The state of L2 networks as curtains draw on 2023

- The overall L2 sector reached an ATH in terms of daily active users.

- Arbitrum outperformed other networks, but its token failed to see similar growth.

As optimism surged in the crypto sector, the Layer 2 [L2] space showed the most growth during this period. Notably, the daily active users on Ethereum’s [ETH] L2 surged to an unprecedented level, surpassing 800,000 at press time.

This remarkable growth signaled a rising interest and adoption of Layer 2 solutions, indicating a positive trend in the platform’s scalability and user engagement.

As more users turn to Layer 2 for enhanced transaction speed and reduced fees, the sector is poised for substantial expansion. This could result in a robust ecosystem in the coming years.

The amount of #Ethereum L2 users reached an all-time high of over 800,000 daily active users!

Expecting this number to grow over at least 10 million daily active users during 2024 and 2025. pic.twitter.com/YrwlAiBADj

— Leon Waidmann | On-Chain Insights? (@LeonWaidmann) December 4, 2023

L2s on the rise

Due to the huge potential of this sector, new competitors have emerged in the space. Some of them have even succeeded in surpassing protocols that have been in the sector for quite some time.

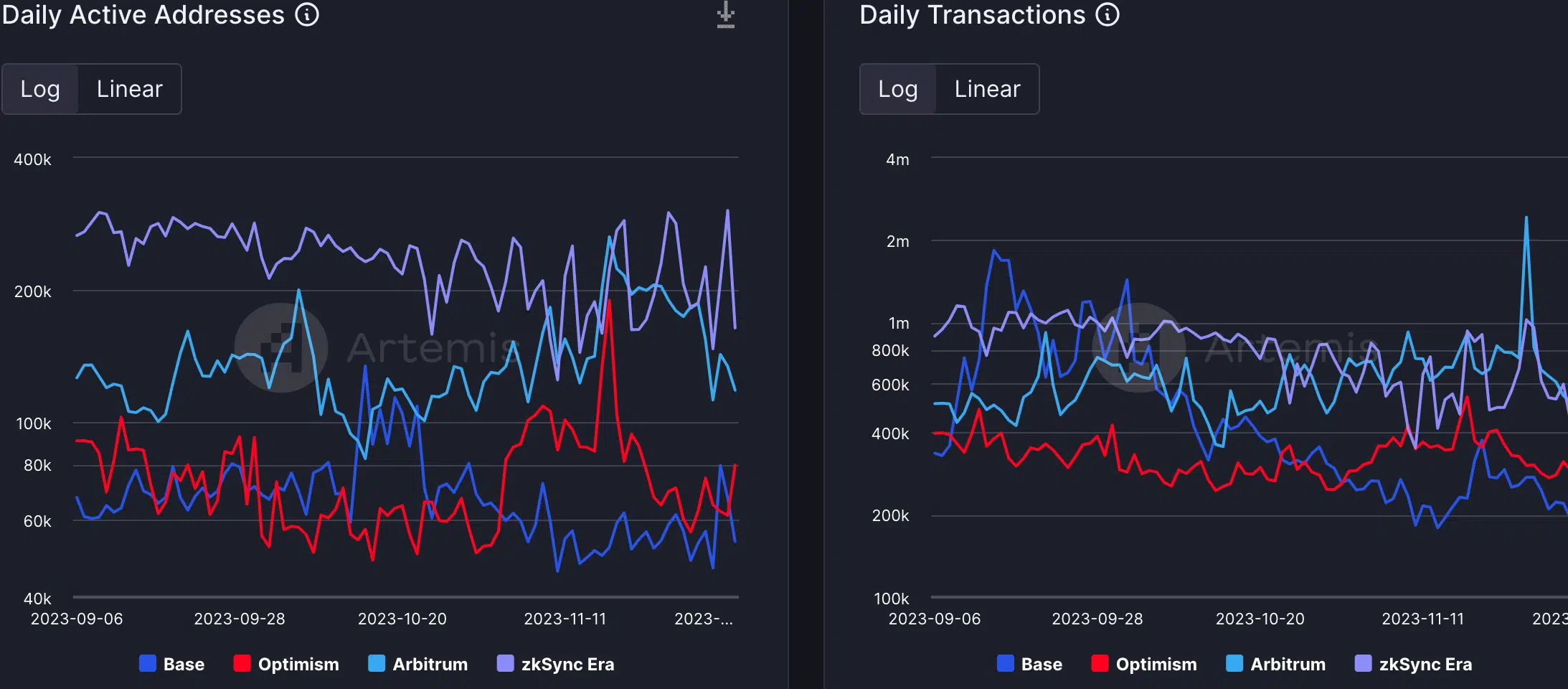

For instance, zkSync Era outperformed all other solutions in terms of daily activity. Even in terms of the number of transactions, zkSync Era did well.

