Why Ethereum Foundation’s latest sale will not plunge ETH’s price

- ETH’s value increased above $2,600 despite the 100 ETH sell-off.

- Dominance over Bitcoin jumped, but it could be better to wait for a pullback.

The Ethereum Foundation let go of another round of Ether [ETH] on the 16th of January, data from Etherscan revealed.

According to the details from the transaction, the Foundation changed 100 ETH to stablecoin DAI through its “Grant Provider” address.

Though the purpose of the sale was unknown at press time, previous similar transactions suggest that it was probably a donation to a project.

Over the past year, AMBCrypto revealed how the foundation sold some of its coins. But at different points, the team cleared the air that it was not liquidating its holdings unnecessarily.

Trust in ETH continues to rise

This time, it does not seem like ETH’s value will plummet because of the action. In fact, on the same day, the value of ETH rose past $2,600 before it later reversed below the level.

However, there were solid reasons why we concluded that ETH would not feel the effect of the sell-off. This could be traced to a recent post by on-chain analysis tool Santiment.

According to Santiment, 89,400 new addresses were created per day on the Ethereum network in the past week. It also mentioned that a higher number of wallets appeared on the 16th of January.

? #Ethereum's price dominance continues to surge against #Bitcoin's, now +22.4% in a week. During this stretch, there have been 89.4K new $ETH addresses created per day, and 96.3K wallets just yesterday. Additionally, the 2nd largest market cap asset's supply on

(Cont) ? pic.twitter.com/9nHCl6PJPy

— Santiment (@santimentfeed) January 16, 2024

This data implied a surge in network growth, suggesting that ETH’s adoption has been incredible. Should this remain the same way, the chance of ETH’s plunge will remain extremely low.

Also, the increase in the number of wallets created sparked conviction in the long-term potential of the cryptocurrency.

However, it did not end there. AMBCrypto also looked at the supply of the altcoin on exchanges and the supply outside of it. At press time, ETH’s supply outside of exchanges had reached an All-Time High (ATH) of 121.31 million.

Conversely, the supply on exchanges got close to an All-Time Low (ATL). At press time, the percentage was 8.08%. These occurrences have helped Ethereum’s dominance over Bitcoin [BTC].

Okay, now could be time to wait for a pullback

In the past seven days, Ethereum’s market dominance had risen by 22.4% over Bitcoin. If this continues to be the case, then ETH, alongside some altcoins, would outperform BTC.

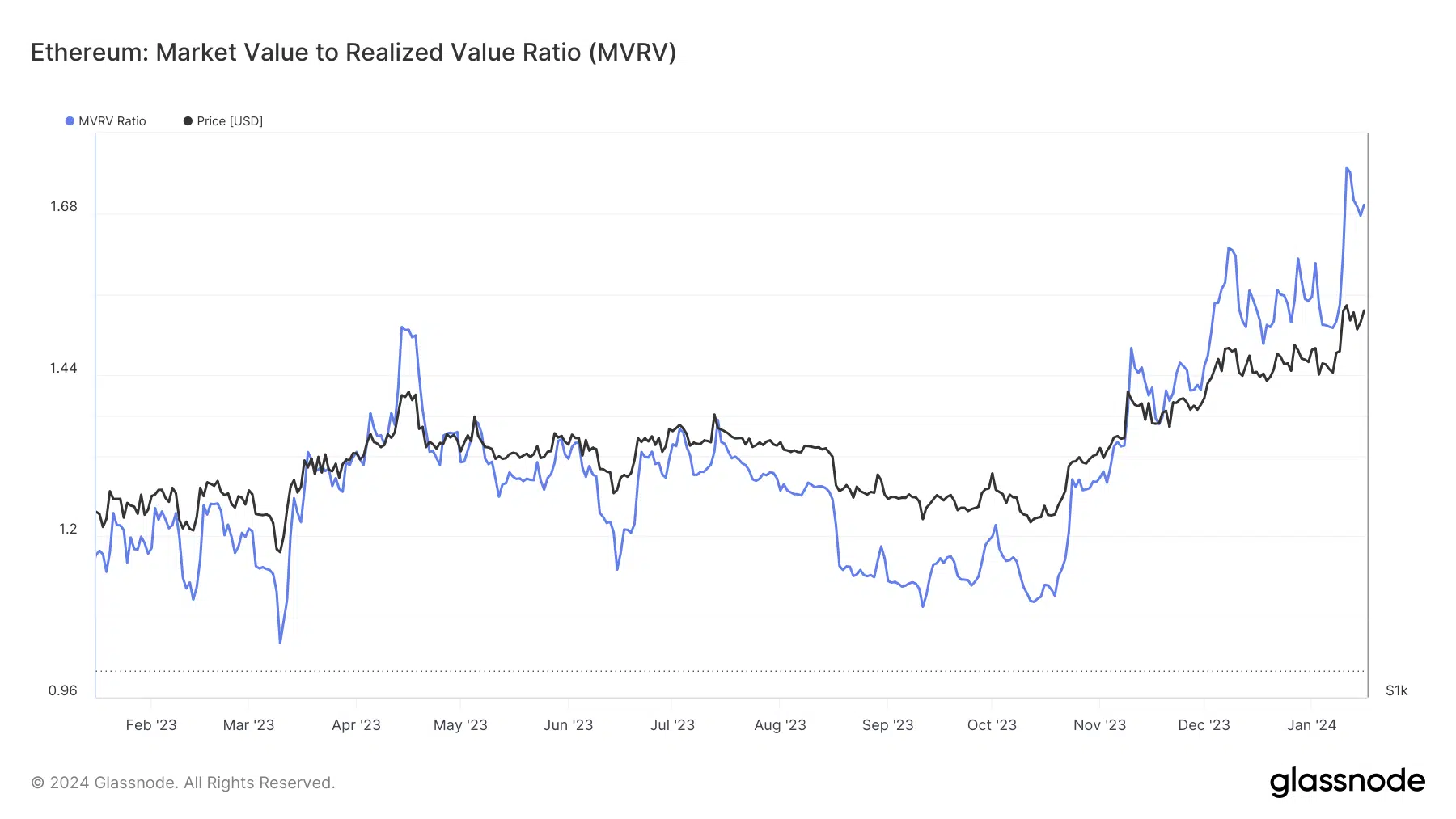

However, an assessment of the Market Value to Realized Value Ratio (MVRV) ratio preached caution.

The MVRV ratio tells whether a cryptocurrency is trading at a fair value, below it, or is overvalued. Values lower than 1 suggest that the coin is undervalued. But when the MVRV ratio is higher than 1, it suggests closeness to the local top.

Is your portfolio green? Check out the ETH Profit Calculator

At press time, Glassnode’s data showed that Ethereum’s MVRV ratio was 1.67. This suggested that the market was a little overheated. However, the metric seemed to be falling, which is something that could excite investors.

If the MVRV ratio drops lower than 1.5, it could be a good entry for those looking to profit from ETH in the long term.