As dYdX unlocks 150M tokens, here’s how whales reacted

- dYdX has unlocked 150 million DYDX tokens.

- Three big whales who received some of the tokens have sent the same to Binance.

In the early trading hours of 1st December, leading perpetual contracts platform dYdX [DYDX] completed the unlocking of 150 million DYDX tokens, totaling around $465 million.

Data from Token Unlocks showed that the tokens unlocked formed over 80% of the asset’s circulating supply of 180 million.

AMBCrypto found that DYDX tokens worth around $257 million of all tokens unlocked were released to the protocol’s investors, some of which include a16z crypto, Defiance Capital, and Polychain Capital.

DYDX flows into Binance

Following the unlocking event, three whale accounts that received some of the unlocked tokens have since transferred the same for onward sales on cryptocurrency exchange Binance.

In a series of posts on X (formerly Twitter), on-chain sleuth Lookokchain found that three large wallets have collectively transferred 6.81 million DYDX tokens valued at $21.46 million to Binance.

1/ 150M $DYDX($505.5M) was unlocked 2 hours ago and can be sold!

We noticed that 3 whale wallets that received $DYDX from the dYdX Foundation Wallet have transferred 6.81M $DYDX ($21.46M) to #Binance.https://t.co/0HsVwDNREk pic.twitter.com/yfKi6G1HY4

— Lookonchain (@lookonchain) December 1, 2023

The spike in DYDX inflows on exchange has resulted in a downward pressure on its value. Data from Coingecko showed that the altcoin’s value has plummeted by over 5% in the past 24 hours.

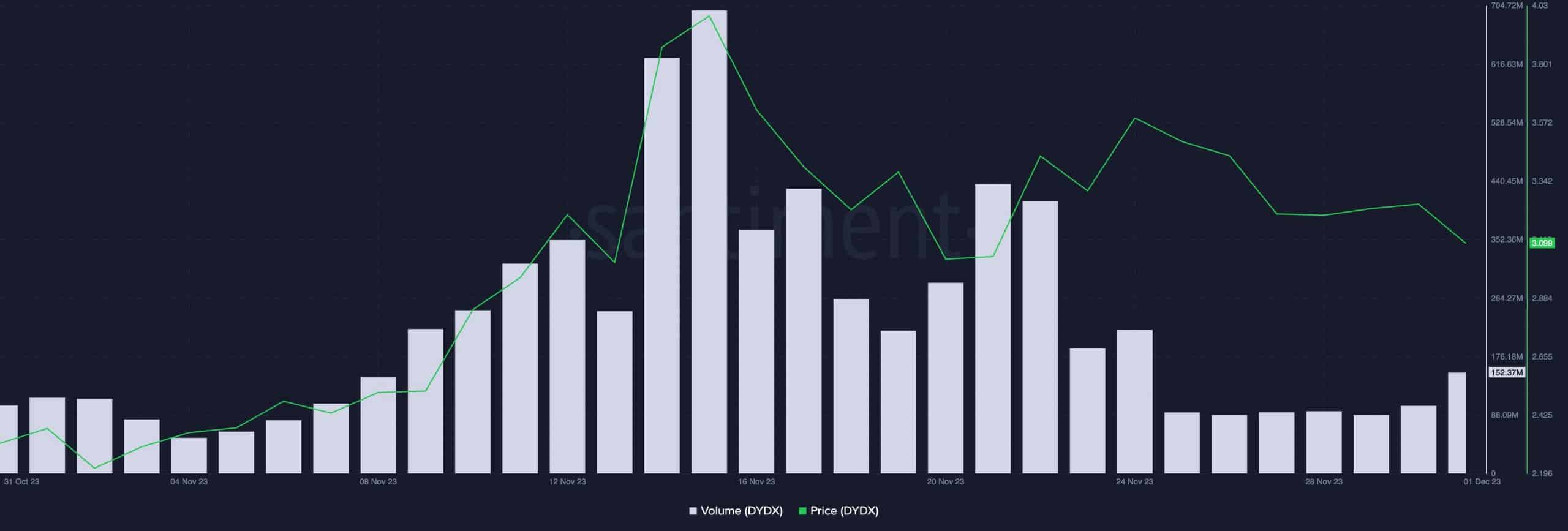

While its price declines, DYDX’s trading volume has rallied in the last 24 hours. According to data from Santiment, the coin’s trading volume totaled $152 million at press time, surging by 49% in the last 24 hours.

The volume uptick without a corresponding price rally suggests a bearish price/volume divergence. This is often followed by a further decline in an asset’s price.

This is so because when an asset’s price decreases while it records a high trading volume, the trading activity is mostly people trying to distribute their holdings and exit trading positions.

Bears take charge

Key momentum indicators observed on a 12-hour chart confirmed the selling activity that has taken over the market since the completion of the unlocking event.

DYDX’s Relative Strength Index (RSI) trailed downward and rested at 43.31 at press time. Its Money Flow Index (MFI) was spotted at 3073, trending closer to the oversold territory.

The values returned by these indicators hinted at the heavy token distribution that has taken place since the unlocking.

Read Dydx’s [DYDX] Price Prediction 2023-24

Lastly, DYDX’s Directional Movement Index (DMI) placed the bears in control of its spot markets.

As of this writing, its positive directional index (green) at 17.63 rested below the negative directional index (red) at 19.53. This suggested that the sellers’ power exceeded that of the buyers.