Coming in second, Arbitrum [ARB] managed to flip zkSync in terms of transactions and came close to reaching the same level of activity. However, Optimism [OP] and Base failed to generate similar levels of activity for a consistent period.

What the metrics suggest

Analyzing activity across different chains is crucial because it helps us understand how people use each Layer 2 (L2) chain. Moreover, it gives crucial insights into the scalability and efficiency of each L2 solution.

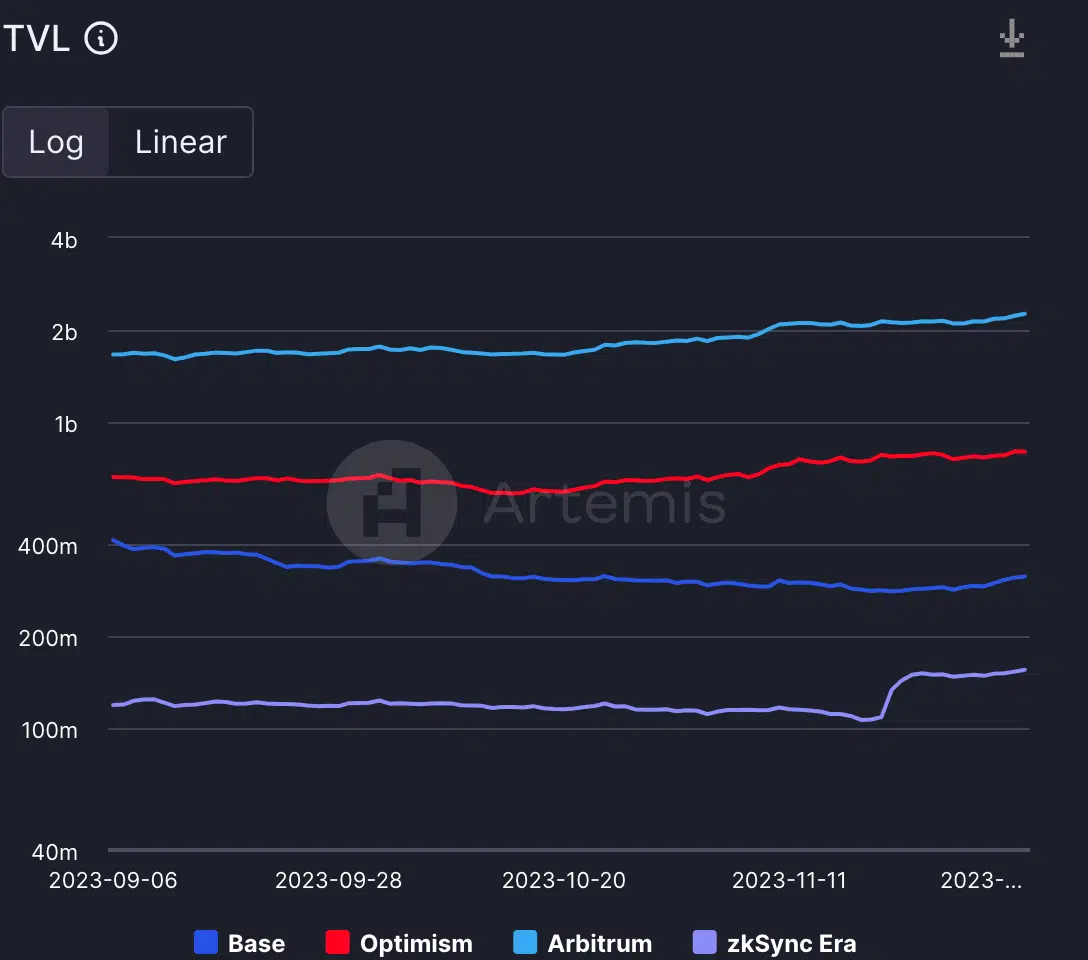

AMBCrypto’s of Artemis’ chart gave more insight into the world of L2s. Notably, Arbitrum reigned supreme in the DeFi sector, as its Total Value Locked (TVL) was much higher than its contemporaries.

