Optimism performs impressively in 2023 – Can it outshine Arbitrum?

- OP’s active addresses and transactions surpassed those of ARB’s on one occasion.

- OP was down by more than 3% in the last 24 hours, but social metrics were unharmed.

Since the beginning of 2023, Optimism [OP] has shown consistent growth in terms of its network activity. In fact, the L2 also managed to outshine its top competitor, Abritrum [ARB], on quite a few occasions.

While the blockchain’s network activity grew, its native token’s price action also improved during that period.

Optimism has come a long way this year

Layer2 Index recently posted a tweet highlighting how Optimism has grown over the last year.

As per the tweet, the number of holders in the Optimism ecosystem has steadily grown since the beginning of 2023. This clearly indicated a hike in the L2’s adoption over the past few months.

⚔️Optimism Ecosystem Overview

⚖️Optimism is on the road to become King of Layer2

?Take a look deep insight via @intotheblock

Master Thread ?#Optimism #Layer2 pic.twitter.com/7xUcJVRAO1

— Layer2 Index (@indexlayer2) November 21, 2023

Interestingly, the Worldcoin token debuted early this summer. During its launch, the number of token holders skyrocketed, reaching over 400 thousand on Optimism in only the first month.

WLD has the highest number of holders in profit, followed by SNX. The tweet also mentioned that the transaction volume on Optimism settled down after a solid start and solidified at around $400 million–$700 million weekly.

Optimism vs. Arbitrum

The increase in adoption and usage was also reflected on the L2’s performance when placed in comparison with its top competitor Arbitrum.

