Bakkt’s launch coincides eerily with Bitcoin’s breakout: Will Bakkt be a tailwind or a headwind?

Now that Bakkt is launching in less than a week, it is safe to say that Bitcoin will reach a new milestone, especially with the large-scale onboarding of institutional buyers and price discovery, in tandem with physically settling Bitcoin. After almost a year of delays and regulatory pushbacks, Bakkt is finally set to launch in less than a week.

Bakkt and Loaded

Bakkt has been in the works since the first announcement on 3 August, 2018. There have been a lot of expectations from it, mainly due to the marquee group of companies backing it like BCG, Microsoft, Starbucks, and others. Unlike other exchanges that are present in the cryptocurrency ecosystem and are plagued with manipulation, front running, pumps and dumps, Bakkt is supposed to be devoid of all such activities and will entertain nothing but good behavior and facilitate cryptocurrency trading to institutional buyers. Moreover, with Bakkt price discovery for Bitcoin, it could perhaps be the beginning of a new era.

Bakkt is going to be the first exchange/platform to allow physically-settled Bitcoin for two of their futures offerings – Daily and monthly settled futures Contracts.

Eerily so, the launch of Bakkt is coinciding with the end of a price pattern that Bitcoin has been witnessing for over four months now. So, in a way, the fate of this breakout rests partly on Bakkt.

Source: TradingView

The above chart describes the dilemma that Bitcoin is facing. How will the breakout fare? Will it be a bullish breakout and will the much-awaited bull run reconquer the old ATH? Or will it be wallowing with the bears?

Since the pattern is symmetrical it is hard to judge how the breakout is going to be.

Almost all of Twitter is bullish on the breakout, except for a select few traders who believe otherwise. The former might be right considering the prior trend, which is bullish, so they expect the subsequent breakout to be bullish.

If only Technical Analyses were that simple.

Bakkt and Cohorts

In times like these, it is probably better to take a look at factors that might affect the breakout, and the most important one is Bakkt’s launch.

Bakkt has been awaited for almost a year, and people expect it to be able to handle massive demands of institutional buyers, since it is going to be the first to offer physically-settled Bitcoins. Other notable futures offerings for Bitcoin include CME, CBOE’s VanEck Bitcoin Solid Trust, Wilshire Phoenix, Bitwise Asset Management, etc. Although futures so-far have been settled in cash, it would provide a brief idea to gauge Bakkt’s performance.

VanEck’s SolidX Bitcoin Trust offers shares, which represents units of fractional undivided beneficial interest, and ownership of the Trust is vaguely similar to the offering by Grayscale. The net assets of VanEck’s futures as of September 18 is around $40.8k, which is approximately worth 3.99 BTC. This is a very minute demand for VanEck’s offering, and this could be perhaps because Grayscale has all the advantage as their AUM [Assets Under Management] was a whopping $2.4 billion at the time of writing.

CME’s futures showed a whopping $19 million from January 10 to February 08, 2018. However, for the last 430+ days, showed an average daily interest of $235 million. Moreover, the daily open interest for CME’s Bitcoin futures peaked at ~$1.7 billion.

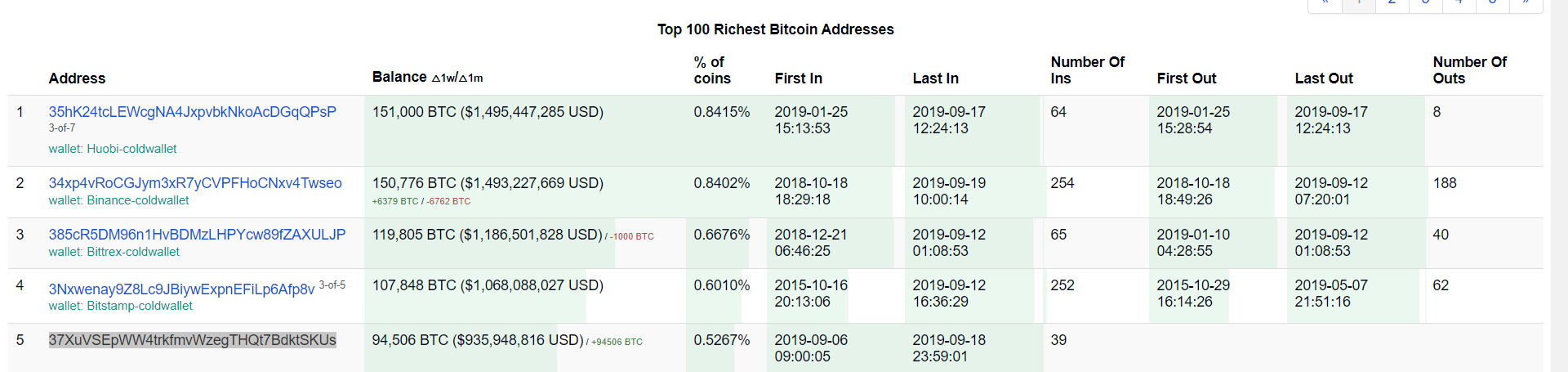

Bitcoin worth $1 billion was moved recently to a new wallet, which is now the fifth-largest Bitcoin holder in the world. Quite a few people have speculated that this could Bakkt preparing ahead of its launch.

