All that is NOT bullish for DeFi

There are enough narratives of DeFi’s bullishness in response to every new development in the crypto space. Starting from the KuCoin hack to the recent CFTC charges on BitMEX, every event is known to have a positive impact on DeFi projects’ ROI in the long run. However, the immediate and short-term implications of DeFi are more relevant for traders.

Retail traders have parked funds in DeFi projects for their high ROI, and the performance of DeFi in the past month has fallen short in most respects. Projects like Yearn.Finance, Compound, and Chainlink clocked ROI upwards of 500% before September; however, throughout September, there was a rapid drop in ROI.

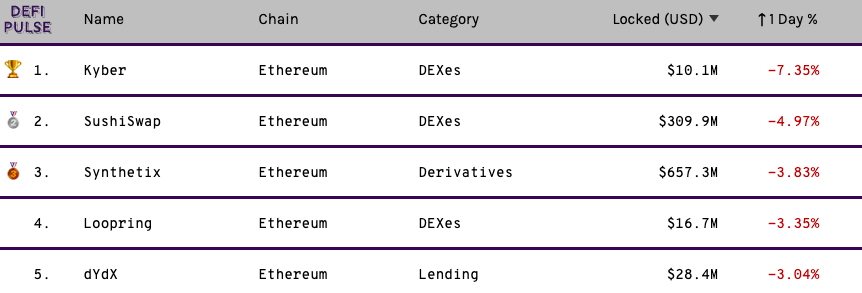

Considering 1-day returns, 3 of the projects that rank consistently in the top 5 have negative TVL.

Lowest 24-hr returns on DeFi Projects || Source: DeFiPulse

Based on data from DeFiPulse, TVL has increased by 30% in the past 30 days; however, this increase in TVL is not an indicator of the profitability of DeFi projects.

30-day and YTD returns on DeFi projects || Source: Messari

The long term returns on DeFi projects like UMA and AKRO are optimistic; however, the short term returns – 7 days and 30 days are -19% to -67%. The projects listed in the chart from Messari are the ones with the lowest returns in the past week and month. However, the overall DeFi ecosystem has suffered a similar drop in ROI, which could be due to baseless hype or lack of actual utility/ use case of the projects in the real world.

The narrative that every adverse event that occurs to Bitcoin or in the crypto space has a positive connotation for DeFi may have backfired in the short run. Retail traders, bored with the lack of volume and price action in Bitcoin and top altcoins on spot exchanges, moved to DeFi, and their portfolio has taken a hit.

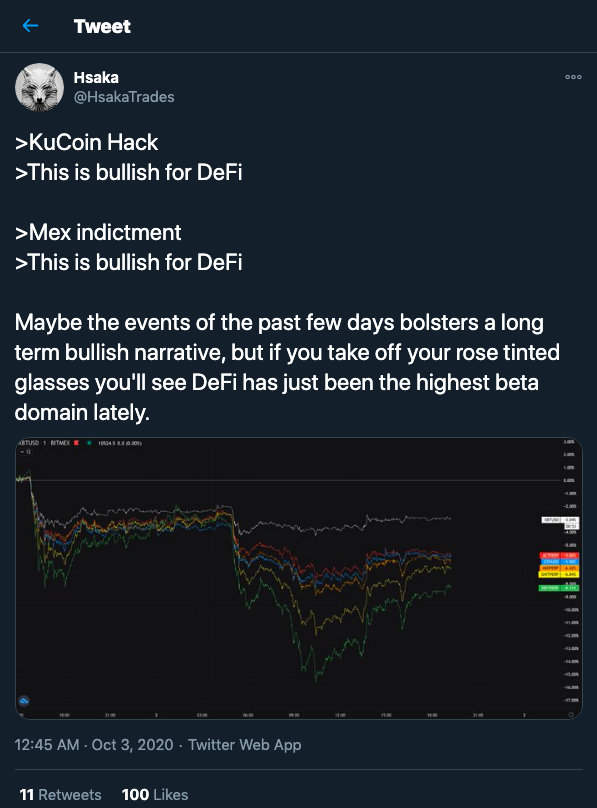

Popular trader and influencer, Hsaka tweeted on DeFi’s returns

Source: Twitter

DeFi has been in the beta domain lately, and most projects have offered returns of -40 to -60%. While long-term outlook and prediction are crucial to every investment instrument, it is necessary to focus on short-term performance as well. As that has the most visible impact on a traders’ portfolio. Top DeFi projects have performed poorly and are losing ROI every day and it is important to acknowledge the need to rebalance your portfolio if you must. There are enough altcoins with moderate returns to help traders recover the losses made in DeFi. However, for the ones in it for the long run, DeFi projects continue to hold hope.