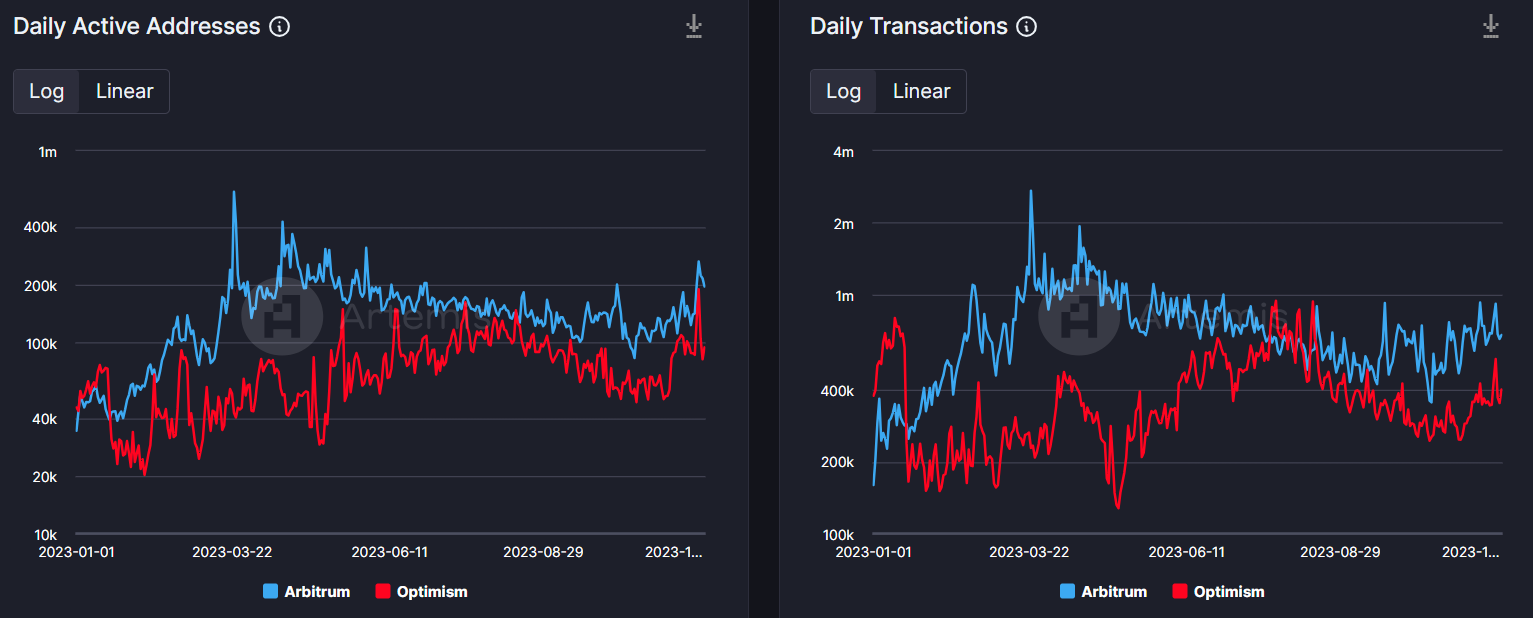

AMBCrypto’s analysis of Artemis’ data revealed that OP’s daily active addresses increased over the last few months and even managed to surpass that of ARB for a short while. A similar trend was also noted in terms of OP and ARB’s daily number of transactions.

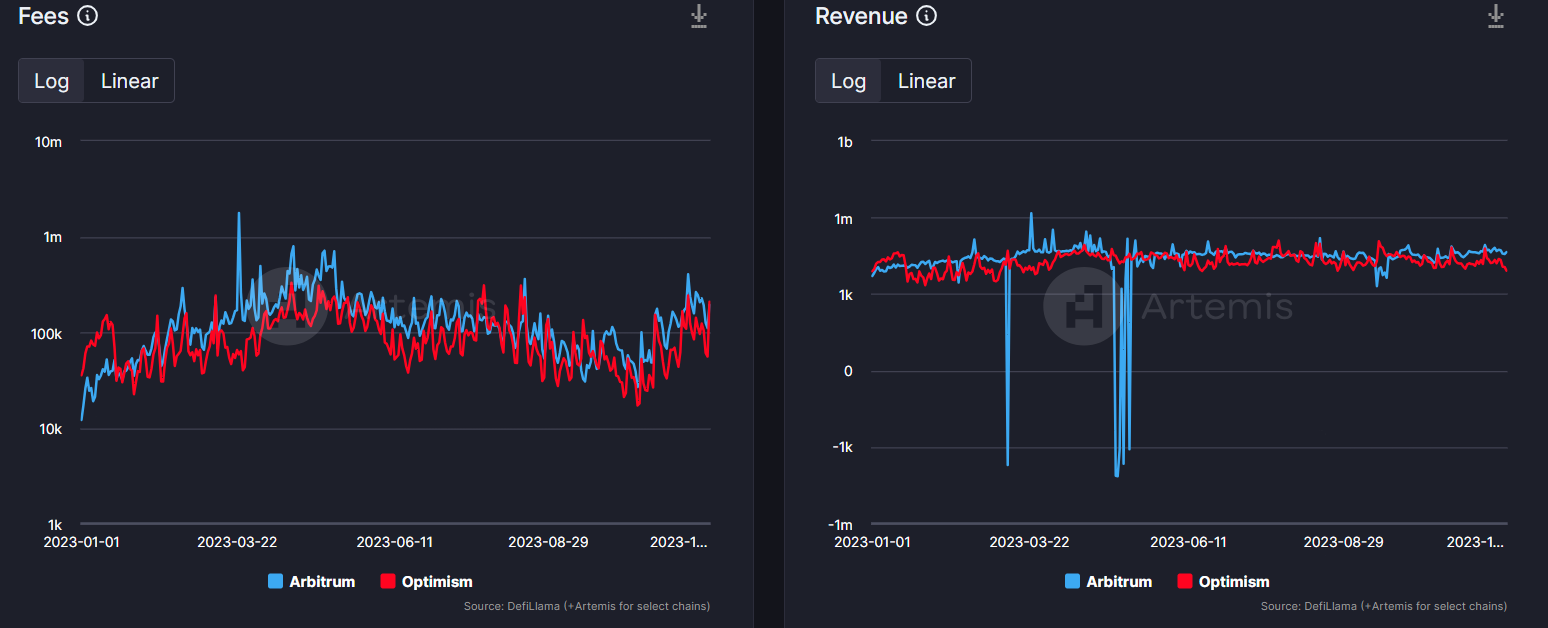

Things were slightly different in terms of both L2’s captured values.