Optimism was the runner-up in terms of TVL. Base came in third and zkSync, despite the high activity on the network, came in last. These numbers remained consistent over the last few months.

If the Total Value Locked (TVL) on a Layer 2 (L2) chain is high, it means a lot of assets are being used and stored on that chain. This is a positive sign, indicating trust and adoption.

If there’s a gap between user activity and TVL on an L2, it might suggest that even though people are using the chain, they’re not locking up significant assets. This could be due to the type of transactions or activities happening on the chain.

It is also important to note that Base is relatively younger than other networks and may still need time to find a strong user base and collect even more TVL.

As can be seen from the image, Base already surpassed zkSync in terms of TVL at press time. With the backing of Coinbase, Base may do even more positively in the future.

How are the tokens doing?

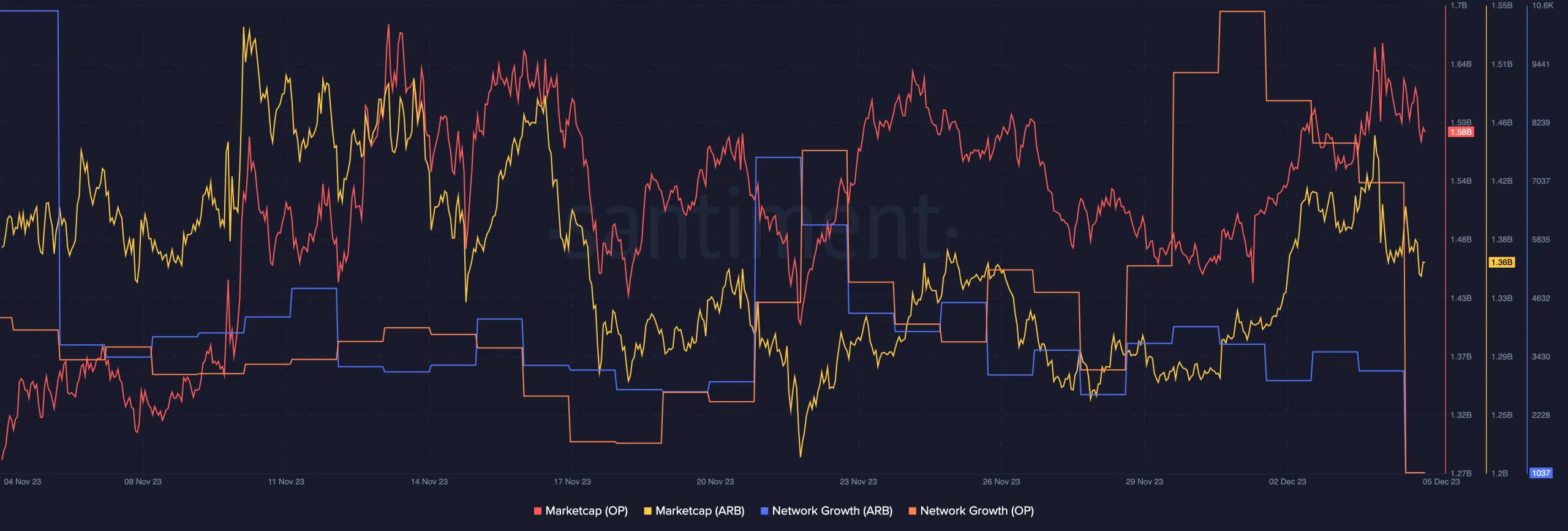

Out of the Layer 2 solutions discussed, Optimism and Arbitrum have individual tokens representing their networks.

Despite Arbitrum’s dominance in various fields, it was OP that had a larger market cap of 1.58 billion compared to ARB’s 1.36 billion. Moreover, OP did much better than ARB in terms of Network Growth as well.

Therefore, it remains to be seen whether the discrepancy between protocol performance and token growth proves to be a worthwhile opportunity for traders.