Bakkt Bitcoin Futures’ Open Interest touches new all-time high

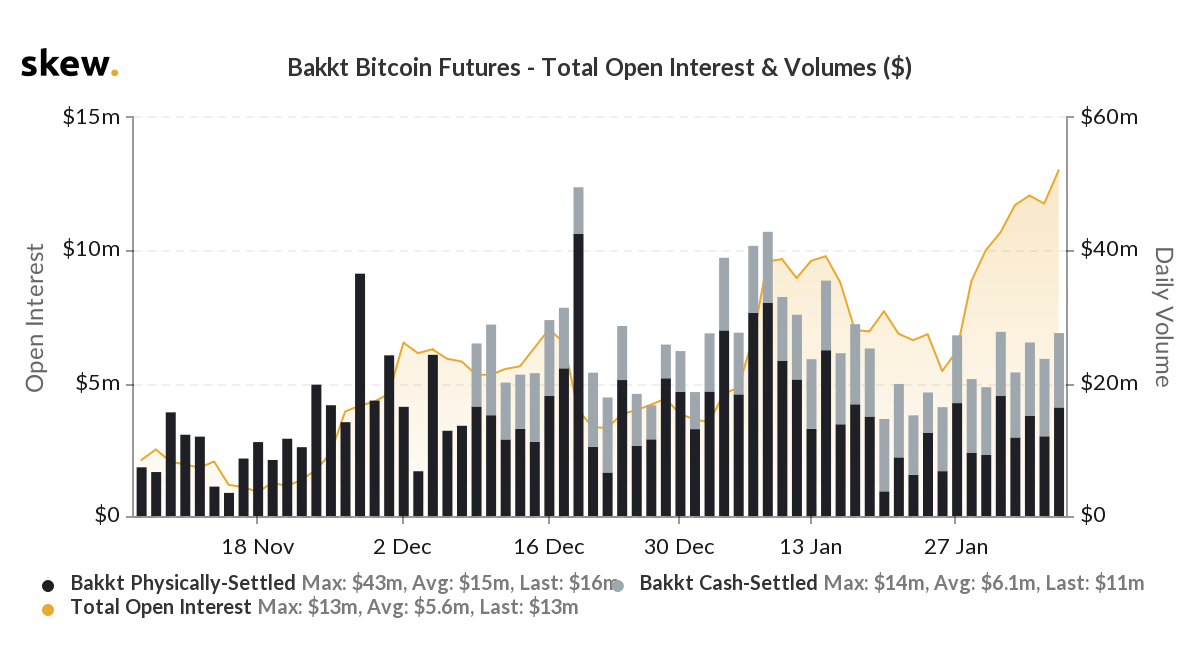

Data analytics firm for cryptocurrency derivatives, Skew, recently reported that the total interest on ICE-backed Bakkt Bitcoin Futures contracts had touched a new all-time high of $13 million. Open Interest represents the total open positions held by market participants on the exchange.

Source: Skew

Typically, Open Interest is looked at as an indicator of market sentiment and in determining the strength of the prevailing trend of the underlying asset — in this case, Bitcoin. Since an increase in Open Interest highlights capital flowing into the market, market sentiment could be more bullish for investors on the Bakkt exchange.

Though BTC Futures volumes on the CME exchange saw a slight dip post-January, they looked to be going through an overall rising trend in 2020. Bitcoin also recently recorded an uptick above the $9700 mark and the world’s largest cryptocurrency has been moving through an uptrend for the past few weeks.

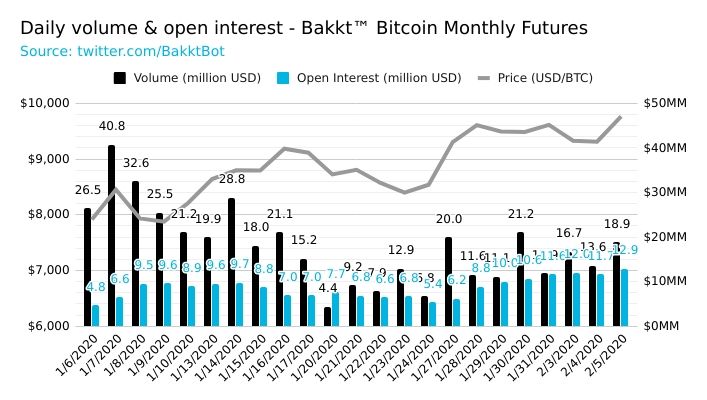

Source: Bakkt Volume Bot

The Bakkt Volume Bot on Twitter showed that volume on the exchange for its monthly Bitcoin Futures has been steadily rising since the start of the year. With both volume and Open Interest on the rise, this could be a sign of a bull market.

Since late-September last year, Bitcoin has been unable to move above the $10,000 mark, coming close only once in October. Bitcoin even dropped to as low as $6500 towards the end of last year, creating an overall bearish sentiment throughout the holiday season.

However, 2020 has seen renewed energy from Bitcoin and other crypto-assets. Since the start of the year, Bitcoin is up by nearly 42%, with altcoins seeing substantial gains too. Bakkt’s rising volume trend and Open Interest, coupled with BTC’s positive price action over the last few weeks could be a strong indication of an upcoming push over the $10,000 level.