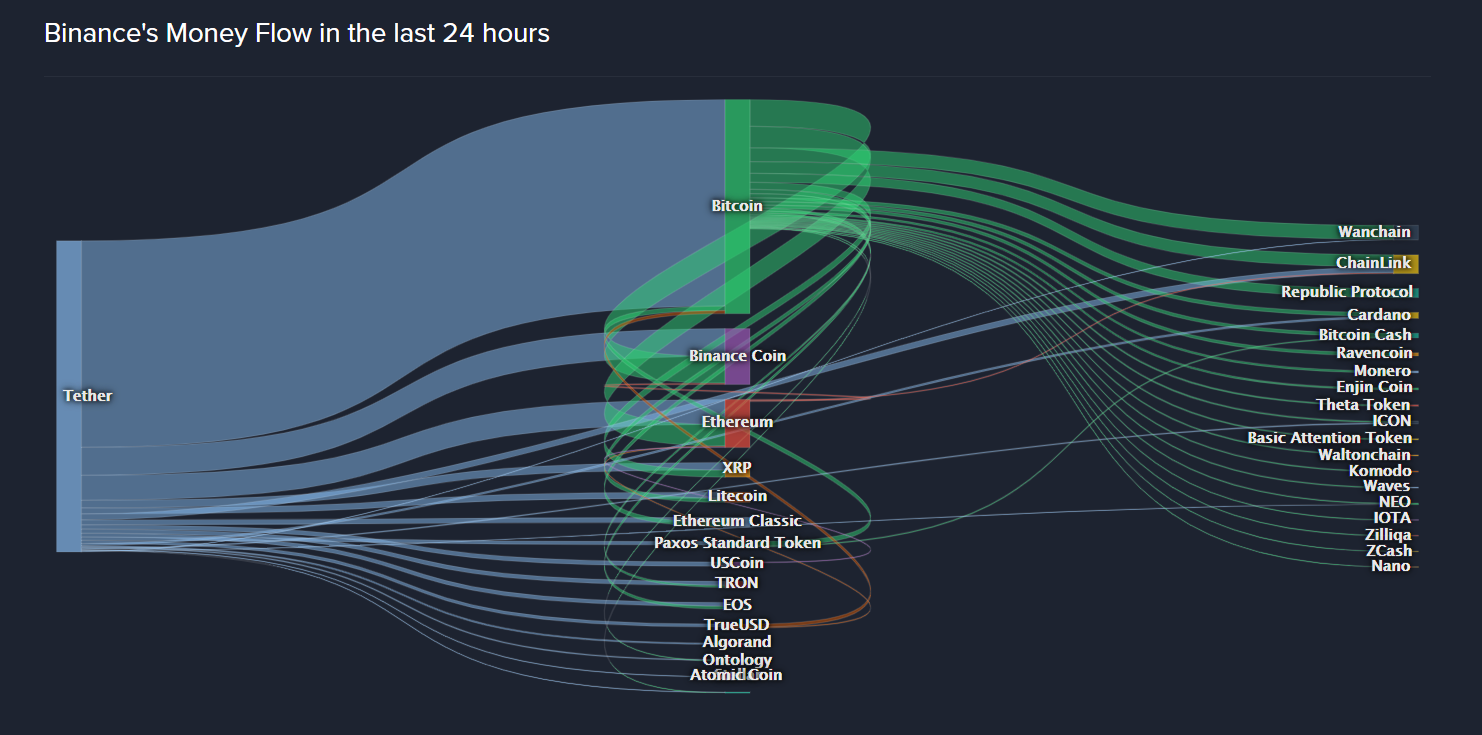

One thing that remains is the speculation of why ETC was selected and not other coins like BTC or ETH. While some speculate that this is a good thing and that Binance is trying to unbank the crypto-community, others say that this announcement is just a marketing gimmick and it will ultimately make CZ rich. Looking at the trading volume on Binance, it is clear that Bitcoin has the highest volume; following it is Binance Coin [BNB] and Ethereum [ETH].

Source: Coinlib.io

In a statement to AMBcrypto, Binance noted that the addition of ETC to the lending platform was based on margin trading volumes.

“The first phase of our lending service is more experimental and we want to understand the market demand for lending products. There are more cryptocurrencies we plan to add to our lending platform in the future, including BTC and other coins. “

Be that as it may, the people who will lend their crypto will earn handsomely as their lots mature in 14 days. Looking at Binance’s announcement, the first phase seems to have gone better than expected, which would mean that Binance will proceed with the next step and add more coins, including Bitcoin in the future.