Binance Coin, Dogecoin, Monero Price Analysis: 13 October

Most altcoins faired well through the weekend, recording impressive gains, as Ethereum surged towards the $ 385 level.

Binance Coin was witnessing a continuation of its upward price momentum. The digital asset was up once again on its daily chart, following the positive sentiment seen across the market today. Monero too, could be in for a quick reversal, towards the bullish side.

Dogecoin, on the other hand, recorded some selling pressure and could break out downwards after a brief consolidation period.

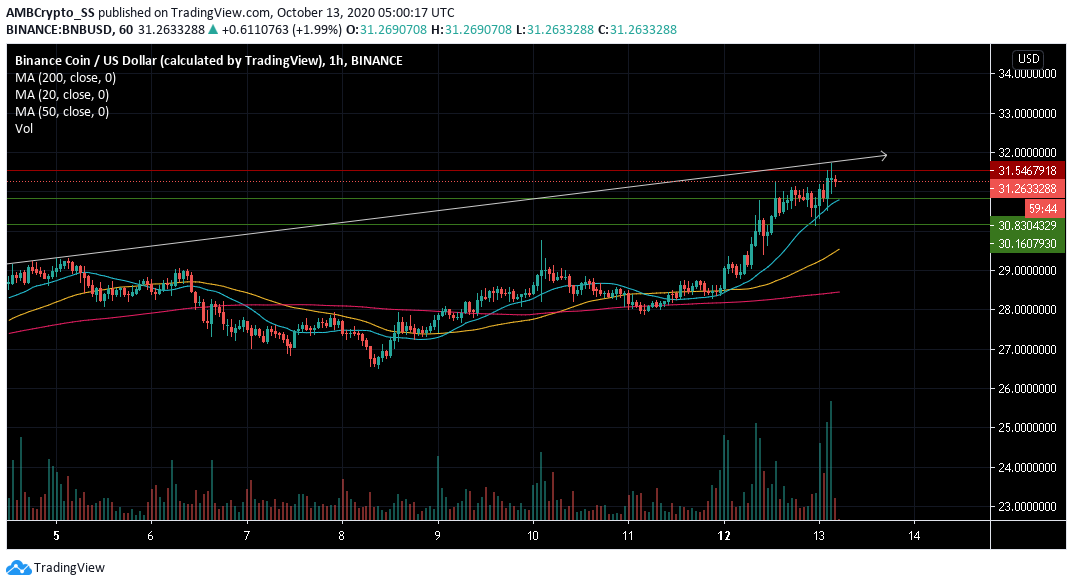

Binance Coin [BNB]

Source: BNB/USD on TradingView

At the time of writing, Binance Coin was trading at $ 31.26 after moving above its immediate resistance turned support at the $ 30.83 mark.

Recording a drop in prices before the weekend, BNB was up by almost 6.4% since yesterday.

The digital asset remained fairly bullish as per its technical indicators: the 20 period Simple Moving Average (blue) was above the 50 SMA (yellow), which was above the 200 SMA (pink)- a highly bullish sentiment. The bounce above the 20 SMA, further indicated that bears respected the price movement above the short term moving average.

The bullishness visible from its moving averages was also supported by heavy buying volumes. Coinciding with the immediate price hike volumes also remained high, indicating strength in the buying sentiment.