As per the data, OP and ARB’s fees and revenue were closely knit, meaning that despite ARB having more users and transactions, both L2’s generated comparable revenue over the last several months.

However, ARB clearly dominated OP in terms of TVL.

OP bears are here

Unlike the L2’s robust network activity, its token’s price action went southwards in the recent past. As per CoinMarketCap, OP was down by over 3% in the last 24 hours.

At press time, it was trading at $1.66 with a market capitalization of more than $1.4 billion.

Read Optimism’s [OP] Price Prediction 2023-24

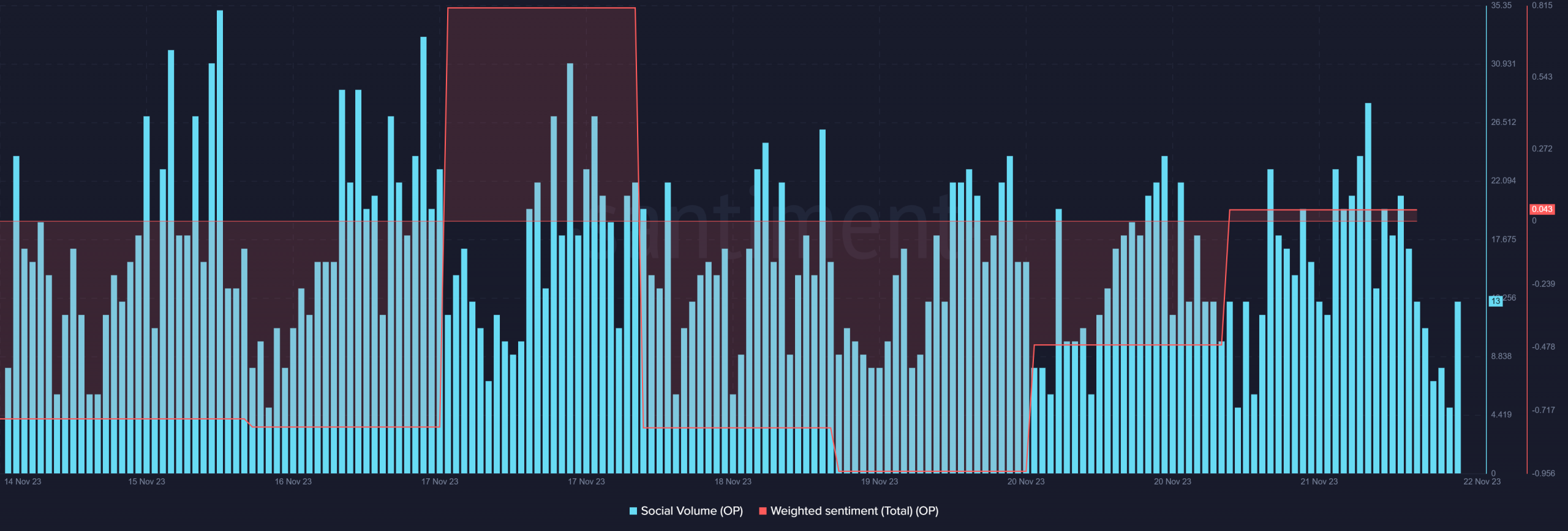

Despite the recent decline in price, the token’s popularity remained unharmed as its social volume remained high.

AMBCrypto also found that sentiment around OP improved over the last week, which was evident from the rise in its weighted sentiment.