Bitcoin’s fall triggers liquidation of approximately $150 million in longs on BitMEX

After being restricted under $9k for a long time, Bitcoin’s price shot up and was surfing within the $10k range since the beginning of September. However, on September 19, Bitcoin collapsed by a massive 6.71% within a couple of hours, resulting in its price to fall from $10290.49 to $9,600. The coin noted a percentage growth post the fall, but that restricted the price of the largest cryptocurrency to $9,871.05, at press time.

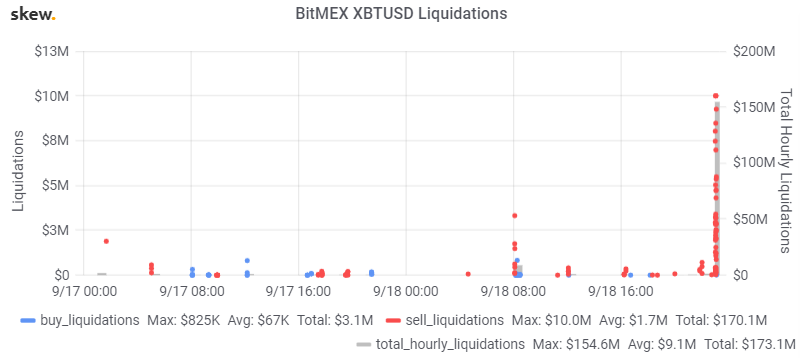

However, the falling price of Bitcoin provoked the liquidation of a string of longs on BitMEX exchange. According to a market observer on twitter, @CarpeNoctom, the liquidation on BitMEX alone was reported to be worth $150 million.

Source: Twitter, @CarpeNoctom

The fall of BTC came on the heels of the U.S. Federal Reserve printing $53 billion and the CEO of BitMEX claiming that the digital gold will soon reach its 2017 ATH. The Fed has been trying to prevent the economic crunch and thus, had cut interest rates on certain loans and its most immediate measure was to implement Quantitative Easing (QE) measures by injecting $53 billion in the global economy.

Hayes took this opportunity to comment on the Fed’s stance to claim that Bitcoin will reach $20k, once again.

“QE4eva is coming. Once the Fed gets religion again, get ready for #bitcoin $20,000.”

Few Bitcoin enthusiasts have noted the cryptocurrency reacting to global economic and political uncertainty, during the U.S-China Trade war. The price of Bitcoin has been expected to boom as tension builds up in global economics. However, the correlation between the two has not been proven yet.

As for liquidation, the market’s leaning has been clear, with the longs liquidating at approximately $9,700 for Bitcoin. A similar trend was observed almost 3 weeks back when the price of Bitcoin dropped by 9% overnight, to $9,500. This came in as a surprise for many BitMEX trades as total liquidation of nearly $150 million longs was reported.

$150 million worth of Longs just got Liquidated at BitMEX#bitcoin pic.twitter.com/RweaP9KoS3

— Boxmining (@boxmining) August 28, 2019

As the market struggles to obtain stability, there is a tug of war in progress between buyers and sellers. A recurring buy wall of 7 to 9 million was observed at $9,850, at press time.