Binance DEX receives 151 listing proposals after recording $229 million in trading volume in July

July 2019 has been a monumental month for the cryptocurrency space. Several digital assets succumbed to a bearish hold [Bitcoin included] in the aftermath of the Facebook-Libra hearings and U.S President Donald Trump’s statements on cryptocurrencies. Despite brief resurgences here and there, the market remains slow to post major gains.

Binance’s Research wing recently collaborated with Binance Trading to generate July’s monthly report, an issue which discussed the cryptocurrency market from an institutional standpoint.

The Global Markets report revealed losses suffered by major digital assets in July, with Ethereum leading the way with a depreciation of about 29.87 percent. EOS also significantly lost its valuation, falling down the rankings from 4th to 8th on the back of a repeated collapse.

The report also touched upon other aspects, including Binance’s busy development and the listing of new coins on its exchange. The most notable one was Binance’s GBP-backed stablecoin, which was established with an objective to “diversify” stablecoin usage in the cryptospace.

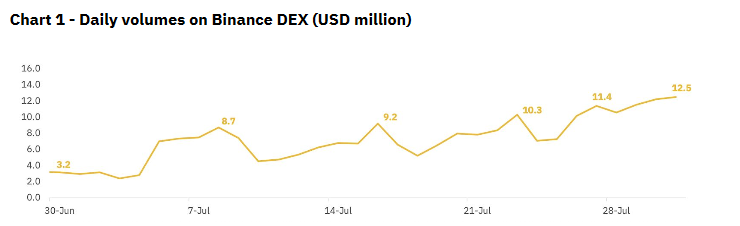

Binance DEX, which is developed on top of the Binance Chain, was a popular target and received a count of 151 listing proposals. The list of new pairs added to the DEX in July also remained relatively high with 41 new pairs.

Source: Binance Research

Binance.com, the parent chain of Binance DEX, has higher liquidity than the DEX. However, Binance DEX recorded an average daily volume of $7.4 million in July, despite market volatility. As a result, it became the most used decentralized exchange in terms of trading volume, with a total volume of $229 million.

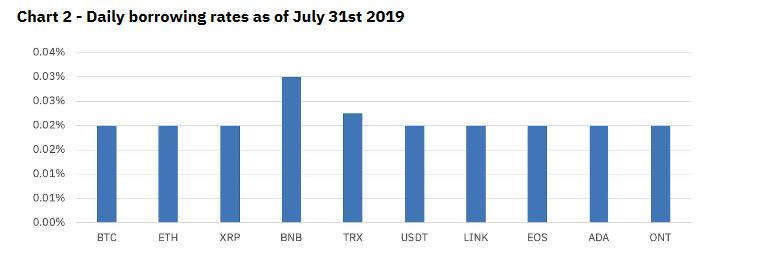

Other than the DEX, Binance.com also added 4 new assets to their margin trading platform, which included EOS, ChainLink, Ontology, and Cardano. Binance coin [BNB] was also competent as a borrowable asset at press time, which opened new trade possibilities for investors and traders.

Source: Binance Research

Following its eligibility as a borrowable asset, Binance Coin was also the most borrowed asset in the space, with an annualized rate fluctuating between 7.57 percent and 11.57 percent. However, DeFi rates were significantly higher with DAI’s stability fee set at around 20.5 percent.