Binance downs BitMEX and others in Bitcoin Futures volume dominance

What a week it has been for Binance. Days after securing the acquisition of the world’s largest cryptocurrency data aggregator CoinMarketCap, the exchange, based in God knows where, has stepped up its Bitcoin Futures game and is now the most dominant derivatives exchange across the market.

For months, three exchanges were leading the Bitcoin Futures charts – BitMEX, OKEx, and Huobi DM, with Binance playing fourth fiddle to the trio. The point of overtake happened, fortunately for Binance, and unfortunately for the rest of the market, during the Bitcoin plummet, now called ‘Black Thursday.’

On 12 March, Bitcoin lost over 45 percent of its value, dropping from $7,800 to below $5,500, with a momentary collapse to $3,800. This massive volatility triggered an uptick in Futures volume. As traders rushed onto the top-3 platforms, the size and scale of the price move, coupled with massive liquidations and volume, overwhelmed the exchanges. BitMEX, infamously, had a circuit-breaker debacle, as liquidations on the Seychelles-based exchange reached over $800 million in a single day.

This loss of confidence in BitMEX was a blessing in disguise for other derivatives players, Binance in particular. Since then, Binance, OKEx, and Huobi led BitMEX in trading volume, with the latter two accounting for more individual trading than Binance, until now.

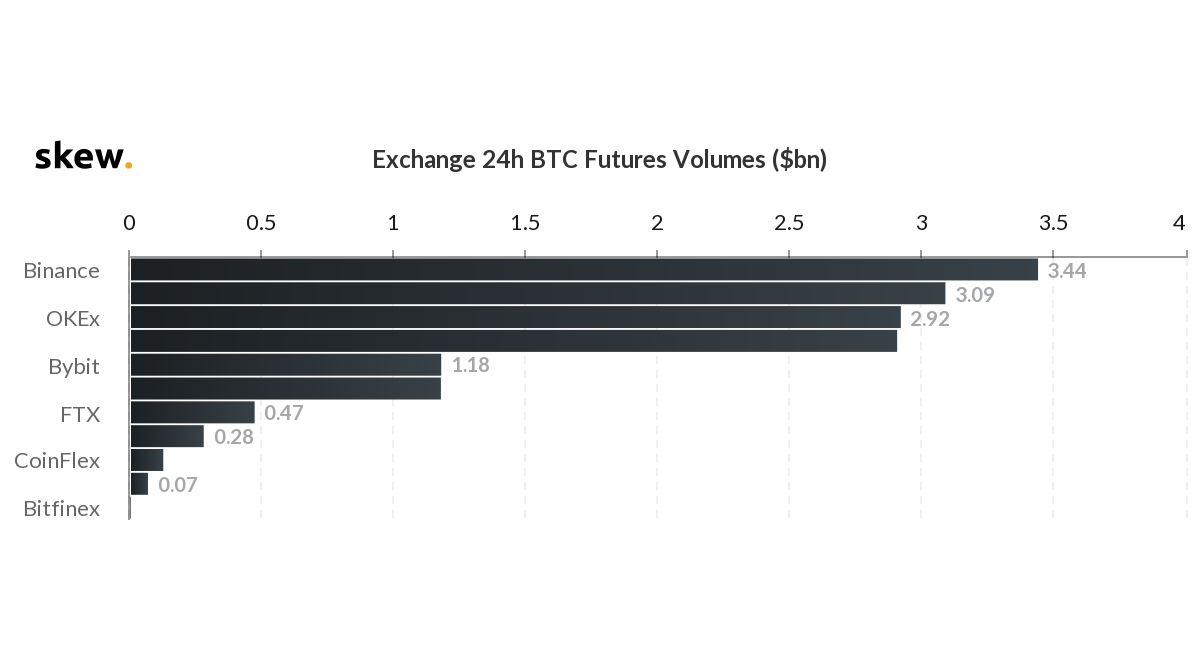

Bitcoin Futures 24-hour volume by exchanges | Source: skew

According to data from Skew markets, the 24-hour trading volume of Bitcoin Futures contracts, succeeding the temporary move over $7,000, and then an immediate pushback, has pushed Binance’s trading volume to $3.44 billion. In comparison, Huobi, OKEx, and BitMEX had volumes of $3.09 billion, $2.92 billion and $2.91 billion, respectively.

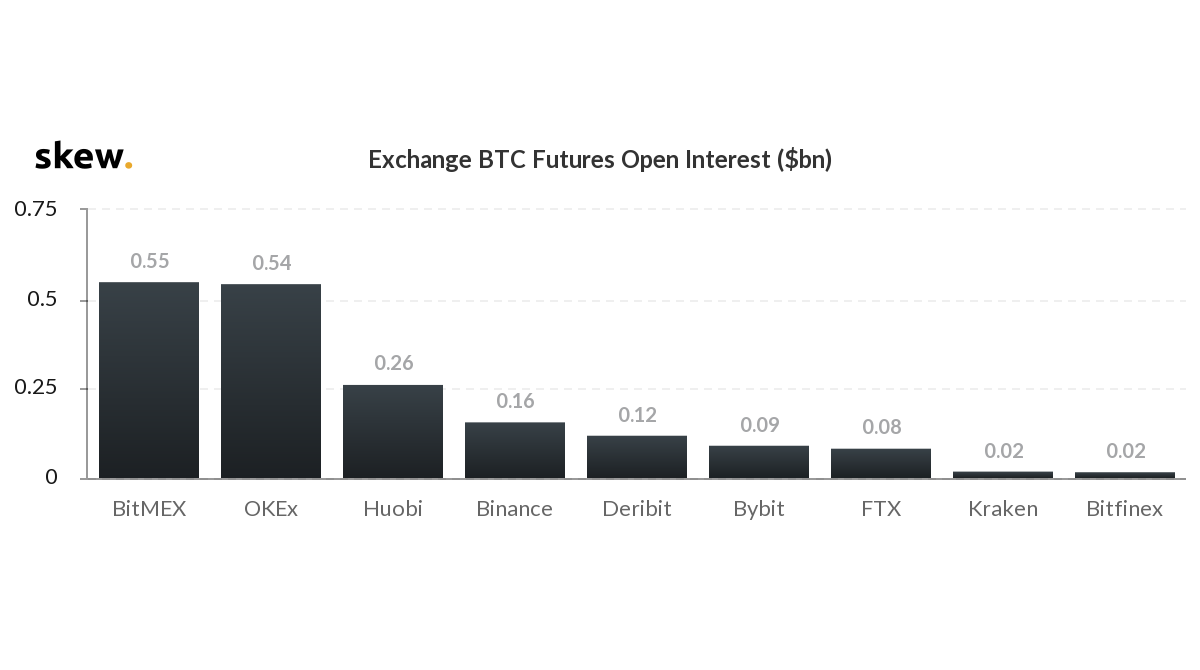

Interestingly, the volume movement has not been reciprocated in the open and active positions in the market. Binance, in comparison to the three exchanges, was trailing in Open Interest [OI]. The OI for Binance was $160 million, while that of Huobi, OKEx, and BitMEX, was $260 million, $540 million and $550 million, respectively.

Bitcoin Futures 24-hour OI by exchanges | Source: skew

Based on this divergence of volume and Open Interest, Binance has indeed more trades, in either amount or quantity, but traders are less likely to open either long or short positions, and instead are trading on previous positions.

However, this could also be a lagging indicator as the OI has been in the same range since 13 March, with no massive price movements to push traders to open new positions on the exchanges. Either way, Binance, less than a year after initiating its derivatives market, has seen massive success in trading volume.