Source: Bitfinocharts

Although Bakkt has not officially come out with a statement claiming the transfer, crypto-Twitter didn’t hold back speculating about it. Interestingly enough, the transfer of 94k BTC took place on the same day Bakkt announced that their Warehouse Custody was live. Maybe Bakkt expects there will be a surge in demand and it is preparing for it. Moreover, Bakkt also announced that their warehouse was also protected with a $125 million insurance policy. However, they did not specify as to how much of Bakkt’s holdings are insured.

All of this evidence, no matter how small, seem to be pointing towards a good start for Bakkt, indicating a bullish move for Bitcoin. If this is how things will play out, the breakout would definitely be bullish and there might be a chance that Bitcoin might head to reconquering old highs. However, on the downside, if the demand from institutions does fall short, as it did with VanEck, Bakkt’s underwhelming acceptance could be expensive for BTC.

Moreover, the $125 million in insurance that is covering Bakkt is yet to be fully understood, specifically whether the insurance is in terms of fiat or Bitcoin. On the off chance, if something does happen to Bakkt’s holdings, the insurance might cover it with cash. However, those Bitcoins would be lost forever. Until enough clarity is provided by Bakkt on this matter, this could be something that could deter Bakkt’s performance.

Bakkt to Basics

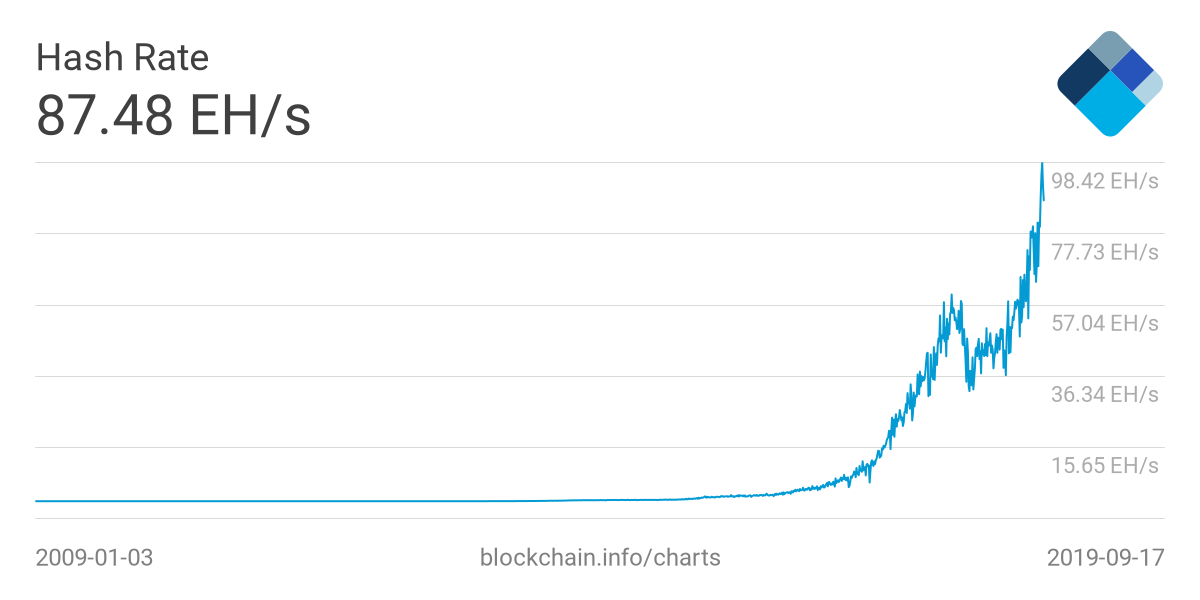

Bitcoin’s fundamentals, especially hashrate, has been growing non-stop and hitting all-time highs. For PoW chains, hashrate is the lifeline of the network and it determines how secure a network is. Bitcoin’s hashrate, at press time, was 84 EH/s, as seen in the image below.

Source: Blockchain.com

It hit a peak of 98.52 EH/s, shattering the previous high seen during the peak of December 2017 [60.89 EH/s]. The hashrate has gone parabolic like never before and this might be another ace up Bakkt’s sleeve.

The hashrate of Bitcoin is dependent on the number of miners present, which in turn depends on the price of Bitcoin and if the miners are breaking-even or profiting from mining. Since the price of Bitcoin is profitable to miners now and the hashrate is rising exponentially, it could be that BTC could be valued more on Bakkt when it launches and could cause an exodus of people from unregulated exchanges and into Bakkt. Judging from this hypothesis, even if Bitcoin does break bearish, the price discovery might help the price climb back up again.

The Critical Point

Bitcoin’s price has coiled long enough; it has built up enough energy to undergo a spectacular breakout, irrespective of the direction. It is quite simple, the price will either go higher and reconquer old highs or it could head down and retest important levels, or perhaps even create a new bottom. However, looking at the aforementioned facts, it does look like the breakout will be bullish. Bakkt’s launch is a stepping stone for Bitcoin in its journey towards revolution and it is all upside for BTC on a macroscale.