AVAX rallies past $20 – Is another 50% gain around the corner?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- AVAX showed a strong bullish intent with its recent move above $23.

- A retest of a liquidity pool could present a good risk-to-reward buying opportunity.

Avalanche [AVAX] was selected as the platform upon which the investment firm Republic would launch its digital asset. AMBCrypto’s analysis showed that despite the news, the price had taken a bearish bias on the lower timeframes.

However, the past three days of price action showed that the $20 zone was flipped to support. This was an interesting development, as it meant AVAX was primed for further gains.

The previous 2023 highs were finally broken

In February earlier this year, AVAX reached the $21.66 mark. In late January, it had climbed even higher, albeit momentarily, to $22.79. Therefore, these are the two levels that were considered resistances to be flipped to support.

On 17th November, AVAX reached $24.69, although it hasn’t flipped either the $21.66 or $22.79 to support. The market structure remained bullish on the one-day chart, and the RSI floated above 70. Together they signaled firm bullish momentum.

Additionally, the move past the 2023 high was another sign of bullish intent.

The On-Balance Volume (OBV) shot higher over the past six weeks to reflect intense buying pressure in the market. To the north, the next major resistance level was at $30. Hence a retest of the $19-$20 region could present a good buying opportunity.

There was additional evidence that a sweep of the $20 was a likelihood

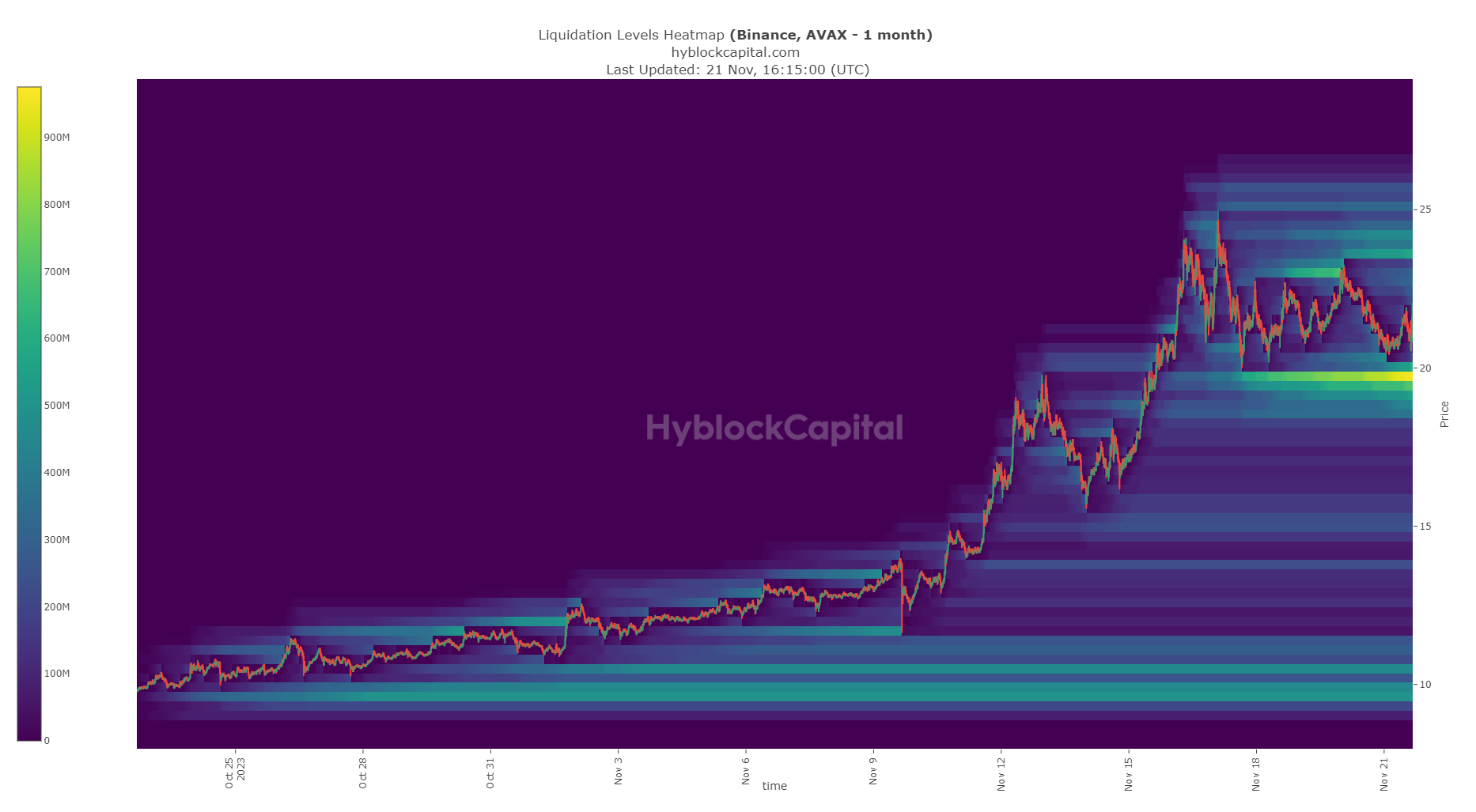

Source: Hyblock

AMBCrypto’s analysis of Hyblock liquidation data showed that there were two regions of interest for AVAX to watch out for. The first and less important one was the $23.6 zone which had close to $600 million in liquidation, based on the past 30 days’ data.

Read Avalanche’s [AVAX] Price Prediction 2023-24

The other was the $19.4-$19.7 region which has a huge number of liquidations built up. It also lined up with the liquidity pool from the price action at $19-$20.

Therefore, an AVAX revisit of the $19 area would present a good buying opportunity. While it appeared ambitious, a move to the $30 weekly resistance remained a likelihood.