Bakkt’s trading volume reports ATH as Open Interest takes a hit

Bitcoin Futures Market Bakkt was intended to be the refuge for institutions to buy the world’s largest cryptocurrency. However, on the day of its much-awaited launch, Bitcoin fell sharply. This only strengthened the view of some who believed that Bakkt’s launch would never correlate with Bitcoin’s price.

Despite a cold start, however, Bakkt has now picked up the pace after the trading volume on the platform hit an all-time high of $10.3 million on 25 October 2019. As Bakkt caught on, it also managed to breach its previous ATH and reported its highest trading volume of $15.63 million on 8 November 2019.

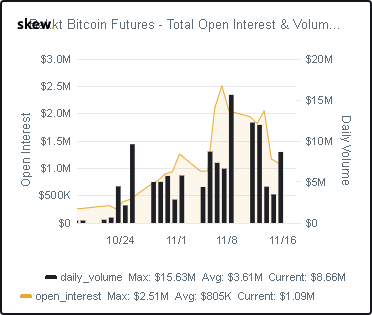

On 18 November, Skew markets highlighted the surging volume in the market. However, it also noted declining open interest in the market.

Source: Skew Markets

Unlike trading volume, the Open Interest [OI] started to decline after reporting an ATH of $2.5 million on 7 November. Open Interest can be defined as the number of Futures contracts held by market participants at the end of the trading day. After a closer look, it was found that either more participants’ contracts have reached expiration, or there are people exiting the market.

For almost a month after its launch, from 24 September to 22 October, the average volume on Bakkt remained under $700,000. However, 23 October saw Bakkt trading 640 contracts when BTC’s price was hovering below $7,400. This put Bakkt back on track, reporting its first-ever ATH in volume at $4.8 million. The CTO of cryptocurrency exchange Interdex told AMBCrypto that Bakkt could be picking up the volume from other places and arbitrageurs might be trading more using Bakkt’s contracts.

Open Interest [OI] over the past week closed at $1.09 million, while the trading volume remained as high as $8.66 million.