Crypto News

Binance Futures’ daily trading volume crosses $1 billion; hits new ATH

For the very first time, Binance Futures’ trading volume exploded to a high of $1.14 billion with 165k BTC traded, following the drastic upward momentum gained by Bitcoin after it surged from $7,400 to just past the $10,000 mark on the charts. Bitcoin trading at Binance Futures rose close to this level on September 27 at a volume of $930 million.

Bitcoin posts a massive recovery

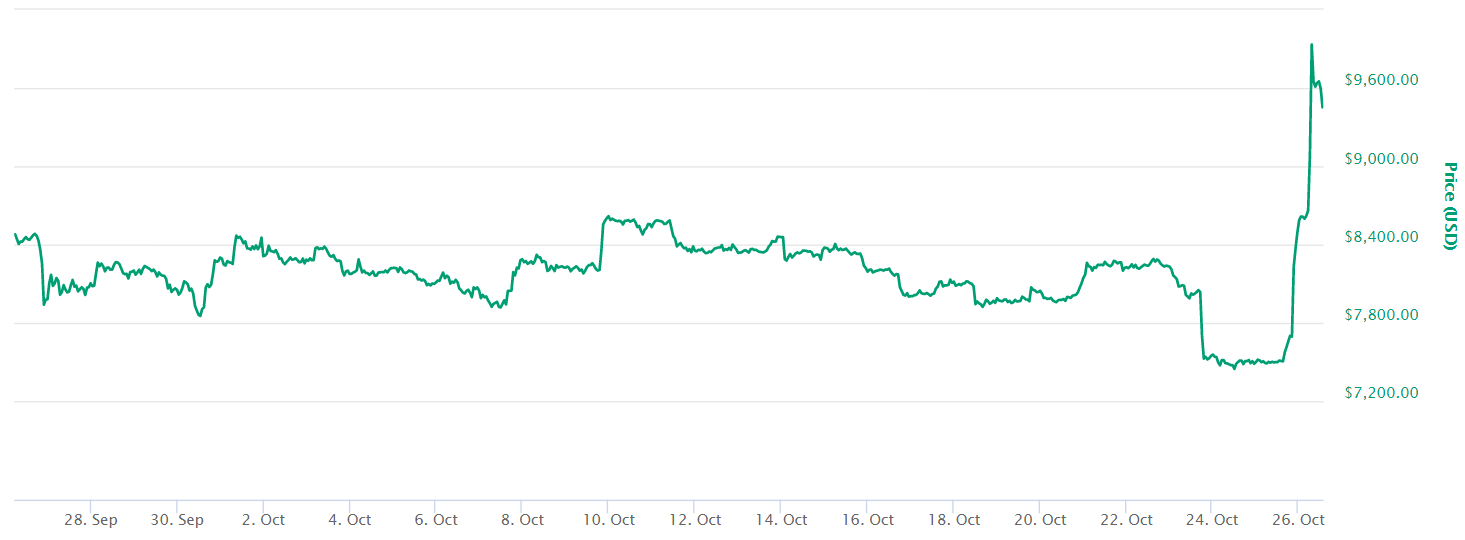

Source: CoinMarketCap | Bitcoin Price against USD

After Bitcoin dropped below the critical level of $10,000, the king coin rallied from $7,700 to $8,400 and then, jumped further past the 10k mark, movement which sent the cryptospace into a frenzy. At press time, Bitcoin had recorded 25.5% gains over the last 24 hours and was trading at $9,428.

Binance ups the game

Binance Futures went live on 24 September following its beta launch. The Futures exchange had previously raised leverage to 125x with the launch of Bitcoin [BTC]/Tether [USDT] contracts, in a bid to increase institutional participation in trading on Binance Futures platform. Binance’s leverage positions even exceeded crypto-exchange BitMEX’s Futures leverage positions.

According to the CZ-led crypto-exchange, the BTC Futures contract provides a “built-in hedging tool” to help manage risks faced by the traders associated with high leverage. To top that, Binance is also providing an “insurance fund” to “help limit the chances of auto-deleverage.”

According to data from CoinGecko, Binance Futures is at the sixth position in terms of its daily trading volume in the overall Futures market.

The daily trading volume, for the most part, was below the $750 million range ever since Binance Futures was first launched. However, after dropping to a low of $300 million last week, daily trading volume figures shot up to $820 million on 15 October.

Additionally, the latest Bitcoin spike also led to Bakkt climbing and meeting its own all-time high volume of 1094 BTC with its physically-settled Bakkt Bitcoin monthly Futures.