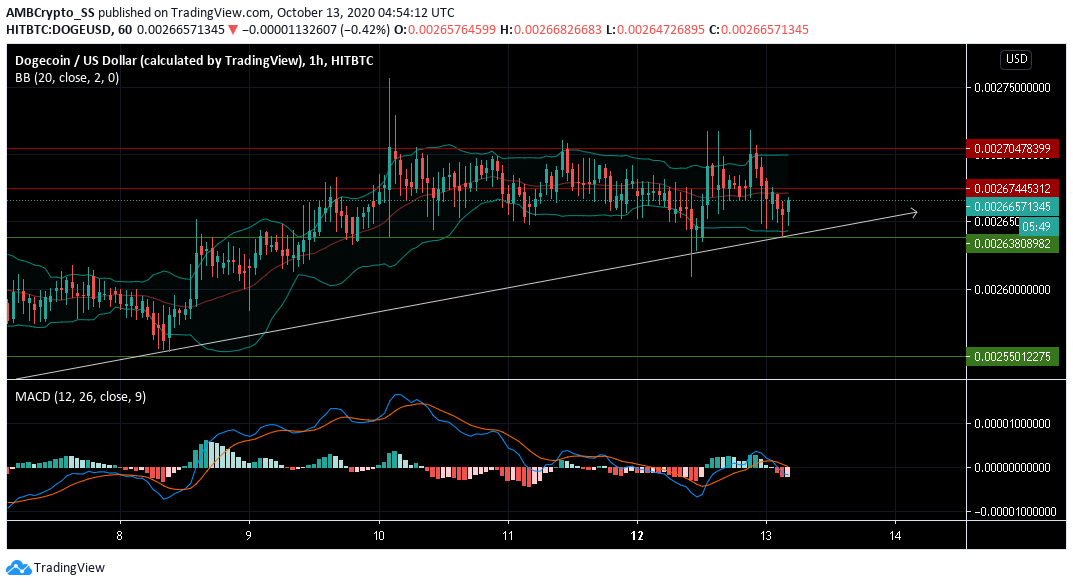

Dogecoin [DOGE]

Source: DOGE/USD on TradingVew

After a dump in the price of Dogecoin visible over the last 24 hours, it appeared to be finally stabilizing. The digital asset was trading at $ 0.00265 at the time of writing.

With a minor rise in its level of volatility, BNB displayed a downtrend towards the $ 0.00263 support level. This was seen post its week-long horizontal price movement along the $ 0.00267 level.

The divergence of the Bollinger bands confirmed a hike in the level of volatility.

Further the bearishness indicated by the MACD, also confirmed a downtrend, that could unfold over the next few days.

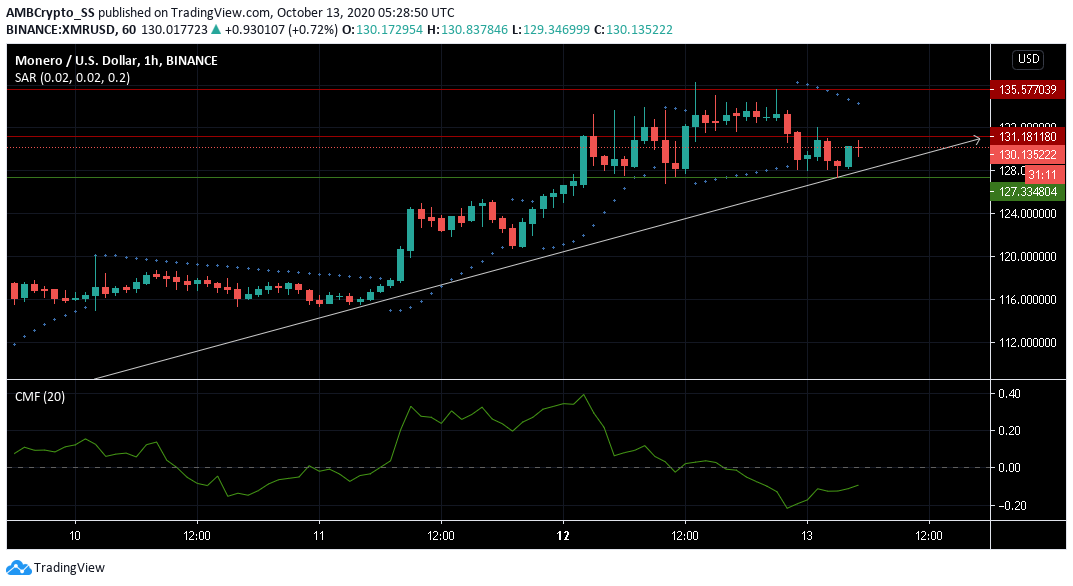

Monero [XMR]

Source: XMR/USD on TradingVew

Despite Monero traders betting on an uptrend, the digital asset recorded some losses recently. The Chaikin Money Flow Indicator, below the zero line was signaling bearishness.

With capital outflows being greater than inflows, existing cash leaving the Monero market, added to the selling pressure. Parabolic SAR too gave a sell signal.

However, if XMR bulls, continue to maintain price levels above the $ 127.33 support, the selling pressure could be weakened. The digital asset given its overall uptrend, is likely to see a bullish reversal in the next few trading sessions.

Monero announced on twitter, the rollout of its latest Ledger Nano App update version (1.7.3). It would be compatible with the latest GUI and CLI clients (0.17.0.1 – Oxygen Orion).